How to Manage a Sales Pipeline in 2026: Process, Metrics, and Best Practices

Feb 23, 2026

Feb 23, 2026

Alex Zlotko

CEO at Forecastio

Last updated

Feb 23, 2026

Reading time

15 min

Share:

Share

What is a sales pipeline?

A sales pipeline is a visual representation of all the deals a company is actively working on, from first contact to closed revenue. It shows how many deals, where they are, and how much revenue they may generate. In sales pipeline management, the pipeline is not just a list. It is a working system that helps sales teams plan, prioritize, and close business.

A well-structured sales pipeline reflects the real sales process your company uses to turn a prospective customer into an active client. Each deal moves through various stages based on progress in the buying process. This allows sales leaders and sales managers to understand pipeline value, risks, and future revenue.

Without a clear sales pipeline, it becomes difficult to track sales activities, manage sales reps, or estimate future sales. Research from Harvard Business Review shows that companies with a defined pipeline process grow revenue up to 18 percent faster than those without one.

A strong sales pipeline helps organizations:

Track deal values and deal volume

Understand conversion rates between sales stages

Improve forecast accuracy

Identify stale deals and bottlenecks early

Align lead generation with revenue goals

Organizations that prioritize sales pipeline quality are 2x more likely to exceed customer acquisition expectations

In modern B2B environments, sales pipeline management also depends heavily on sales data and customer relationship management systems. Tools like Forecastio extend CRM data by adding deeper pipeline visibility, trend analysis, and forecasting logic.

A well managed sales pipeline gives teams clarity. It shows what is real, what is risky, and what needs action now. This clarity is the foundation of effective pipeline management and predictable growth.

What is the difference between a sales pipeline and sales funnel?

The difference between a sales pipeline and a sales funnel is about perspective. The sales funnel describes how many potential customers move from awareness to purchase. The sales pipeline focuses on how sales teams manage all the deals that already exist.

A sales funnel is typically owned by marketing. It tracks lead nurturing, lead scoring, and lead qualification. Its goal is volume. How many leads enter. How many become a sales qualified lead. How many convert into opportunities.

A sales pipeline, on the other hand, is owned by sales. It tracks deal stages, sales efforts, deal tracking, and progress toward closing. Its goal is execution and revenue.

Here is a simple way to compare them:

Sales funnel measures interest and intent

Sales pipeline measures deal progress and value

Funnel answers “who might buy”

Pipeline answers “who will close and when”

In sales pipeline management, confusing these two often leads to poor decisions. Teams may think they have a strong pipeline because the funnel is full. In reality, deals may be weak, unqualified, or stalled.

A proper sales pipeline starts after lead qualification. It includes only qualified lead opportunities that entered the selling process. This is where pipeline management practices matter most.

Modern sales leaders rely on both views. The funnel feeds the pipeline. The pipeline feeds sales forecasting and planning. Clear separation between funnel and pipeline is critical for sales pipeline management best results.

What is sales pipeline management?

Sales pipeline management is the structured way companies manage sales pipelines, monitor deal progress, and improve outcomes using data, rules, and reviews. It ensures the pipeline reflects reality and supports predictable revenue.

At its core, sales pipeline management answers four questions:

What deals do we have?

Where are they in the sales cycle?

What risks exist?

How likely are we to close?

This discipline goes far beyond moving deals between stages. It includes pipeline hygiene, sales data standards, activity expectations, and performance tracking. Strong sales pipeline management helps sales teams manage workload and priorities while helping leaders plan capacity and cash flow.

Companies that effectively manage pipelines are far more accurate in forecasting. Gartner reports that organizations with structured pipeline management improve forecast accuracy by up to 20 percent.

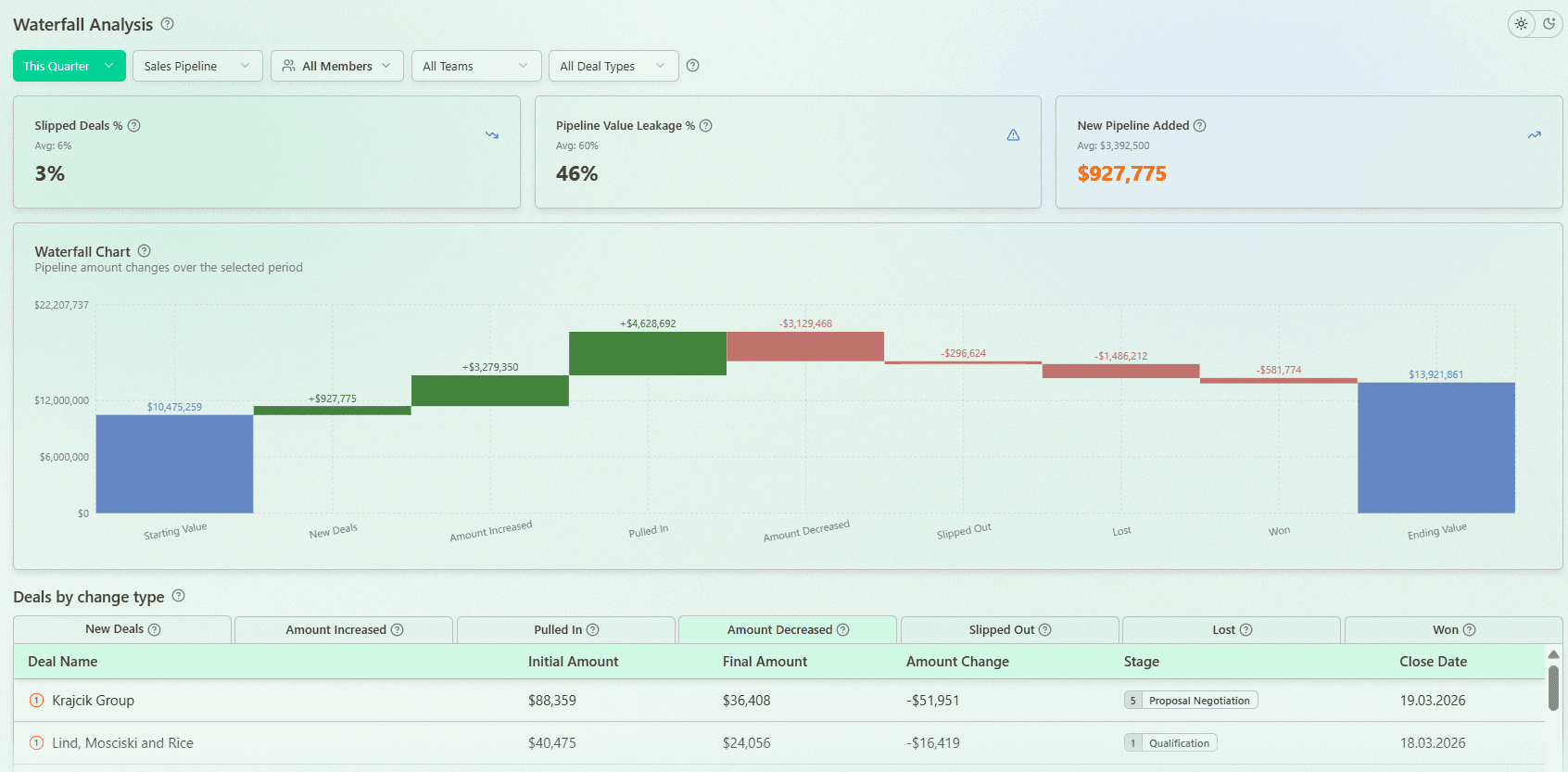

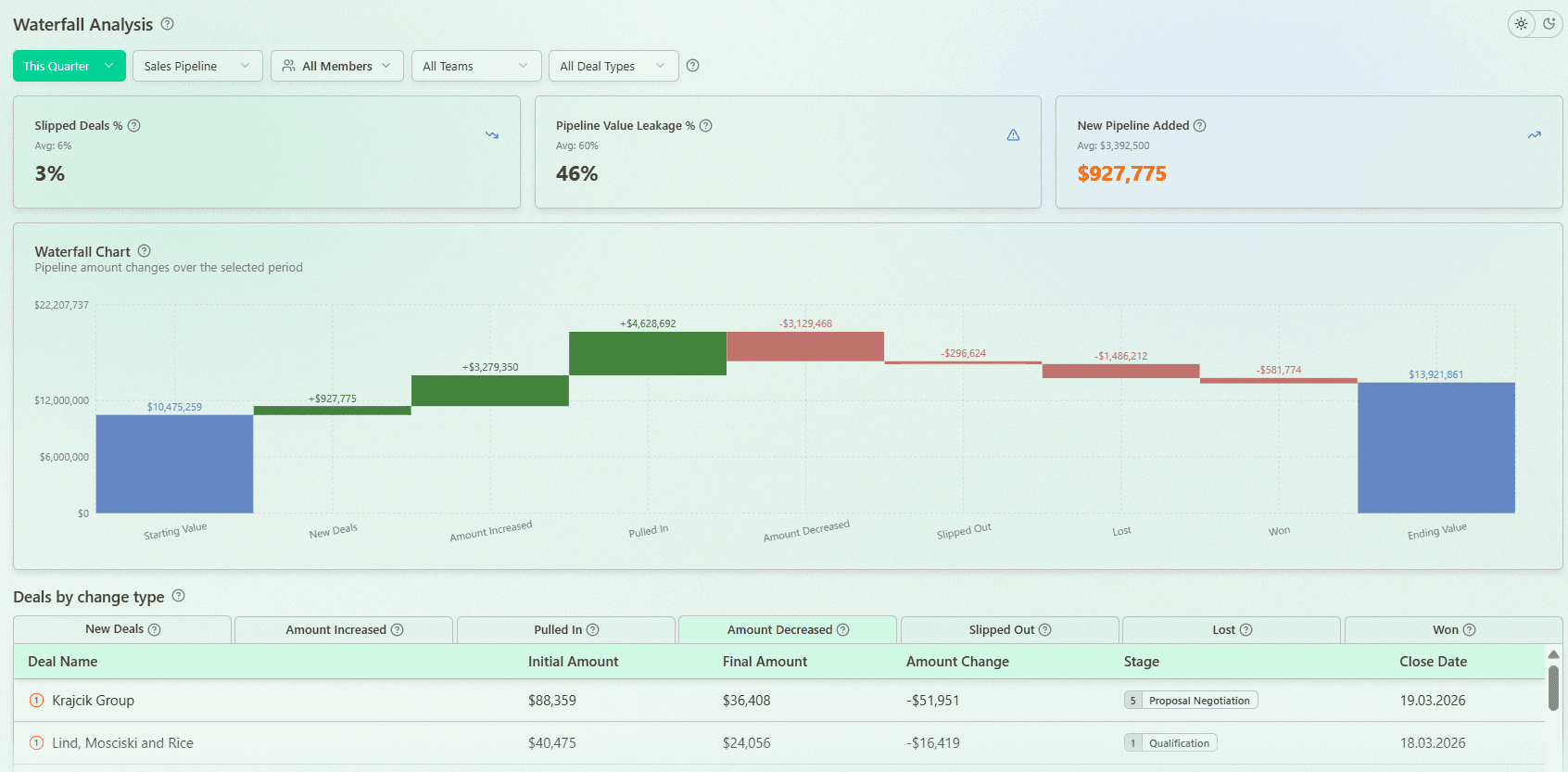

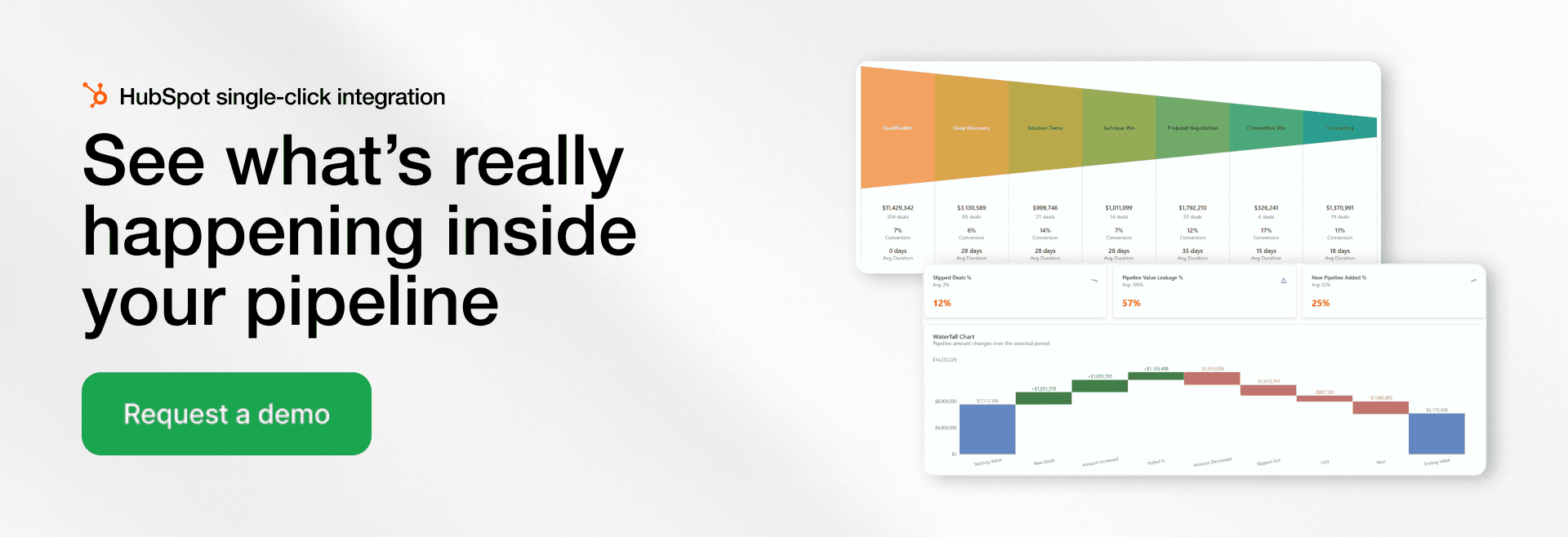

Pipeline Waterfall Analysis with Forecastio

Key elements of sales pipeline management include:

Designing clear sales pipeline stages

Defining pipeline stage entry and exit rules

Monitoring pipeline health

Running regular pipeline reviews

Identifying risks like stale deals

Linking pipeline insights to future revenue

A weak approach leads to optimism bias, poor visibility, and missed sales quota. A strong approach creates discipline and accountability.

Modern sales pipeline management software plays a critical role. CRMs provide the foundation, but advanced tools like Forecastio add forecasting logic, risk signals, and trend analysis that standard CRM views lack.

Why is sales pipeline management important?

Sales pipeline management is important because revenue does not come from effort alone. It comes from visibility, discipline, and timely decisions. Without structured pipeline management, teams operate on assumptions instead of facts.

A strong pipeline system allows sales leaders to understand how much revenue is realistic, not just hopeful. It improves pipeline visibility, supports sales strategy, and protects cash flow.

When pipeline management is weak:

Deals stay too long in stages

Close dates slip without explanation

Sales reps chase low-quality opportunities

Forecasts become unreliable

With effective management, companies can:

Identify bottlenecks early

Focus sales efforts on deals that matter

Improve conversion rates

Balance deal volume and quality

Data shows that companies conducting regular pipeline reviews achieve higher win rates and shorter sales cycle length. This directly impacts sales performance and growth stability.

Pipeline discipline also improves customer relationships. Deals move forward based on buyer signals, not pressure. This aligns sales actions with the real buying process.

Platforms like Forecastio help teams go beyond static pipeline views. They surface risk, track trends, and connect pipeline signals to sales forecasting and planning.

How to design sales pipeline stages

Designing sales pipeline stages means translating your real sales process into clear, measurable steps. A good pipeline structure helps teams move deals forward consistently and improves effective sales pipeline execution.

How sales pipeline stages reflect your sales process

Sales pipeline stages should directly reflect how your real sales process works, not how your CRM is configured. Each stage must represent a clear shift in buyer commitment, such as moving from problem exploration to solution evaluation. When stages mirror real buyer behavior, sales teams can manage deals more consistently and leaders gain better pipeline visibility.

Common sales pipeline stage examples in B2B

In B2B environments, deal stages usually follow a structured decision flow rather than emotional impulse. Typical sales pipeline stages include:

Discovery / Demo

Proposal

Negotiations

Contracting

Closed won or lost

These stages help sales reps track progress across all the deals and understand where sales efforts are concentrated.

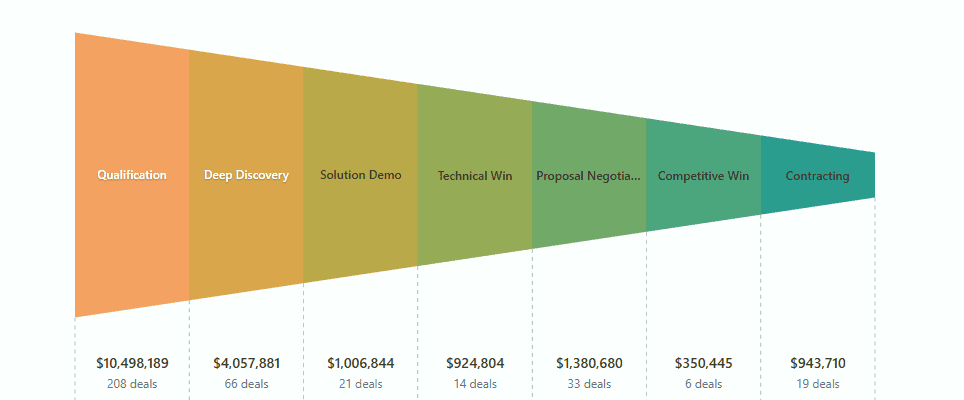

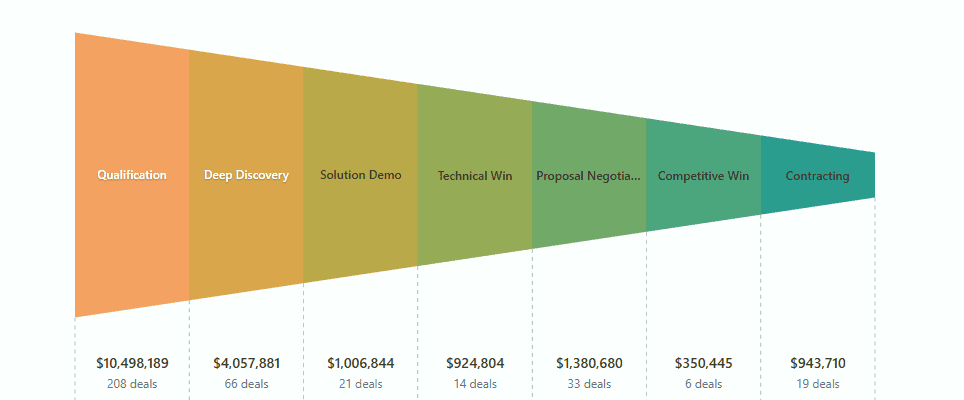

Pipeline Stage Analysis with Forecastio

How many stages should a sales pipeline have?

Most B2B organizations perform best with 5 to 7 sales pipeline stages. Too many stages slow down deal movement and increase manual tasks for sales reps. Too few stages reduce insight and make it harder to identify bottlenecks or risks within the sales cycle.

Aligning pipeline stages with buyer journey

Pipeline stages must align with the buyer’s buying process, not internal sales activities. Buyers move through evaluation, comparison, and approval phases, and your sales stages should reflect those shifts. This alignment improves trust, strengthens customer relationships, and increases conversion rates across the pipeline.

Defining clear entry and exit criteria for each stage

Every pipeline stage needs clear entry and exit criteria based on objective signals, not opinions. These criteria may include completed discovery calls, confirmed budgets, or identified decision-makers. Clear rules improve reliable data, strengthen pipeline hygiene, and reduce inflated pipeline value.

When to customize pipeline stages by segment or deal type

Not all deals follow the same path, especially when deal size, market, or sales motion differs. Enterprise deals, renewals, and upsells often require different sales pipeline stages than SMB new business. Customizing pipelines allows sales teams to manage complexity better and helps sales managers apply the right expectations to each deal type.

In my career, I have seen thousands of sales pipelines across different industries and deal types. Based on this experience, I strongly recommend creating separate pipelines when you have enough deals of each type and the sales process differs significantly.

Using one pipeline for very different deal motions often leads to distorted sales metrics, misleading conversion rates, and unreliable sales forecasting. Separate pipelines allow sales teams to work more efficiently, apply the right expectations at each pipeline stage, and improve both pipeline health and forecast accuracy.

This approach also helps sales leaders clearly understand performance by segment and make better decisions about resources, priorities, and future revenue.

Sales pipeline management process step-by-step

The sales pipeline management process is a continuous system, not a one-time setup. It helps you manage your sales pipeline with clarity and discipline. The goal is simple. Keep the sales pipeline accurate, actionable, and tied to revenue goals. When teams follow a repeatable approach, they improve pipeline health, reduce manual tasks, and create more predictable future revenue.

Step 1: Define what “pipeline” means in your company

Start by defining what should be included in the sales pipeline and what should not. Many teams mix early leads with real opportunities, which distorts pipeline value and forecast accuracy. Clarify what qualifies as a real opportunity, and what minimum criteria must be met. This is where you separate lead qualification from active pipeline work.

Step 2: Design pipeline stages that match your sales motion

Your sales pipeline stages must match how you actually sell. A complex enterprise motion needs different deal stages than a fast SMB motion. Keep stages buyer-oriented and easy for sales reps to apply consistently.

Step 3: Set entry and exit criteria for every stage

Each pipeline stage needs objective rules for entry and exit. This prevents deals from moving forward based on hope or pressure. Criteria should be based on buyer actions and verified facts, not internal activity. For example, “proposal sent” is not the same as “proposal reviewed by decision makers.”

Step 4: Standardize required fields and data hygiene rules

Define what deal data must exist for every stage, and enforce it. This includes close date, deal amount, next step, and key contacts. Without reliable data, you cannot trust reports or sales forecasting. Strong pipeline hygiene reduces confusion and improves decision-making for sales leaders.

Step 5: Establish activity expectations by stage

Pipeline movement requires consistent sales activities. Define what “good execution” looks like in each stage. This also helps sales managers coach reps based on actions, not opinions. Examples of stage expectations can include:

Minimum number of buyer interactions

Required follow ups within a timeframe

Required meetings or stakeholder alignment

Step 6: Build your pipeline dashboard and core reports

A pipeline is only useful if you can see it clearly. Build dashboards that show both volume and quality, not just totals. Good reporting should help you answer: What is stuck? What is slipping? Where do we identify bottlenecks? Strong dashboards improve pipeline visibility across the team.

Step 7: Define pipeline health rules and risk signals

Create simple rules that define a healthy vs risky deal. This makes pipeline management proactive instead of reactive. Common risk signals include stale deals, missing data, inactive deals, and repeated close-date changes. When risk rules are clear, sales teams manage deals with less debate and more action.

Step 8: Set a cadence for pipeline reviews

Pipeline reviews must be scheduled and consistent. Most teams need weekly reviews for active deals and monthly reviews for trends. The key is to make regular pipeline reviews a habit, not an emergency event. Reviews should focus on deal progress, risks, and next actions.

Step 9: Monitor pipeline performance and trends

Do not only look at the pipeline as a snapshot. Track how it changes over time. Watch key metrics like conversion rates, stage duration, win rate, and deal velocity. Trends show whether your pipeline is improving or slowly degrading.

Step 10: Audit and clean the pipeline regularly

Pipeline accuracy declines if you do not clean it. Deals that have no activity, no next step, or outdated close dates should be corrected or removed. This keeps pipeline reports trustworthy and prevents inflated forecasts. A clean pipeline also reduces wasted sales efforts on low-probability deals.

Step 11: Improve the pipeline using insights and experiments

Use pipeline data to make small improvements and measure results. For example, test tighter qualification rules, change stage definitions, or adjust activity expectations. Then track impact on win rate, speed, and average deal size. Continuous improvement is a core part of effective pipeline management.

Step 12: Align pipeline management with forecasting and planning

Pipeline management should directly support planning and accurate sales forecasts. Your pipeline is the input for capacity planning, hiring decisions, and target setting. This is where platforms like Forecastio add value, especially when you need deeper analysis, better risk detection, and stronger forecasting logic than standard CRM reporting.

Key sales pipeline metrics

Sales pipeline management depends on tracking the right sales metrics, not just looking at deal lists. Metrics turn raw sales data into insight and help sales leaders understand pipeline quality, risk, and potential future revenue. When tracked consistently, these metrics support better decisions, stronger pipeline health, and more reliable planning.

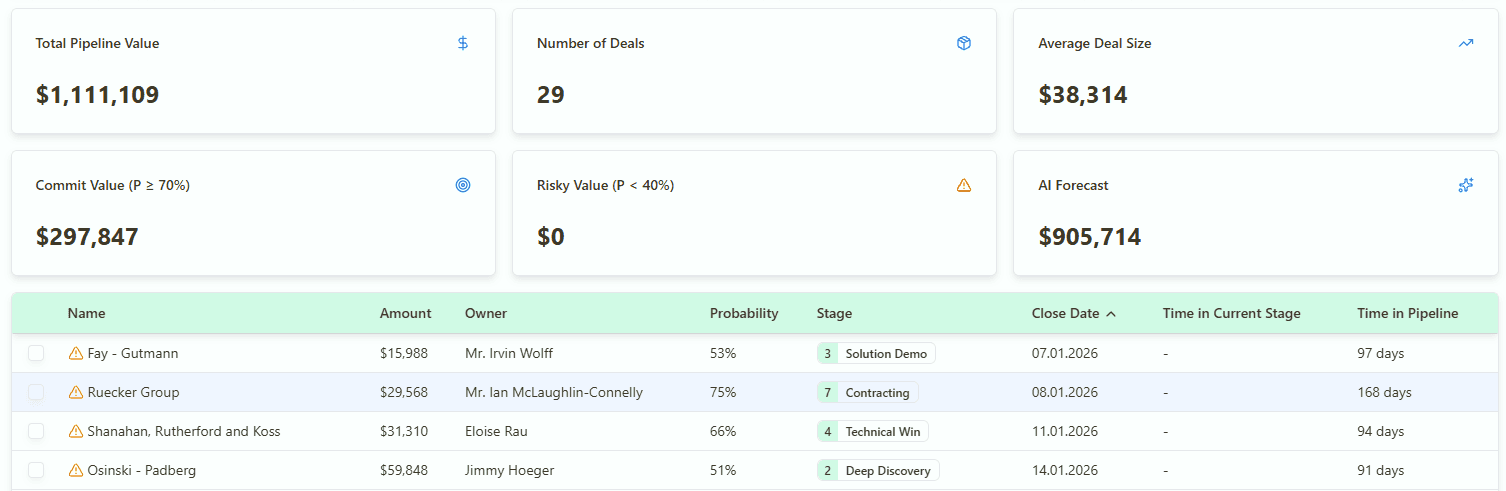

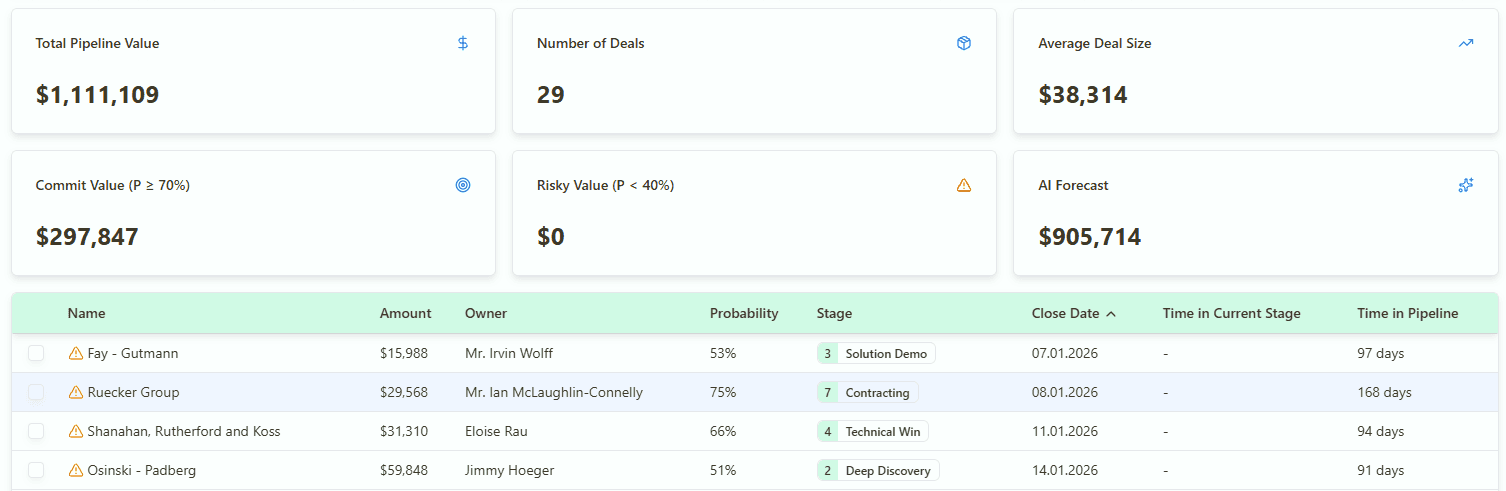

Pipeline Overview and Risky Deals Analysis with Forecastio

Total pipeline value

Total pipeline value is the sum of all open deal values in the sales pipeline. It shows how much potential revenue is currently being pursued. On its own, this metric can be misleading, so it should always be reviewed alongside quality indicators like win rate and stage distribution.

Pipeline growth rate

Pipeline growth rate measures how fast new opportunities are entering the pipeline over time. It helps sales teams understand whether lead generation and lead qualification efforts are keeping pace with revenue targets. A declining growth rate often signals future revenue gaps.

Pipeline coverage ratio

The pipeline coverage ratio compares total pipeline value to the sales quota for a given period. For example, a 3× sales pipeline coverage ratio means the pipeline value is three times the target revenue. This metric helps estimate whether there are enough deals to realistically hit goals.

Win rate

Win rate is the percentage of deals that close successfully out of all closed opportunities. It reflects both deal quality and execution effectiveness. A stable or improving win rate is a strong signal of a well managed sales pipeline.

Average deal size

Average deal size shows the typical revenue generated per closed deal. It helps teams understand whether growth comes from closing more deals or larger ones. Changes in this metric often impact capacity planning and sales strategy.

Sales cycle length

Sales cycle length measures how long it takes to move a deal from first contact to closed won. Shorter cycles usually indicate strong qualification and clear buyer alignment. Longer cycles may signal friction, complexity, or weak pipeline management practices.

Sales velocity

Sales velocity combines average deal size, win rate, and sales cycle speed into a single view. It shows how quickly revenue moves through the pipeline. Improving sales velocity directly improves cash flow and forecasting confidence.

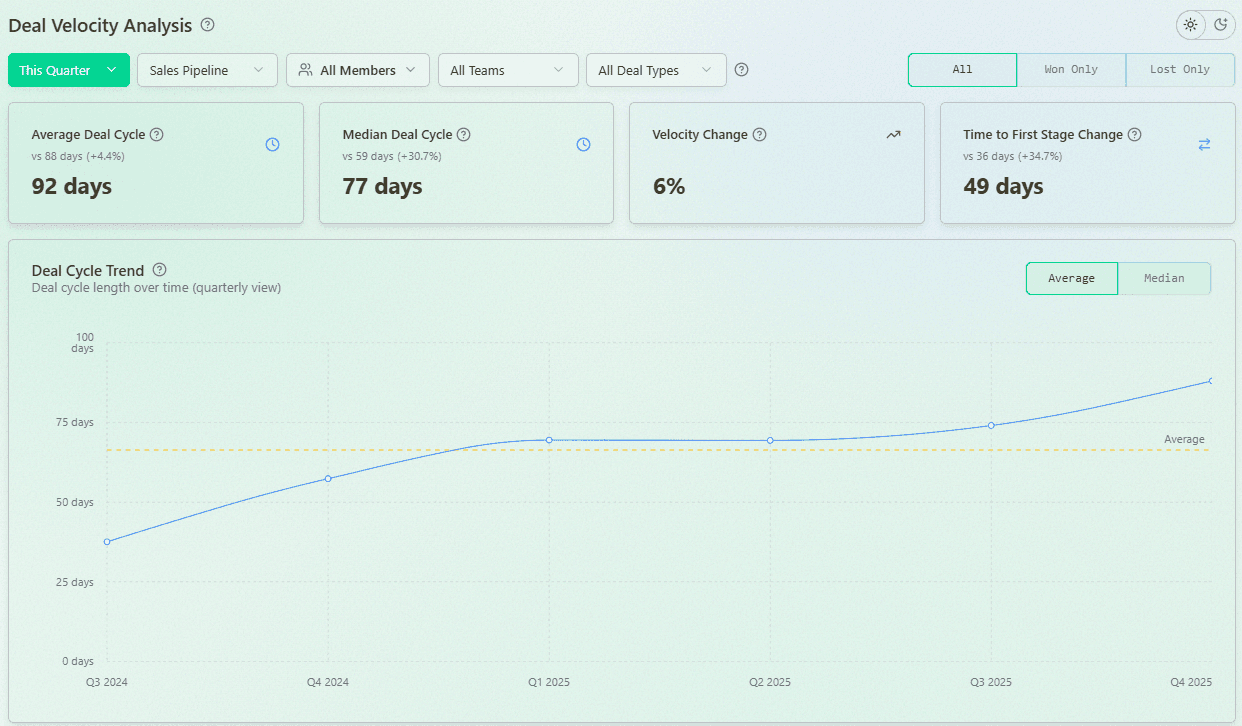

Deal velocity

Deal velocity shows how quickly individual deals move through the sales pipeline, from creation to close. It helps sales managers spot slow-moving opportunities and friction within the sales cycle. Low deal velocity often signals stalled decisions or weak buyer engagement.

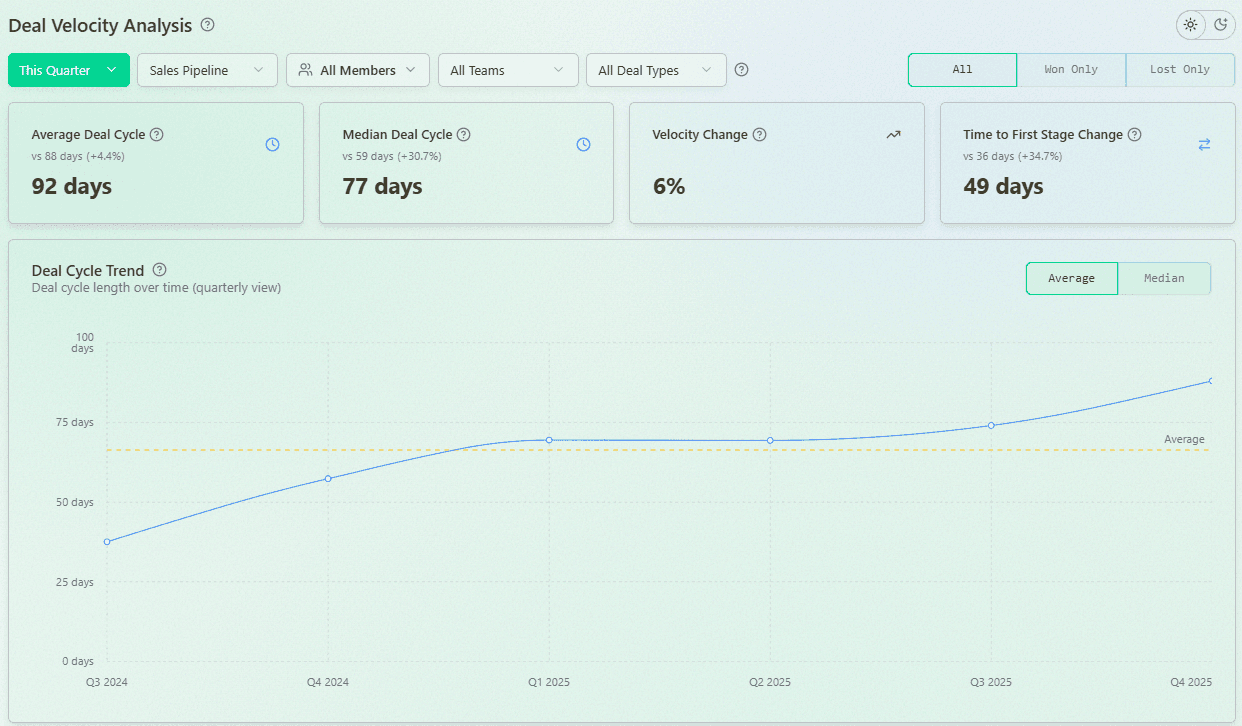

Deal Velocity Analysis with Forecastio

Pipeline stage conversion rates

Pipeline stage conversion rates show how efficiently deals move between sales pipeline stages. They help identify bottlenecks where deals frequently stall or drop off. Monitoring these rates supports continuous improvement of the selling process.

Slippage rate

Slippage rate tracks how often deals miss their original close dates. High slippage reduces forecast accuracy and often points to weak qualification or unrealistic expectations. This metric is critical for trustworthy sales forecasting.

Key sales pipeline signals

Pipeline signals help sales teams identify risk early, before deals are lost or forecasts become unreliable. These signals act as early warnings that highlight where attention and action are needed.

Stalled deals

Stalled deals show no meaningful movement for an extended period within the same pipeline stage. They often indicate lack of buyer urgency or unclear next steps.

Inactive deals

Inactive deals have no recent sales activities such as calls, emails, or meetings. A growing number of inactive deals usually signals poor prioritization or overstretched sales reps.

Slipping close dates

Repeated changes to close dates are a strong risk indicator. Slipping close dates reduce sales forecast accuracy and often reflect weak qualification or unrealistic expectations.

Low-engagement opportunities

These deals show minimal buyer interaction and limited responsiveness. Low engagement often means the opportunity is not a real priority for the prospective customer.

Single-threaded deals

Single-threaded deals rely on only one contact inside the customer organization. If that contact goes silent or leaves, the deal is at high risk.

Missing or outdated deal data

Deals with incomplete or outdated fields weaken pipeline hygiene. Poor sales data quality makes pipeline reports and forecasts unreliable.

Overweighted pipeline stages

When too many deals sit in one sales pipeline stage, it often signals bottlenecks or overly loose stage criteria. This distorts conversion rates and pipeline insights.

Changes in pipeline stage conversion

Sudden drops in pipeline stage conversion rates are early warnings of process or market issues. These changes often point to breakdowns in messaging, qualification, or buyer alignment.

Changes in pipeline stage duration

Longer time spent in a pipeline stage shows growing friction in the sales cycle. Monitoring stage duration helps teams identify where deals slow down and why.

Is CRM alone enough to manage a sales pipeline?

Customer Relationship Management systems are essential for managing deals, contacts, and relationships with customers, but they are often not enough on their own. While CRMs help manage your sales pipeline at a basic level, they are designed mainly for record-keeping and execution. As pipelines grow in size and complexity, teams need deeper insight into risk, trends, and future revenue than standard CRM views can provide.

Limitations of standard CRM pipeline views

Most CRM pipeline views focus on current deal status and stage placement. They show where deals are, but not how healthy they are or how likely they are to close. This limits pipeline visibility and makes it hard to proactively manage risk across all the deals.

Gaps in forecasting and pipeline intelligence

CRM forecasting is often based on static probabilities or manual inputs from sales reps. These probabilities rarely adjust based on real sales performance, deal behavior, or historical patterns. As a result, forecasts can look confident while still being inaccurate.

Why pipeline analytics often require dedicated tools

Advanced pipeline management requires deeper analysis of trends, signals, and patterns over time. Dedicated tools can analyze pipeline stage movement, duration, slippage, and risk across the entire sales cycle. This level of insight helps sales leaders make better decisions and improve forecast accuracy.

When teams outgrow CRM-only pipeline management

Teams usually outgrow CRM-only pipeline management when deal volume increases, sales motions diversify, or forecasting becomes critical for planning. At this stage, relying only on CRM reports leads to blind spots and delayed reactions. This is where platforms like Forecastio help sales teams manage pipelines more effectively by adding intelligence, risk detection, and forecasting on top of CRM data.

Sales pipeline management software

Choosing the right sales pipeline management software depends on your team size, sales complexity, and forecasting needs. Some teams need a strong CRM foundation. Others require advanced pipeline management and forecasting intelligence on top of CRM data. The best tools help sales teams improve pipeline visibility, reduce manual work, and make better decisions about future revenue.

Core features to look for in pipeline management tools

Effective sales pipeline management tools should go beyond deal tracking. At a minimum, it should support:

Clear visual representation of the sales pipeline

Custom sales pipeline stages and rules

Pipeline health indicators and risk signals

Forecasting logic tied to real performance

Reporting on key metrics like win rate, slippage, and sales cycle length

These features allow teams to effectively manage pipelines instead of reacting too late.

CRM-native vs standalone pipeline tools

CRM-native tools focus on execution, data storage, and customer relationship management. They are essential for managing contacts, sales activities, and deal ownership. Standalone pipeline tools focus on analysis, risk detection, and sales forecasting.

In practice, many teams use both. The CRM manages daily work, while a dedicated pipeline tool improves insight, accuracy, and planning.

Pipeline intelligence and forecasting software

Pipeline intelligence tools analyze how deals move through pipeline stages over time. They highlight stalled deals, slipping close dates, and unhealthy patterns that are hard to see in standard CRM views. This category is critical for improving forecast accuracy and supporting leadership decisions.

This is where platforms like Forecastio add strong value by combining pipeline analytics with accurate sales forecasts based on historical behavior and real signals.

Tools for SMB vs mid-market sales teams

SMB teams usually prioritize speed, simplicity, and fast setup. Mid-market teams need deeper reporting, segmentation, and forecasting support as deal volume and complexity increase. As teams scale, sales pipeline management best practices require more automation and intelligence.

How to evaluate ROI of pipeline management software

ROI should be measured in outcomes, not features. Focus on:

More close deals

Better forecast accuracy

Shorter sales cycle

Less time spent on manual tasks

If a tool improves decision quality and saves time for sales reps and sales managers, it delivers real value.

Best sales pipeline management tools

Below is a practical list of widely used tools, grouped by category.

CRM platforms with strong pipeline management

HubSpot

A powerful CRM with intuitive pipeline views, strong reporting, and built-in automation. Very popular with SMB and mid-market sales teams manage pipelines daily.Salesforce

The most flexible enterprise CRM on the market. Highly customizable pipelines, but often requires admin effort and add-ons for advanced analytics.Pipedrive

A sales-first CRM focused on visual pipelines and activity tracking. Well suited for smaller teams with straightforward sales motions.

Pipeline intelligence and forecasting tools

Forecastio

Designed specifically for sales pipeline management and forecasting. Adds pipeline intelligence, risk signals, and advanced forecasting on top of CRM data, especially for HubSpot users.

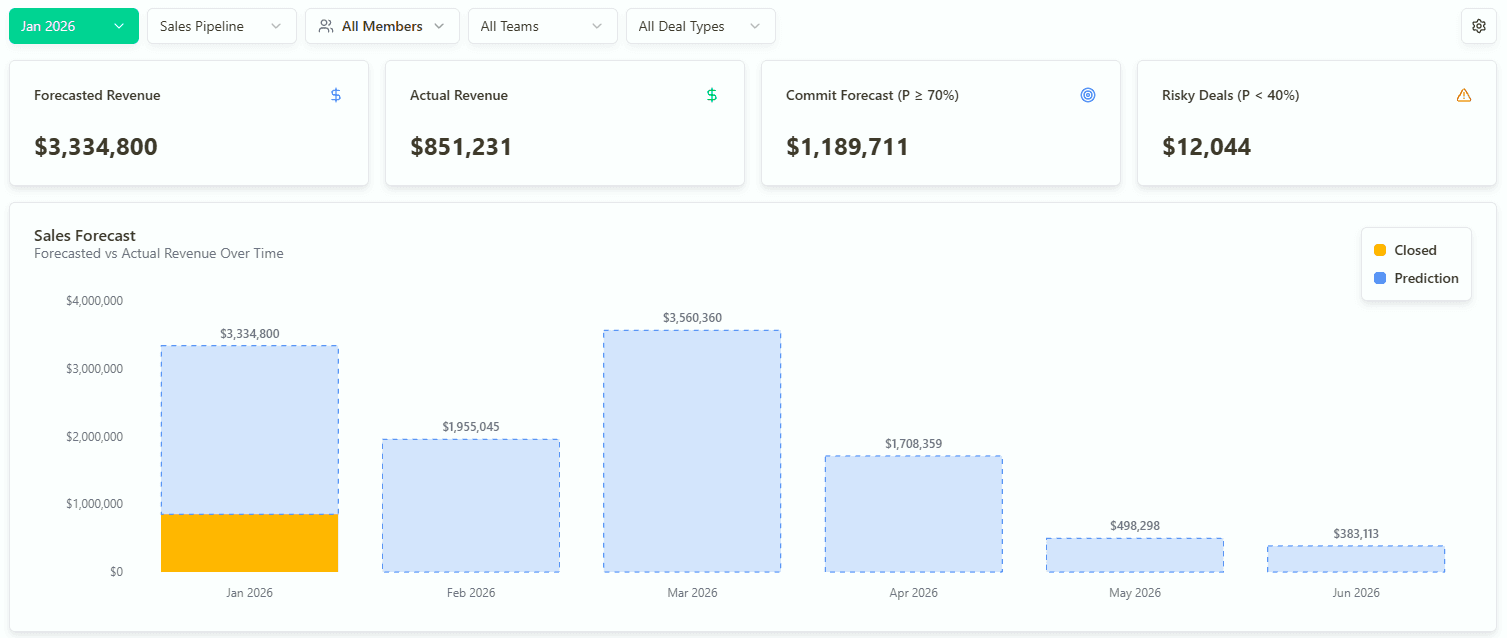

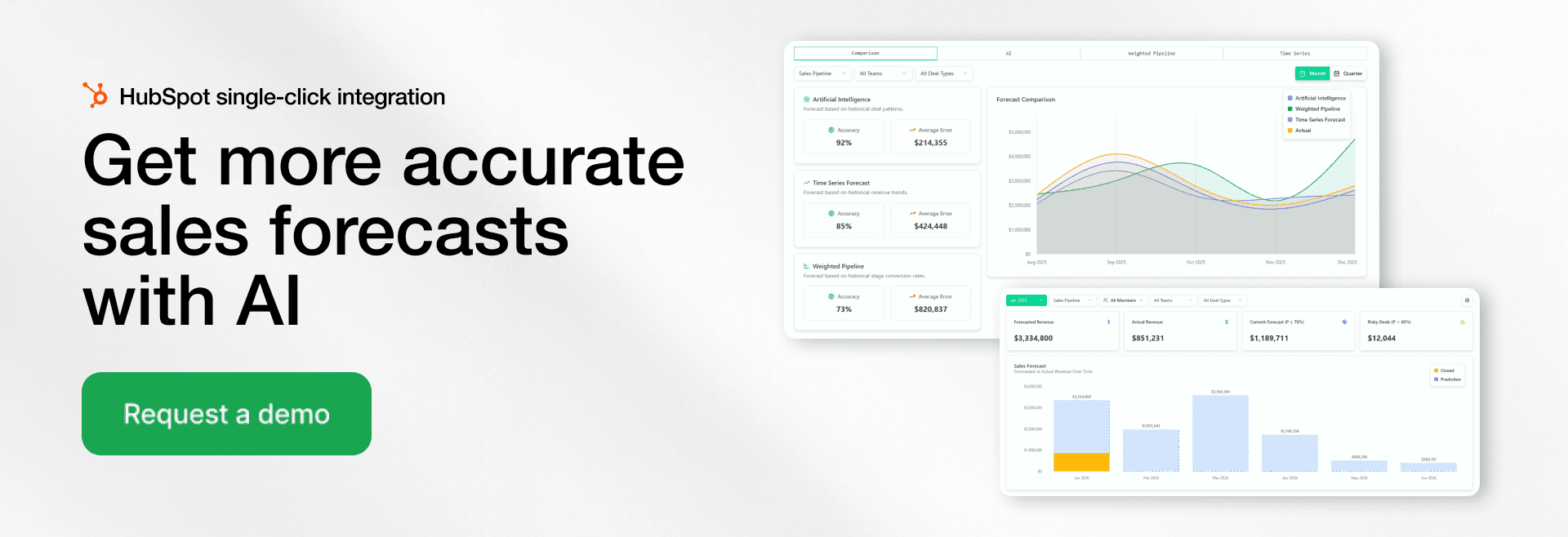

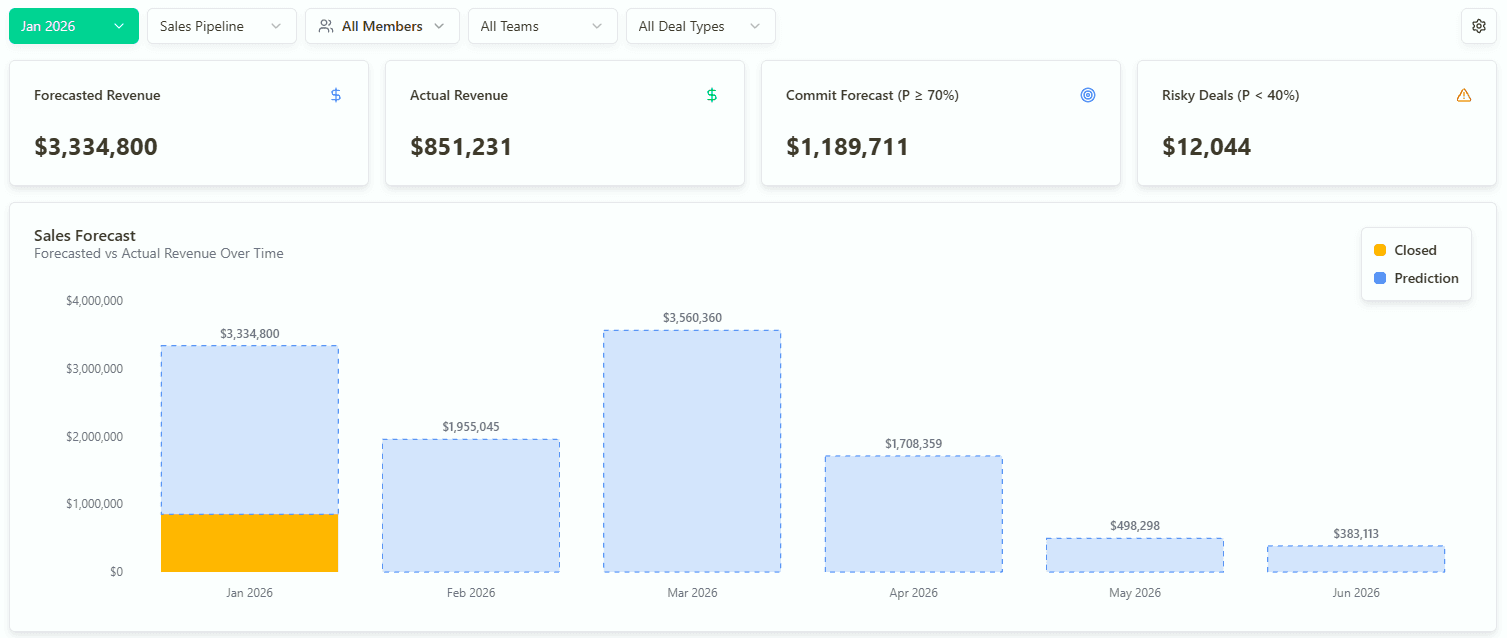

AI Sales Forecasts with Forecastio

Clari

A revenue intelligence platform used by larger sales organizations. Strong forecasting and pipeline inspection capabilities.InsightSquared

Focuses on sales analytics and performance reporting. Useful for understanding pipeline trends and team efficiency.

When to combine tools

Many high-performing teams use:

A CRM to manage deals and sales activities

A pipeline intelligence tool to analyze health, risk, and forecasts

This combination supports effective pipeline management without overloading the CRM with complex logic.

Best practices in managing sales pipelines

Strong management creates consistency, transparency, and predictability across sales teams. When best practices are applied daily, teams spend less time debating data and more time closing deals. These practices help build a well managed sales pipeline that supports growth and reliable planning.

Keep pipeline data clean and up to date

Accurate sales data is the foundation of effective pipeline management. Deals with outdated close dates, missing fields, or unclear next steps distort pipeline value and forecasts. Clean data improves pipeline hygiene and trust in reports.

Review pipeline regularly, not occasionally

Pipelines should be reviewed on a set cadence, not only when targets are at risk. Regular pipeline reviews help sales managers spot issues early and coach proactively. Discipline in reviews leads to better execution.

Focus on pipeline quality, not just size

A large pipeline does not always mean a healthy one. Too many low-quality deals inflate numbers but reduce forecast accuracy. Focusing on qualified opportunities improves conversion rates and closing efficiency.

Align sales reps and leadership on pipeline definitions

Everyone must share the same understanding of sales pipeline stages, deal status, and qualification criteria. Misalignment creates confusion and inconsistent reporting. Shared definitions lead to better pipeline visibility and decision-making.

Use historical data to improve pipeline accuracy

Past deal behavior provides strong signals for future outcomes. Analyzing win rates, sales cycle length, and stage movement helps teams make better predictions. Historical insights reduce reliance on assumptions.

Combine human judgment with data-driven insights

Data provides structure, but experience adds context. The best results come from balancing rep judgment with analytics and signals. This combination strengthens sales pipeline management without removing human ownership.

Key mistakes in sales pipeline management

Avoiding common errors is just as important as following best practices. Many pipeline problems come from habits that feel normal but quietly damage pipeline health, forecast accuracy, and execution.

Treating the pipeline as a static report

A sales pipeline should be a working management tool, not a snapshot viewed once a month. When pipelines are not actively reviewed, risks remain hidden. Active pipelines require continuous updates and decisions.

Overestimating deal probabilities

Deals are often marked as likely to close without enough evidence. This creates inflated pipeline value and unreliable forecasts. Optimism without data directly harms sales forecasting.

Ignoring early warning signals

Signals like stalled activity or slipping close dates rarely fix themselves. Ignoring them delays action and reduces the chance to recover deals. Early signals exist to protect future revenue.

Allowing deals to stay too long in stages

Deals that sit too long in one pipeline stage usually lose momentum. Long stage duration often indicates weak buyer engagement or unclear next steps. Time is one of the biggest deal killers.

Relying on gut feeling instead of data

Experience matters, but intuition alone does not scale across teams. Decisions based only on gut feeling lead to inconsistent results. Sales data provides structure and repeatability.

Managing pipeline without forecasting context

A pipeline without forecasting is disconnected from planning and targets. Teams may feel busy but still miss revenue goals. Sales pipeline management works best when tightly linked to accurate sales forecasts.

Sales pipeline management trends in 2026

Sales pipeline management continues to evolve as data quality, automation, and forecasting expectations increase. In 2026, teams focus less on manual updates and more on continuous insight, risk prevention, and planning accuracy.

Shift from manual to automated pipeline analysis

Manual pipeline updates and spreadsheet reviews are gradually disappearing. Automated analysis reduces human bias and saves time for sales reps and sales managers. This shift improves consistency and pipeline visibility across teams.

AI-driven pipeline risk detection

AI models analyze patterns across sales data, stage duration, and deal behavior. Instead of relying on intuition, teams receive early risk signals based on evidence. This helps address problems before deals are lost.

Continuous pipeline forecasting

Forecasts are no longer static monthly numbers. Modern systems update forecasts continuously as deals move, data changes, or signals appear. This improves forecast accuracy and supports faster decision-making.

Stronger role of RevOps in pipeline management

Ownership of pipeline management is moving toward RevOps teams. Centralized ownership ensures consistent definitions, clean data, and aligned processes. This reduces friction between sales, leadership, and planning.

Focus on pipeline health over pipeline volume

Teams are shifting attention from how big the pipeline looks to how healthy it actually is. Metrics like engagement, stage duration, and slippage matter more than raw pipeline value. Quality pipelines lead to better outcomes.

Deeper integration between CRM and forecasting tools

CRMs remain the system of record, but forecasting and pipeline intelligence increasingly live outside the CRM. Deeper integrations allow teams to connect execution with planning and future revenue. Platforms like Forecastio lead this shift by linking pipelines directly to forecasting and strategic decisions.

FAQ

What is sales pipeline management?

Sales pipeline management is the process of tracking, analyzing, and improving all active deals as they move through the sales process. It helps sales teams understand deal progress, identify risks, and predict future revenue more accurately.

What are the 5 stages of the sales pipeline?

While stages vary by company, a common 5-stage sales pipeline includes:

Lead qualification

Discovery or needs analysis

Proposal or solution presentation

Negotiation or decision

Closed won or closed lost

These stages reflect how a buyer moves through the buying process.

What tools can manage a sales pipeline?

Sales pipelines are usually managed in CRM systems like HubSpot or Salesforce. For deeper insights, teams often use sales pipeline management software such as Forecastio, which adds pipeline analytics, risk detection, and forecasting on top of CRM data.

How do you organize a sales pipeline?

To organize a sales pipeline, define clear stages, set entry and exit criteria, standardize required data fields, and review the pipeline regularly. A well-organized pipeline reflects the real sales process and stays clean, accurate, and actionable.

What is a sales pipeline?

A sales pipeline is a visual representation of all the deals a company is actively working on, from first contact to closed revenue. It shows how many deals, where they are, and how much revenue they may generate. In sales pipeline management, the pipeline is not just a list. It is a working system that helps sales teams plan, prioritize, and close business.

A well-structured sales pipeline reflects the real sales process your company uses to turn a prospective customer into an active client. Each deal moves through various stages based on progress in the buying process. This allows sales leaders and sales managers to understand pipeline value, risks, and future revenue.

Without a clear sales pipeline, it becomes difficult to track sales activities, manage sales reps, or estimate future sales. Research from Harvard Business Review shows that companies with a defined pipeline process grow revenue up to 18 percent faster than those without one.

A strong sales pipeline helps organizations:

Track deal values and deal volume

Understand conversion rates between sales stages

Improve forecast accuracy

Identify stale deals and bottlenecks early

Align lead generation with revenue goals

Organizations that prioritize sales pipeline quality are 2x more likely to exceed customer acquisition expectations

In modern B2B environments, sales pipeline management also depends heavily on sales data and customer relationship management systems. Tools like Forecastio extend CRM data by adding deeper pipeline visibility, trend analysis, and forecasting logic.

A well managed sales pipeline gives teams clarity. It shows what is real, what is risky, and what needs action now. This clarity is the foundation of effective pipeline management and predictable growth.

What is the difference between a sales pipeline and sales funnel?

The difference between a sales pipeline and a sales funnel is about perspective. The sales funnel describes how many potential customers move from awareness to purchase. The sales pipeline focuses on how sales teams manage all the deals that already exist.

A sales funnel is typically owned by marketing. It tracks lead nurturing, lead scoring, and lead qualification. Its goal is volume. How many leads enter. How many become a sales qualified lead. How many convert into opportunities.

A sales pipeline, on the other hand, is owned by sales. It tracks deal stages, sales efforts, deal tracking, and progress toward closing. Its goal is execution and revenue.

Here is a simple way to compare them:

Sales funnel measures interest and intent

Sales pipeline measures deal progress and value

Funnel answers “who might buy”

Pipeline answers “who will close and when”

In sales pipeline management, confusing these two often leads to poor decisions. Teams may think they have a strong pipeline because the funnel is full. In reality, deals may be weak, unqualified, or stalled.

A proper sales pipeline starts after lead qualification. It includes only qualified lead opportunities that entered the selling process. This is where pipeline management practices matter most.

Modern sales leaders rely on both views. The funnel feeds the pipeline. The pipeline feeds sales forecasting and planning. Clear separation between funnel and pipeline is critical for sales pipeline management best results.

What is sales pipeline management?

Sales pipeline management is the structured way companies manage sales pipelines, monitor deal progress, and improve outcomes using data, rules, and reviews. It ensures the pipeline reflects reality and supports predictable revenue.

At its core, sales pipeline management answers four questions:

What deals do we have?

Where are they in the sales cycle?

What risks exist?

How likely are we to close?

This discipline goes far beyond moving deals between stages. It includes pipeline hygiene, sales data standards, activity expectations, and performance tracking. Strong sales pipeline management helps sales teams manage workload and priorities while helping leaders plan capacity and cash flow.

Companies that effectively manage pipelines are far more accurate in forecasting. Gartner reports that organizations with structured pipeline management improve forecast accuracy by up to 20 percent.

Pipeline Waterfall Analysis with Forecastio

Key elements of sales pipeline management include:

Designing clear sales pipeline stages

Defining pipeline stage entry and exit rules

Monitoring pipeline health

Running regular pipeline reviews

Identifying risks like stale deals

Linking pipeline insights to future revenue

A weak approach leads to optimism bias, poor visibility, and missed sales quota. A strong approach creates discipline and accountability.

Modern sales pipeline management software plays a critical role. CRMs provide the foundation, but advanced tools like Forecastio add forecasting logic, risk signals, and trend analysis that standard CRM views lack.

Why is sales pipeline management important?

Sales pipeline management is important because revenue does not come from effort alone. It comes from visibility, discipline, and timely decisions. Without structured pipeline management, teams operate on assumptions instead of facts.

A strong pipeline system allows sales leaders to understand how much revenue is realistic, not just hopeful. It improves pipeline visibility, supports sales strategy, and protects cash flow.

When pipeline management is weak:

Deals stay too long in stages

Close dates slip without explanation

Sales reps chase low-quality opportunities

Forecasts become unreliable

With effective management, companies can:

Identify bottlenecks early

Focus sales efforts on deals that matter

Improve conversion rates

Balance deal volume and quality

Data shows that companies conducting regular pipeline reviews achieve higher win rates and shorter sales cycle length. This directly impacts sales performance and growth stability.

Pipeline discipline also improves customer relationships. Deals move forward based on buyer signals, not pressure. This aligns sales actions with the real buying process.

Platforms like Forecastio help teams go beyond static pipeline views. They surface risk, track trends, and connect pipeline signals to sales forecasting and planning.

How to design sales pipeline stages

Designing sales pipeline stages means translating your real sales process into clear, measurable steps. A good pipeline structure helps teams move deals forward consistently and improves effective sales pipeline execution.

How sales pipeline stages reflect your sales process

Sales pipeline stages should directly reflect how your real sales process works, not how your CRM is configured. Each stage must represent a clear shift in buyer commitment, such as moving from problem exploration to solution evaluation. When stages mirror real buyer behavior, sales teams can manage deals more consistently and leaders gain better pipeline visibility.

Common sales pipeline stage examples in B2B

In B2B environments, deal stages usually follow a structured decision flow rather than emotional impulse. Typical sales pipeline stages include:

Discovery / Demo

Proposal

Negotiations

Contracting

Closed won or lost

These stages help sales reps track progress across all the deals and understand where sales efforts are concentrated.

Pipeline Stage Analysis with Forecastio

How many stages should a sales pipeline have?

Most B2B organizations perform best with 5 to 7 sales pipeline stages. Too many stages slow down deal movement and increase manual tasks for sales reps. Too few stages reduce insight and make it harder to identify bottlenecks or risks within the sales cycle.

Aligning pipeline stages with buyer journey

Pipeline stages must align with the buyer’s buying process, not internal sales activities. Buyers move through evaluation, comparison, and approval phases, and your sales stages should reflect those shifts. This alignment improves trust, strengthens customer relationships, and increases conversion rates across the pipeline.

Defining clear entry and exit criteria for each stage

Every pipeline stage needs clear entry and exit criteria based on objective signals, not opinions. These criteria may include completed discovery calls, confirmed budgets, or identified decision-makers. Clear rules improve reliable data, strengthen pipeline hygiene, and reduce inflated pipeline value.

When to customize pipeline stages by segment or deal type

Not all deals follow the same path, especially when deal size, market, or sales motion differs. Enterprise deals, renewals, and upsells often require different sales pipeline stages than SMB new business. Customizing pipelines allows sales teams to manage complexity better and helps sales managers apply the right expectations to each deal type.

In my career, I have seen thousands of sales pipelines across different industries and deal types. Based on this experience, I strongly recommend creating separate pipelines when you have enough deals of each type and the sales process differs significantly.

Using one pipeline for very different deal motions often leads to distorted sales metrics, misleading conversion rates, and unreliable sales forecasting. Separate pipelines allow sales teams to work more efficiently, apply the right expectations at each pipeline stage, and improve both pipeline health and forecast accuracy.

This approach also helps sales leaders clearly understand performance by segment and make better decisions about resources, priorities, and future revenue.

Sales pipeline management process step-by-step

The sales pipeline management process is a continuous system, not a one-time setup. It helps you manage your sales pipeline with clarity and discipline. The goal is simple. Keep the sales pipeline accurate, actionable, and tied to revenue goals. When teams follow a repeatable approach, they improve pipeline health, reduce manual tasks, and create more predictable future revenue.

Step 1: Define what “pipeline” means in your company

Start by defining what should be included in the sales pipeline and what should not. Many teams mix early leads with real opportunities, which distorts pipeline value and forecast accuracy. Clarify what qualifies as a real opportunity, and what minimum criteria must be met. This is where you separate lead qualification from active pipeline work.

Step 2: Design pipeline stages that match your sales motion

Your sales pipeline stages must match how you actually sell. A complex enterprise motion needs different deal stages than a fast SMB motion. Keep stages buyer-oriented and easy for sales reps to apply consistently.

Step 3: Set entry and exit criteria for every stage

Each pipeline stage needs objective rules for entry and exit. This prevents deals from moving forward based on hope or pressure. Criteria should be based on buyer actions and verified facts, not internal activity. For example, “proposal sent” is not the same as “proposal reviewed by decision makers.”

Step 4: Standardize required fields and data hygiene rules

Define what deal data must exist for every stage, and enforce it. This includes close date, deal amount, next step, and key contacts. Without reliable data, you cannot trust reports or sales forecasting. Strong pipeline hygiene reduces confusion and improves decision-making for sales leaders.

Step 5: Establish activity expectations by stage

Pipeline movement requires consistent sales activities. Define what “good execution” looks like in each stage. This also helps sales managers coach reps based on actions, not opinions. Examples of stage expectations can include:

Minimum number of buyer interactions

Required follow ups within a timeframe

Required meetings or stakeholder alignment

Step 6: Build your pipeline dashboard and core reports

A pipeline is only useful if you can see it clearly. Build dashboards that show both volume and quality, not just totals. Good reporting should help you answer: What is stuck? What is slipping? Where do we identify bottlenecks? Strong dashboards improve pipeline visibility across the team.

Step 7: Define pipeline health rules and risk signals

Create simple rules that define a healthy vs risky deal. This makes pipeline management proactive instead of reactive. Common risk signals include stale deals, missing data, inactive deals, and repeated close-date changes. When risk rules are clear, sales teams manage deals with less debate and more action.

Step 8: Set a cadence for pipeline reviews

Pipeline reviews must be scheduled and consistent. Most teams need weekly reviews for active deals and monthly reviews for trends. The key is to make regular pipeline reviews a habit, not an emergency event. Reviews should focus on deal progress, risks, and next actions.

Step 9: Monitor pipeline performance and trends

Do not only look at the pipeline as a snapshot. Track how it changes over time. Watch key metrics like conversion rates, stage duration, win rate, and deal velocity. Trends show whether your pipeline is improving or slowly degrading.

Step 10: Audit and clean the pipeline regularly

Pipeline accuracy declines if you do not clean it. Deals that have no activity, no next step, or outdated close dates should be corrected or removed. This keeps pipeline reports trustworthy and prevents inflated forecasts. A clean pipeline also reduces wasted sales efforts on low-probability deals.

Step 11: Improve the pipeline using insights and experiments

Use pipeline data to make small improvements and measure results. For example, test tighter qualification rules, change stage definitions, or adjust activity expectations. Then track impact on win rate, speed, and average deal size. Continuous improvement is a core part of effective pipeline management.

Step 12: Align pipeline management with forecasting and planning

Pipeline management should directly support planning and accurate sales forecasts. Your pipeline is the input for capacity planning, hiring decisions, and target setting. This is where platforms like Forecastio add value, especially when you need deeper analysis, better risk detection, and stronger forecasting logic than standard CRM reporting.

Key sales pipeline metrics

Sales pipeline management depends on tracking the right sales metrics, not just looking at deal lists. Metrics turn raw sales data into insight and help sales leaders understand pipeline quality, risk, and potential future revenue. When tracked consistently, these metrics support better decisions, stronger pipeline health, and more reliable planning.

Pipeline Overview and Risky Deals Analysis with Forecastio

Total pipeline value

Total pipeline value is the sum of all open deal values in the sales pipeline. It shows how much potential revenue is currently being pursued. On its own, this metric can be misleading, so it should always be reviewed alongside quality indicators like win rate and stage distribution.

Pipeline growth rate

Pipeline growth rate measures how fast new opportunities are entering the pipeline over time. It helps sales teams understand whether lead generation and lead qualification efforts are keeping pace with revenue targets. A declining growth rate often signals future revenue gaps.

Pipeline coverage ratio

The pipeline coverage ratio compares total pipeline value to the sales quota for a given period. For example, a 3× sales pipeline coverage ratio means the pipeline value is three times the target revenue. This metric helps estimate whether there are enough deals to realistically hit goals.

Win rate

Win rate is the percentage of deals that close successfully out of all closed opportunities. It reflects both deal quality and execution effectiveness. A stable or improving win rate is a strong signal of a well managed sales pipeline.

Average deal size

Average deal size shows the typical revenue generated per closed deal. It helps teams understand whether growth comes from closing more deals or larger ones. Changes in this metric often impact capacity planning and sales strategy.

Sales cycle length

Sales cycle length measures how long it takes to move a deal from first contact to closed won. Shorter cycles usually indicate strong qualification and clear buyer alignment. Longer cycles may signal friction, complexity, or weak pipeline management practices.

Sales velocity

Sales velocity combines average deal size, win rate, and sales cycle speed into a single view. It shows how quickly revenue moves through the pipeline. Improving sales velocity directly improves cash flow and forecasting confidence.

Deal velocity

Deal velocity shows how quickly individual deals move through the sales pipeline, from creation to close. It helps sales managers spot slow-moving opportunities and friction within the sales cycle. Low deal velocity often signals stalled decisions or weak buyer engagement.

Deal Velocity Analysis with Forecastio

Pipeline stage conversion rates

Pipeline stage conversion rates show how efficiently deals move between sales pipeline stages. They help identify bottlenecks where deals frequently stall or drop off. Monitoring these rates supports continuous improvement of the selling process.

Slippage rate

Slippage rate tracks how often deals miss their original close dates. High slippage reduces forecast accuracy and often points to weak qualification or unrealistic expectations. This metric is critical for trustworthy sales forecasting.

Key sales pipeline signals

Pipeline signals help sales teams identify risk early, before deals are lost or forecasts become unreliable. These signals act as early warnings that highlight where attention and action are needed.

Stalled deals

Stalled deals show no meaningful movement for an extended period within the same pipeline stage. They often indicate lack of buyer urgency or unclear next steps.

Inactive deals

Inactive deals have no recent sales activities such as calls, emails, or meetings. A growing number of inactive deals usually signals poor prioritization or overstretched sales reps.

Slipping close dates

Repeated changes to close dates are a strong risk indicator. Slipping close dates reduce sales forecast accuracy and often reflect weak qualification or unrealistic expectations.

Low-engagement opportunities

These deals show minimal buyer interaction and limited responsiveness. Low engagement often means the opportunity is not a real priority for the prospective customer.

Single-threaded deals

Single-threaded deals rely on only one contact inside the customer organization. If that contact goes silent or leaves, the deal is at high risk.

Missing or outdated deal data

Deals with incomplete or outdated fields weaken pipeline hygiene. Poor sales data quality makes pipeline reports and forecasts unreliable.

Overweighted pipeline stages

When too many deals sit in one sales pipeline stage, it often signals bottlenecks or overly loose stage criteria. This distorts conversion rates and pipeline insights.

Changes in pipeline stage conversion

Sudden drops in pipeline stage conversion rates are early warnings of process or market issues. These changes often point to breakdowns in messaging, qualification, or buyer alignment.

Changes in pipeline stage duration

Longer time spent in a pipeline stage shows growing friction in the sales cycle. Monitoring stage duration helps teams identify where deals slow down and why.

Is CRM alone enough to manage a sales pipeline?

Customer Relationship Management systems are essential for managing deals, contacts, and relationships with customers, but they are often not enough on their own. While CRMs help manage your sales pipeline at a basic level, they are designed mainly for record-keeping and execution. As pipelines grow in size and complexity, teams need deeper insight into risk, trends, and future revenue than standard CRM views can provide.

Limitations of standard CRM pipeline views

Most CRM pipeline views focus on current deal status and stage placement. They show where deals are, but not how healthy they are or how likely they are to close. This limits pipeline visibility and makes it hard to proactively manage risk across all the deals.

Gaps in forecasting and pipeline intelligence

CRM forecasting is often based on static probabilities or manual inputs from sales reps. These probabilities rarely adjust based on real sales performance, deal behavior, or historical patterns. As a result, forecasts can look confident while still being inaccurate.

Why pipeline analytics often require dedicated tools

Advanced pipeline management requires deeper analysis of trends, signals, and patterns over time. Dedicated tools can analyze pipeline stage movement, duration, slippage, and risk across the entire sales cycle. This level of insight helps sales leaders make better decisions and improve forecast accuracy.

When teams outgrow CRM-only pipeline management

Teams usually outgrow CRM-only pipeline management when deal volume increases, sales motions diversify, or forecasting becomes critical for planning. At this stage, relying only on CRM reports leads to blind spots and delayed reactions. This is where platforms like Forecastio help sales teams manage pipelines more effectively by adding intelligence, risk detection, and forecasting on top of CRM data.

Sales pipeline management software

Choosing the right sales pipeline management software depends on your team size, sales complexity, and forecasting needs. Some teams need a strong CRM foundation. Others require advanced pipeline management and forecasting intelligence on top of CRM data. The best tools help sales teams improve pipeline visibility, reduce manual work, and make better decisions about future revenue.

Core features to look for in pipeline management tools

Effective sales pipeline management tools should go beyond deal tracking. At a minimum, it should support:

Clear visual representation of the sales pipeline

Custom sales pipeline stages and rules

Pipeline health indicators and risk signals

Forecasting logic tied to real performance

Reporting on key metrics like win rate, slippage, and sales cycle length

These features allow teams to effectively manage pipelines instead of reacting too late.

CRM-native vs standalone pipeline tools

CRM-native tools focus on execution, data storage, and customer relationship management. They are essential for managing contacts, sales activities, and deal ownership. Standalone pipeline tools focus on analysis, risk detection, and sales forecasting.

In practice, many teams use both. The CRM manages daily work, while a dedicated pipeline tool improves insight, accuracy, and planning.

Pipeline intelligence and forecasting software

Pipeline intelligence tools analyze how deals move through pipeline stages over time. They highlight stalled deals, slipping close dates, and unhealthy patterns that are hard to see in standard CRM views. This category is critical for improving forecast accuracy and supporting leadership decisions.

This is where platforms like Forecastio add strong value by combining pipeline analytics with accurate sales forecasts based on historical behavior and real signals.

Tools for SMB vs mid-market sales teams

SMB teams usually prioritize speed, simplicity, and fast setup. Mid-market teams need deeper reporting, segmentation, and forecasting support as deal volume and complexity increase. As teams scale, sales pipeline management best practices require more automation and intelligence.

How to evaluate ROI of pipeline management software

ROI should be measured in outcomes, not features. Focus on:

More close deals

Better forecast accuracy

Shorter sales cycle

Less time spent on manual tasks

If a tool improves decision quality and saves time for sales reps and sales managers, it delivers real value.

Best sales pipeline management tools

Below is a practical list of widely used tools, grouped by category.

CRM platforms with strong pipeline management

HubSpot

A powerful CRM with intuitive pipeline views, strong reporting, and built-in automation. Very popular with SMB and mid-market sales teams manage pipelines daily.Salesforce

The most flexible enterprise CRM on the market. Highly customizable pipelines, but often requires admin effort and add-ons for advanced analytics.Pipedrive

A sales-first CRM focused on visual pipelines and activity tracking. Well suited for smaller teams with straightforward sales motions.

Pipeline intelligence and forecasting tools

Forecastio

Designed specifically for sales pipeline management and forecasting. Adds pipeline intelligence, risk signals, and advanced forecasting on top of CRM data, especially for HubSpot users.

AI Sales Forecasts with Forecastio

Clari

A revenue intelligence platform used by larger sales organizations. Strong forecasting and pipeline inspection capabilities.InsightSquared

Focuses on sales analytics and performance reporting. Useful for understanding pipeline trends and team efficiency.

When to combine tools

Many high-performing teams use:

A CRM to manage deals and sales activities

A pipeline intelligence tool to analyze health, risk, and forecasts

This combination supports effective pipeline management without overloading the CRM with complex logic.

Best practices in managing sales pipelines

Strong management creates consistency, transparency, and predictability across sales teams. When best practices are applied daily, teams spend less time debating data and more time closing deals. These practices help build a well managed sales pipeline that supports growth and reliable planning.

Keep pipeline data clean and up to date

Accurate sales data is the foundation of effective pipeline management. Deals with outdated close dates, missing fields, or unclear next steps distort pipeline value and forecasts. Clean data improves pipeline hygiene and trust in reports.

Review pipeline regularly, not occasionally

Pipelines should be reviewed on a set cadence, not only when targets are at risk. Regular pipeline reviews help sales managers spot issues early and coach proactively. Discipline in reviews leads to better execution.

Focus on pipeline quality, not just size

A large pipeline does not always mean a healthy one. Too many low-quality deals inflate numbers but reduce forecast accuracy. Focusing on qualified opportunities improves conversion rates and closing efficiency.

Align sales reps and leadership on pipeline definitions

Everyone must share the same understanding of sales pipeline stages, deal status, and qualification criteria. Misalignment creates confusion and inconsistent reporting. Shared definitions lead to better pipeline visibility and decision-making.

Use historical data to improve pipeline accuracy

Past deal behavior provides strong signals for future outcomes. Analyzing win rates, sales cycle length, and stage movement helps teams make better predictions. Historical insights reduce reliance on assumptions.

Combine human judgment with data-driven insights

Data provides structure, but experience adds context. The best results come from balancing rep judgment with analytics and signals. This combination strengthens sales pipeline management without removing human ownership.

Key mistakes in sales pipeline management

Avoiding common errors is just as important as following best practices. Many pipeline problems come from habits that feel normal but quietly damage pipeline health, forecast accuracy, and execution.

Treating the pipeline as a static report

A sales pipeline should be a working management tool, not a snapshot viewed once a month. When pipelines are not actively reviewed, risks remain hidden. Active pipelines require continuous updates and decisions.

Overestimating deal probabilities

Deals are often marked as likely to close without enough evidence. This creates inflated pipeline value and unreliable forecasts. Optimism without data directly harms sales forecasting.

Ignoring early warning signals

Signals like stalled activity or slipping close dates rarely fix themselves. Ignoring them delays action and reduces the chance to recover deals. Early signals exist to protect future revenue.

Allowing deals to stay too long in stages

Deals that sit too long in one pipeline stage usually lose momentum. Long stage duration often indicates weak buyer engagement or unclear next steps. Time is one of the biggest deal killers.

Relying on gut feeling instead of data

Experience matters, but intuition alone does not scale across teams. Decisions based only on gut feeling lead to inconsistent results. Sales data provides structure and repeatability.

Managing pipeline without forecasting context

A pipeline without forecasting is disconnected from planning and targets. Teams may feel busy but still miss revenue goals. Sales pipeline management works best when tightly linked to accurate sales forecasts.

Sales pipeline management trends in 2026

Sales pipeline management continues to evolve as data quality, automation, and forecasting expectations increase. In 2026, teams focus less on manual updates and more on continuous insight, risk prevention, and planning accuracy.

Shift from manual to automated pipeline analysis

Manual pipeline updates and spreadsheet reviews are gradually disappearing. Automated analysis reduces human bias and saves time for sales reps and sales managers. This shift improves consistency and pipeline visibility across teams.

AI-driven pipeline risk detection

AI models analyze patterns across sales data, stage duration, and deal behavior. Instead of relying on intuition, teams receive early risk signals based on evidence. This helps address problems before deals are lost.

Continuous pipeline forecasting

Forecasts are no longer static monthly numbers. Modern systems update forecasts continuously as deals move, data changes, or signals appear. This improves forecast accuracy and supports faster decision-making.

Stronger role of RevOps in pipeline management

Ownership of pipeline management is moving toward RevOps teams. Centralized ownership ensures consistent definitions, clean data, and aligned processes. This reduces friction between sales, leadership, and planning.

Focus on pipeline health over pipeline volume

Teams are shifting attention from how big the pipeline looks to how healthy it actually is. Metrics like engagement, stage duration, and slippage matter more than raw pipeline value. Quality pipelines lead to better outcomes.

Deeper integration between CRM and forecasting tools

CRMs remain the system of record, but forecasting and pipeline intelligence increasingly live outside the CRM. Deeper integrations allow teams to connect execution with planning and future revenue. Platforms like Forecastio lead this shift by linking pipelines directly to forecasting and strategic decisions.

FAQ

What is sales pipeline management?

Sales pipeline management is the process of tracking, analyzing, and improving all active deals as they move through the sales process. It helps sales teams understand deal progress, identify risks, and predict future revenue more accurately.

What are the 5 stages of the sales pipeline?

While stages vary by company, a common 5-stage sales pipeline includes:

Lead qualification

Discovery or needs analysis

Proposal or solution presentation

Negotiation or decision

Closed won or closed lost

These stages reflect how a buyer moves through the buying process.

What tools can manage a sales pipeline?

Sales pipelines are usually managed in CRM systems like HubSpot or Salesforce. For deeper insights, teams often use sales pipeline management software such as Forecastio, which adds pipeline analytics, risk detection, and forecasting on top of CRM data.

How do you organize a sales pipeline?

To organize a sales pipeline, define clear stages, set entry and exit criteria, standardize required data fields, and review the pipeline regularly. A well-organized pipeline reflects the real sales process and stays clean, accurate, and actionable.

Share:

Alex is the CEO at Forecastio, bringing over 15 years of experience as a seasoned B2B sales expert and leader in the tech industry. His expertise lies in streamlining sales operations, developing robust go-to-market strategies, enhancing sales planning and forecasting, and refining sales processes.

Alex is the CEO at Forecastio, bringing over 15 years of experience as a seasoned B2B sales expert and leader in the tech industry. His expertise lies in streamlining sales operations, developing robust go-to-market strategies, enhancing sales planning and forecasting, and refining sales processes.

Related articles

Sales Strategies

Feb 23, 2026

15 min

Sales Strategies

Feb 23, 2026

15 min

Pipeline Management

Feb 23, 2026

11 min

Pipeline Management

Feb 23, 2026

11 min

Sales Tools

Feb 23, 2026

15 min

Sales Tools

Feb 23, 2026

15 min

Sales Strategies

Feb 23, 2026

15 min

Pipeline Management

Feb 23, 2026

11 min

Sales Strategies

Feb 23, 2026

15 min

Pipeline Management

Feb 23, 2026

11 min

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

© 2025 Forecastio, All rights reserved.

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

© 2025 Forecastio, All rights reserved.

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

© 2025 Forecastio, All rights reserved.

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

© 2025 Forecastio, All rights reserved.