The Ultimate Sales Forecasting Guide for 2026

Alex Zlotko

CEO at Forecastio

What Is Sales Forecasting?

Sales forecasting is the structured process of predicting future sales, future revenue, and overall sales performance based on historical data, current sales pipeline, and relevant market trends. In modern B2B organizations, sales forecasting is not just a planning exercise. It is a core management discipline that connects sales strategy, resource allocation, and executive decision-making.

At its core, sales forecasting answers a simple but critical question. How much revenue will the business generate in a given period, and how confident are we in that number? Accurate sales forecasts help sales leaders, sales managers, and RevOps teams align hiring plans, budgets, and growth initiatives. Inaccurate forecasts create blind spots that cascade across finance, marketing, and operations.

In 2026, sales forecasting increasingly relies on advanced data analytics, real time data, and AI-driven forecasting models. Manual spreadsheets and gut-feel projections are being replaced by structured processes supported by revenue operations software and with AI. This shift reflects one reality. Revenue predictability has become a competitive advantage.

Sales forecasting is the discipline of predicting future revenue using data, process, and models. It underpins strategic planning and operational alignment.

Sales Forecasting Definition

Sales forecasting is the practice of estimating future sales performance by analyzing past sales data, current sales pipeline, sales cycle behavior, and external factors such as market conditions or seasonality. A strong sales forecasting process combines quantitative data with structured judgment rather than intuition alone. Here you can read how Gartner defines sales forecasting.

A forecast is not a guarantee. It is a probabilistic estimate designed to guide decisions. The goal is not perfection but sales forecast accuracy that is consistent, explainable, and improvable over time.

Revenue forecasting estimates future revenue using historical trends, pipeline data, and structured assumptions.

What a Sales Forecast Includes

A modern sales forecast typically includes several dimensions. Revenue represents the expected monetary outcome. Deals reflect the number and value of opportunities in the sales pipeline. Units matter for product or service businesses where volume impacts delivery and inventory. For SaaS companies, ARR vs MRR separates long-term contract value from short-term recurring income. Finally, forecasts often distinguish new business vs expansion, which behave very differently in terms of cycle length and risk.

Ignoring these distinctions reduces forecast clarity and increases volatility. High-performing sales organizations forecast each component explicitly.

A complete sales forecast covers revenue, deal volume, units, recurring metrics, and deal types.

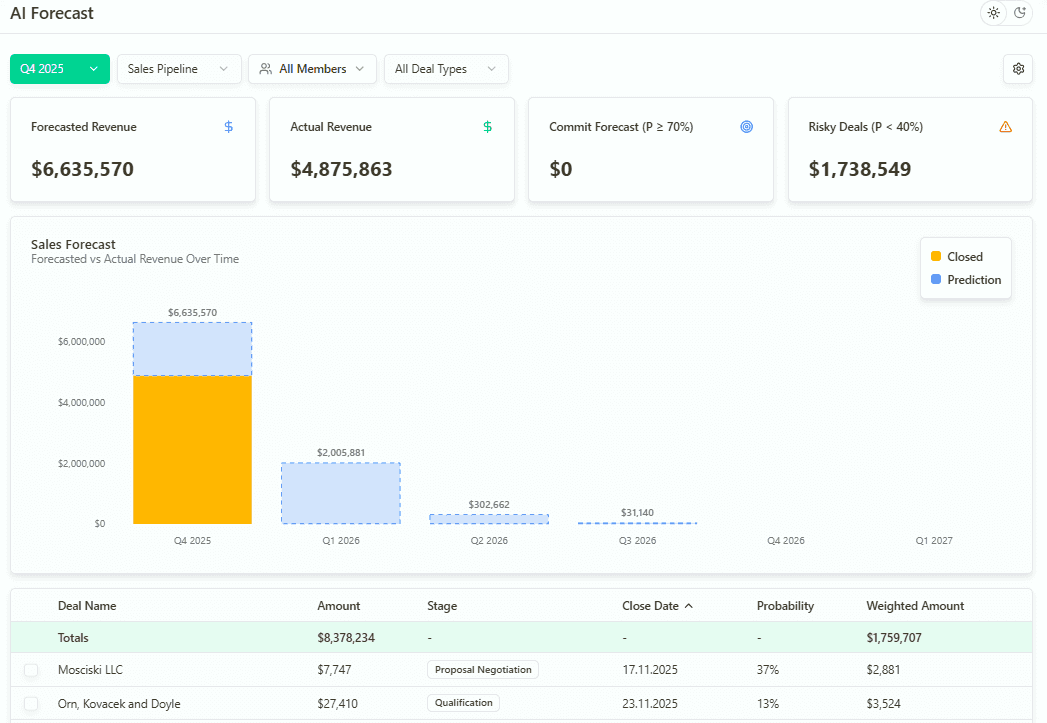

An example of AI Sales Forecast in Forecastio

Sales Forecast vs Sales Targets vs Sales Plans

Sales forecasts, sales targets, and sales plans serve different purposes. A sales target is a goal, often aspirational. A sales plan describes how the organization intends to reach that goal. A sales forecast predicts what will actually happen based on current data.

Confusing targets with forecasts is a common sales forecasting mistake. Forecasts should reflect reality, not ambition. Plans can be optimistic. Forecasts must be honest.

Who Owns Sales Forecasting in Modern Organizations

Ownership of sales forecasting is shared. Sales leadership owns forecast accountability and commits numbers upward. RevOps owns the forecasting process, data quality, and method selection. Finance validates assumptions and aligns forecasts with budgets. The executive team uses forecasts to guide strategic decisions.

Clear ownership reduces bias and improves sales forecasting accuracy.

Sales forecasting is a cross-functional responsibility led by Sales and RevOps.

Why Is Sales Forecasting Important?

Sales forecasting is important because it transforms uncertainty into manageable risk. Without reliable forecasts, companies operate reactively. With accurate forecasts, they plan proactively.

Forecasting and Revenue Predictability

Revenue predictability is the primary outcome of effective sales forecasting. When organizations can reliably forecast sales, they reduce surprises and stabilize growth. Predictable future revenue allows leaders to invest with confidence and avoid emergency corrections.

Impact on Hiring, Budgeting, and Resource Allocation

Hiring plans, marketing budgets, and capacity decisions depend on expected revenue. Over-forecasting leads to overspending. Under-forecasting slows growth. Accurate forecasts enable efficient resource allocation across teams.

Sales Forecasting and Investor Confidence

Investors evaluate companies based on their ability to accurately forecast sales. Consistent forecast accuracy signals operational maturity. Persistent misses raise concerns about execution risk.

Sales Forecasting as a Management Tool

As a management tool, sales forecasting supports performance tracking, early risk detection, and better decision-making. Deviations between forecast and actuals highlight process gaps before they become revenue problems. A similar view is shared in this overview, where forecasting is positioned as an operational tool rather than a static revenue estimate.

Sales forecasting enables revenue predictability and reduces surprises at the end of the month or quarter. Reliable sales forecasts support hiring decisions, budgeting, and resource allocation by grounding plans in expected future revenue rather than assumptions.

Consistent forecasting accuracy strengthens investor confidence and signals operational maturity. As a management tool, sales forecasting helps sales leadership and RevOps teams track performance, detect risks early, and make better decisions before results impact revenue.

Based on observations from the Forecastio team, forecasts are inflated in around 80% of companies. As a result, sales leaders set unreliable sales quotas, which creates constant pressure to “catch up” and ultimately damages sales team morale and trust in the forecast.

Sales Forecasting in B2B vs B2C

The core difference between sales forecasting in B2B and B2C lies in deal structure, data volume, and forecasting granularity. B2B sales forecasting is built around individual opportunities, sales pipeline health, and sales cycle forecasting, while B2C forecasting relies on aggregated transactions and historical sales data.

For example, a B2B company forecasting 20 deals with an average deal size of €50,000 must assess each opportunity’s probability and close date to estimate future revenue. A B2C company selling 10,000 subscriptions at €30 per month focuses instead on conversion rates, churn, and historical trends to predict future sales at scale.

Deal Size, Sales Cycle, and Forecast Volatility

In B2B, larger deal sizes and longer sales cycles significantly increase forecast volatility. A single delayed or lost deal can materially impact future revenue and overall forecast accuracy, especially in smaller sales organizations.

In B2C, shorter cycle lengths and higher transaction volume smooth out volatility. Individual deals have minimal impact, making sales forecasting accuracy more dependent on volume consistency and market conditions than on specific customer decisions.

Forecasting Challenges in B2B Sales

B2B sales forecasting challenges often stem from unreliable close dates, inconsistent deal probability accuracy, and subjective input from sales reps. Human bias, especially optimism bias in late-stage deals, leads to inflated forecasts and distorted views of future sales performance.

Additional complexity comes from heterogeneous pipelines, mixed deal types, and varying sales processes, all of which reduce the reliability of opportunity stage forecasting if not properly segmented.

Forecasting Challenges in B2C Sales

B2C sales forecasting is more sensitive to external factors such as pricing changes, promotions, macroeconomic shifts, and customer behavior trends. Sudden changes in demand or market volatility can quickly invalidate forecasts built purely on past performance.

Another challenge is overreliance on averages. While historical forecasting works well at scale, it may fail to capture rapid shifts in customer preferences or emerging market trends, leading to delayed reactions in sales planning.

Understanding these structural differences is essential for choosing the right sales forecasting methods and building more accurate forecasts across different business models.

Sales Forecasting by Sales Model

Sales forecasting varies significantly depending on the sales motion a company uses. Differences in deal volume, sales cycle length, customer acquisition channels, and buying complexity directly influence how teams forecast sales and which sales forecasting methods deliver reliable results.

Inside sales, enterprise sales, and channel-driven models each produce different types of sales data and levels of forecast volatility. Applying the same forecasting process across all sales models often leads to distorted future revenue projections and lower sales forecasting accuracy.

SMB Sales Forecasting

Inside sales forecasting typically deals with higher deal volume, shorter sales cycles, and more standardized sales processes. This makes pipeline forecasting, stage forecasting, and analysis of historical sales data particularly effective for predicting future sales and improving forecast accuracy.

Because SMB sales teams generate large amounts of real time data, small changes in conversion rates or cycle length can quickly impact future revenue, making frequent forecast updates essential.

Enterprise Sales Forecasting

Enterprise sales forecasting focuses on a small number of high-value opportunities with long and often unpredictable sales cycles. In this model, opportunity stage forecasting, close date reliability, and deal-specific probability models are critical to accurately forecast sales.

Given the impact of a single deal on sales revenue, enterprise teams rely heavily on historical trends, deal behavior analysis, and advanced forecasting models to manage risk and reduce forecast volatility.

Channel and Partner Sales Forecasting

Channel and partner sales forecasting introduces additional complexity due to limited visibility into partner pipelines and delayed sales data. Forecasts in this model often depend on lagging indicators and aggregated historical forecasting, which reduces short-term forecast accuracy.

To mitigate this, sales organizations typically apply conservative assumptions, longer forecasting horizons, and regular adjustments based on past performance and partner reliability.

Different sales motions require different sales forecasting methods. Inside sales benefits from volume-driven pipeline forecasting, enterprise sales demands deal-level probability and close date accuracy, and channel models rely more on historical data and conservative assumptions.

Aligning the forecasting process with the specific sales model improves forecast accuracy, reduces volatility in future revenue projections, and helps sales leaders make more informed decisions.

Observation from the Forecastio team:

Based on practical work with customer data at Forecastio.ai, many SMB sales teams with short sales cycles of 2–4 weeks and high deal volume can rely on time-series sales forecasting as their primary forecasting method. In these environments, pipeline dynamics are stable and repetitive, which makes historical trends highly predictive. Across multiple customer datasets, applying time-series analysis resulted in sales forecasting accuracy of 87–88%, often outperforming traditional pipeline forecasting and weighted models for short-cycle SMB sales.

Sales Forecasting in PLG vs Sales-Led Models

Revenue forecasting differs significantly between product-led growth (PLG) and traditional sales-led organizations because the primary revenue drivers are different. In PLG companies, future sales emerge from product usage and customer behavior, while in sales-led models revenue is driven by managed opportunities moving through a sales pipeline.

This difference impacts the sales forecasting process, the type of sales data used, and the level of predictability. Applying sales-led forecasting logic to PLG businesses often results in distorted future revenue projections and delayed risk detection.

What Is PLG Sales Forecasting

PLG sales forecasting focuses on predicting revenue based on product adoption rather than direct sales activity. Instead of relying on deal stages or rep-submitted commits, PLG forecasts use customer data, usage patterns, and conversion trends to estimate future sales performance.

In this model, forecasting is closely tied to customer behavior, making historical data and trend analysis critical for predicting how users move from product usage to paid plans or higher tiers.

Forecasting in Product-Led Growth Companies

In PLG companies, sales forecasting typically models the full funnel from signups to revenue. Signups represent demand generation, activations indicate product value realization, conversions reflect monetization, and expansion drives long-term future revenue.

Each step has its own conversion rate and time lag. Small changes in activation or expansion rates can materially impact accurate sales forecasts, which is why PLG forecasting relies heavily on analyzing historical data and time-series forecasting rather than individual deal judgment.

Forecasting in Sales-Led and Hybrid Models

Sales-led sales forecasting centers on opportunities managed by sales reps, using pipeline forecasting, stage forecasting, and close date estimates to predict revenue. Accuracy depends heavily on sales process consistency, CRM hygiene, and realistic deal probabilities.

Hybrid models combine PLG signals with traditional pipeline data. In these setups, forecast accuracy improves when product usage data is used to adjust deal probabilities and identify expansion opportunities earlier in the sales cycle.

Common Forecasting Mistakes in PLG Companies

A common mistake in PLG sales forecasting is treating signups or trials as equivalent to pipeline opportunities. This inflates future revenue expectations and masks churn or low activation risk.

Another frequent issue is ignoring time delays between product usage and monetization. Without modeling these delays using historical trends, PLG companies may predict future sales too early, leading to unreliable sales planning and misaligned resource allocation.

SaaS Sales Forecasting vs Traditional Sales Forecasting

Sales forecasting differs significantly between SaaS and traditional businesses because the revenue logic is different. SaaS companies generate future revenue through recurring subscriptions, renewals, and expansion, while traditional companies rely more on one-time or repeat transactions.

As a result, SaaS sales forecasting must account for both new sales and post-sale dynamics such as retention and upsell. Using traditional sales forecasting methods without adapting them to recurring revenue often leads to inflated or misleading forecasts.

What Makes SaaS Sales Forecasting Different

The key difference in SaaS sales forecasting is revenue continuity. Revenue builds over time instead of restarting each period, shifting focus from single deal closure to lifecycle-based sales performance.

Forecasts must reflect onboarding speed, product adoption, and renewal likelihood. Even with solid pipeline forecasting, ignoring post-sale behavior reduces forecast accuracy and weakens future revenue estimates.

Recurring Revenue and Forecasting Accuracy

Recurring revenue improves predictability only if churn and expansion are forecast correctly. Accurate sales forecasts depend on understanding how long customers stay and how often they grow.

For example, stable new bookings can still result in missed targets if churn increases. This is why SaaS sales forecasting accuracy improves when historical sales data and customer behavior are analyzed together.

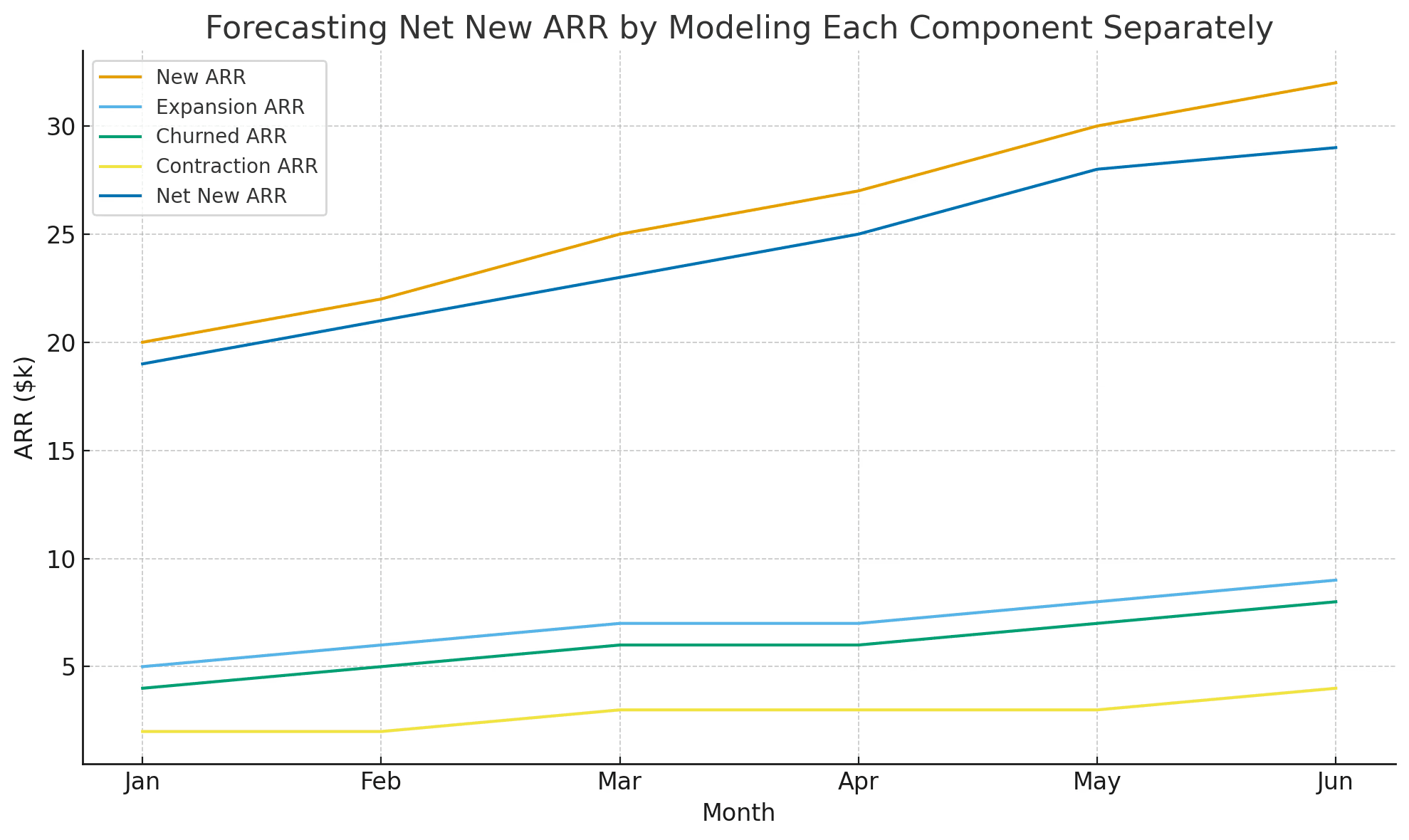

Forecasting ARR, MRR, Churn, and Expansion

SaaS sales forecasting typically models ARR, MRR, churn, and expansion separately. Each component responds to different drivers within the sales process and product usage.

Breaking forecasts into these elements helps teams accurately forecast sales, detect risks earlier, and improve sales planning and resource allocation.

Traditional Sales Forecasting in Non-SaaS Businesses

Traditional sales forecasting focuses on closed deals, unit volume, and timing. Historical forecasting and reviewing historical sales data work well when sales cycles and demand are stable.

However, without recurring revenue, forecasts are more sensitive to seasonality and market conditions, making future sales less predictable than in SaaS models.

SaaS sales forecasting differs from traditional forecasting because recurring revenue, churn, and expansion play a central role in predicting future revenue. Accurate SaaS forecasts require modeling ARR, MRR, retention, and customer behavior alongside new bookings, not just closed deals.

Traditional sales forecasting relies more heavily on transaction timing and historical sales data, making it more sensitive to seasonality and market conditions. Understanding these structural differences is critical for selecting the right sales forecasting methods and improving overall forecast accuracy.

Sales Forecasting in Startups vs Mature Companies

Sales forecasting evolves significantly as a company grows. Startups, scaling businesses, and mature organizations operate with very different levels of sales data, process maturity, and forecast stability. Applying the same sales forecasting methods across all growth stages often leads to unreliable future revenue projections and poor sales planning.

The main difference lies in data availability, predictability, and how much uncertainty the organization can tolerate. Understanding these differences helps sales leaders choose realistic forecasting approaches that match their current business stage.

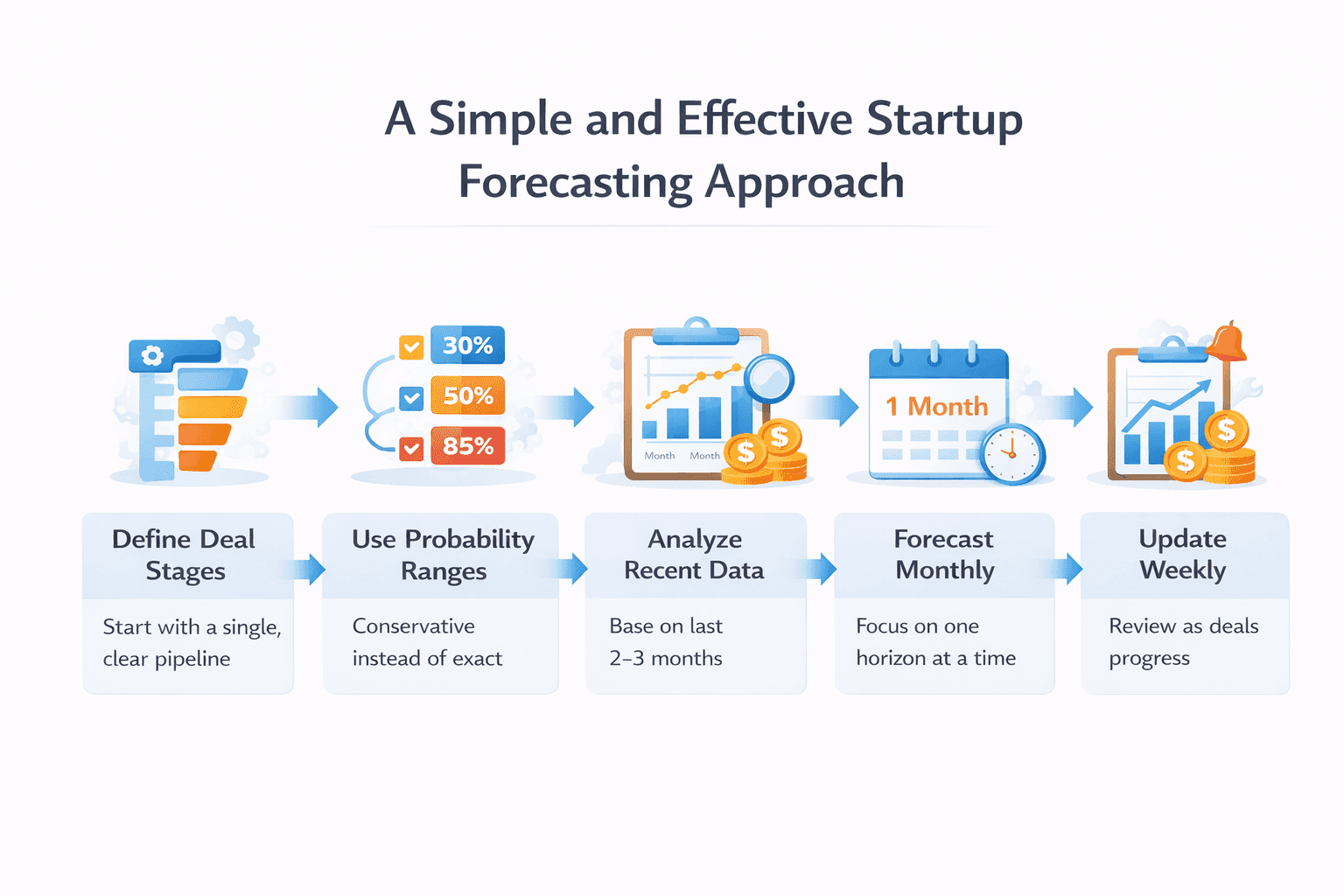

Sales Forecasting in Early-Stage Startups - A Practical Recipe

Early-stage startups should treat sales forecasting as a structured estimation exercise, not as a precision model. The goal is to understand direction, risk, and order of magnitude, not perfect forecast accuracy.

A simple and effective startup forecasting approach looks like this:

Start with a single pipeline and clearly defined deal stages in the CRM.

Use pipeline forecasting with conservative probability ranges instead of exact percentages.

Base assumptions on the last 2–3 months of sales data, even if volume is low.

Forecast only one horizon at a time, usually monthly.

Update forecasts weekly as deals move or slip in the sales cycle.

Technologically, sales forecasting in startups should rely on CRM-native reporting, basic spreadsheets, and lightweight sales forecasting tools. Complex AI models add little value at this stage because historical data is too limited. The priority is learning how deals behave, not optimizing models.

Sales Forecasting in Mature Organizations

Mature organizations operate with stable sales processes, multiple pipelines, and rich historical sales data. This enables more advanced sales forecasting methods, including stage forecasting, time-series sales forecasting, and AI-driven probability models.

At this stage, forecasting focuses on consistency, segmentation, and calibration. Dedicated sales forecasting software and RevOps tools with AI help automate data collection, track forecast accuracy, and manage complexity across regions and teams.

Platforms like Forecastio are typically used to combine historical trends, pipeline signals, and machine learning to produce more reliable future revenue projections.

Short-Term vs Long-Term Sales Forecasting

Sales forecasting serves different purposes depending on the time horizon. Short-term forecasts focus on execution and near-term sales performance, while long-term forecasts support strategic planning, hiring, and investment decisions.

The key difference is precision versus direction. Short-term sales forecasting aims for high forecast accuracy using pipeline data, while long-term forecasting accepts uncertainty and focuses on trends, scenarios, and future revenue potential.

Monthly Sales Forecasting

Monthly sales forecasting is execution-focused and built around the active sales pipeline. It relies on close dates, deal movement, and real time data to assess whether teams will hit short-term sales quotas.

Because the horizon is short, even small changes in deal status can materially affect forecast accuracy, requiring frequent updates and active review.

Quarterly Sales Forecasting

Quarterly sales forecasting balances execution and planning. It includes late-stage deals and selected early-stage opportunities that may close within the quarter.

This horizon typically combines pipeline forecasting, stage forecasting, and historical trends to estimate future sales, making probability calibration critical.

Annual Sales Forecasting

Annual sales forecasting supports budgeting and sales planning. It focuses less on individual deals and more on assumptions such as pipeline capacity, average sales cycle length, and win rates.

Accuracy is lower than in short-term forecasts, but alignment across sales, RevOps, and finance becomes more important.

Long-Term Strategic Forecasting (12–36 Months)

Long-term sales forecasting is directional and scenario-based. It helps leadership estimate future revenue under different growth and market conditions.

Forecasts are usually expressed as ranges rather than exact numbers, reflecting higher uncertainty.

When to Use Each Forecasting Horizon

Use short-term forecasts for execution and risk management. Use quarterly and annual forecasts for planning and reporting. Use long-term forecasts for strategic planning and investment decisions.

Strong sales organizations treat sales forecasting as a set of coordinated forecasts, not a single number.

Observation from the Forecastio team:

Based on work with customer data at Forecastio.ai, companies with sales cycles longer than one month rarely achieve reliable results with monthly sales forecasting. In these cases, starting with quarterly forecasts produces more stable and accurate forecasts. As a general rule, the longer the sales cycle, the longer the forecasting horizon should be to reflect how revenue actually materializes.

Most Popular Sales Forecasting Methods

Modern sales forecasting relies on a small number of core methods. The difference between strong and weak forecasts is not the number of models used, but whether the method matches the sales cycle, data maturity, and business model.

Below are the most widely used and practical sales forecasting methods, explained briefly and applied correctly.

AI Sales Forecasting

AI sales forecasting uses machine learning models to predict future revenue based on large volumes of historical sales data, sales pipeline behavior, and real-time deal signals. Instead of static probabilities, AI models dynamically assign deal likelihoods and close dates based on patterns observed in past performance.

This method works best for companies with sufficient data volume, consistent sales processes, and medium to long sales cycles. AI forecasting reduces human bias and improves sales forecasting accuracy, but it requires clean CRM data and ongoing calibration to remain reliable.

Time-Series Sales Forecasting

Time-series sales forecasting predicts future sales by analyzing patterns in historical revenue over time. It focuses on trends, seasonality, and recurring behavior rather than individual deals or pipeline stages.

This approach works particularly well for SMBs with high deal volume, short and repeatable sales cycles, and stable demand patterns. In these environments, time-series analysis can outperform pipeline-based models because it reflects how revenue actually materializes over time.

Weighted Pipeline Forecasting

Weighted pipeline forecasting estimates future revenue by multiplying deal values by predefined probabilities based on pipeline stage. For example, a deal in “Proposal” might be weighted at 50%, while “Negotiation” is weighted at 70%.

This method is simple and widely used, but its accuracy depends heavily on whether stage probabilities reflect real conversion behavior. Without regular recalibration using historical data, weighted pipeline forecasts tend to be inflated.

Historical Sales Forecasting

Historical sales forecasting uses past sales data to project future performance. It assumes that historical trends, growth rates, and seasonality will continue unless disrupted by external factors or major business changes.

This method is easy to implement and useful for long-term planning, but it struggles in fast-changing environments or when sales strategy, pricing, or markets shift. It should rarely be used alone for short-term forecasting.

Qualitative (Judgment-Based) Sales Forecasting

Qualitative sales forecasting is based on human judgment from sales reps and sales managers, often captured through forecast categories or manual submissions. It reflects deal context and customer signals that are not always visible in sales data.

In mature companies, qualitative input is typically used alongside AI sales forecasting and quantitative models, not instead of them. Comparing rep forecasts with data-driven projections helps detect bias and improve overall forecast accuracy.

What Is Critical for Accurate Sales Forecasting?

Accurate sales forecasting is not driven by a single model or tool. It is the result of several foundational elements working together. When one of these elements is weak, even advanced sales forecasting methods and AI models will produce unreliable future revenue projections.

Below are the most critical factors that consistently determine sales forecasting accuracy across different sales models and company sizes.

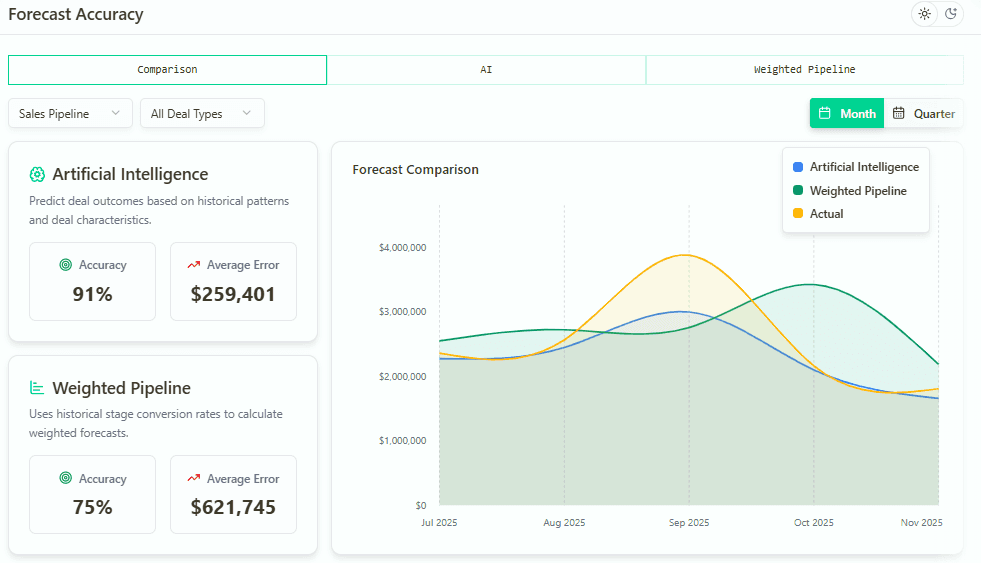

Tracking Sales Forecast Accuracy with Forecastio

Key foundations of accurate sales forecasting:

Sales data quality and CRM hygiene

Forecasts are only as good as the underlying sales data. Missing close dates, outdated deal stages, and inconsistent fields distort pipeline forecasting and reduce trust in the numbers.Clear and consistent sales pipeline structure

Well-defined stages with clear exit criteria improve stage forecasting and make deal probabilities more reliable. Mixing different deal types or sales motions in one pipeline leads to inflated forecasts.Realistic deal probabilities

Probabilities must reflect actual historical conversion rates and deal signals, not gut feeling. Regularly reviewing historical sales data and recalibrating probabilities is essential for maintaining forecast accuracy.Reliable close dates and sales cycle discipline

Inaccurate close dates are one of the biggest drivers of forecast misses. Stable sales cycle definitions and frequent updates help prevent revenue from endlessly slipping between periods.Consistent sales process and documentation

A defined and repeatable sales process makes forecasts more predictable and easier to analyze. Ad-hoc selling behavior increases volatility and weakens sales forecasting accuracy.Ongoing forecast calibration

Forecasts must be measured against actual results. Tracking gaps between forecasted and actual sales revenue allows teams to adjust assumptions and improve future forecasts over time.

In practice, accurate sales forecasting is less about finding a perfect model and more about building discipline around data, process, and continuous learning. You can also read about improving sales forecasting accuracy in this Harvard Business Review article.

How Can AI Reduce Bias in Sales Forecasting?

Bias is one of the most common reasons sales forecasting fails. Human judgment, pressure to hit sales quotas, and optimism around late-stage deals often lead to inflated future revenue projections. AI sales forecasting helps reduce these issues by grounding forecasts in data rather than intuition.

AI does not replace human input. Instead, it adds an objective layer that challenges assumptions and highlights risk earlier in the forecasting process.

How AI reduces bias:

Data-driven deal probabilities

AI models assign probabilities based on historical sales data, deal behavior, and past outcomes. This reduces reliance on subjective estimates from sales reps and improves deal probability accuracy.Pattern-based close date prediction

Rather than trusting manually entered close dates, AI analyzes how long similar deals actually took to close in the past. This improves sales cycle forecasting and reduces deal slippage across periods.Consistent evaluation across deals

AI applies the same logic to every opportunity, eliminating inconsistencies caused by individual rep behavior or management pressure. This leads to more stable and accurate forecasts.Bias detection through comparison

Comparing AI-generated forecasts with rep-submitted or qualitative forecasts helps identify optimism bias and overcommitment. Large gaps between the two views often signal hidden risk in the sales pipeline.Continuous learning and recalibration

AI models improve over time by learning from forecast errors and actual sales revenue outcomes. This ongoing adjustment increases sales forecasting accuracy as data volume grows.

AI-based sales forecasting is most effective when used as a complement to human judgment. By reducing bias and increasing consistency, it enables sales leaders to make more informed decisions based on realistic expectations of future sales.

Sales Forecasting Process Step by Step

A strong sales forecasting process is not just generating a number. It is a repeatable workflow that uses sales data, a consistent sales process, and clear accountability to produce accurate sales forecasts. The best forecasting process also includes feedback loops, so teams can improve forecast accuracy over time instead of repeating the same mistakes.

Below is a practical step-by-step forecasting process that works for most B2B sales organizations.

Step 1 – Define Forecast Scope and Horizon

Start by defining what you are forecasting and why. Decide whether the forecast covers sales revenue, units, new business, expansion, or all of them. Choose the horizon that matches your sales cycle and decision needs, such as monthly, quarterly, or annual.

Also define segmentation early. If you mix very different deal types, your forecast will be distorted and harder to trust.

Step 2 – Prepare and Clean CRM Data

Clean sales data is a non-negotiable input for sales forecasting. Ensure deals have updated stages, amounts, owners, and close dates. Fix broken pipelines, inconsistent fields, and missing activity data.

Good CRM hygiene improves pipeline forecasting, supports stage forecasting, and reduces errors caused by outdated records.

This approach is also reflected in the Salesforce sales forecasting guide, which emphasizes the role of CRM data quality and pipeline structure in reliable forecasting.

Step 3 – Choose Forecasting Methods

Select methods that match your data maturity and sales motion. Many teams combine historical forecasting, weighted pipeline, and stage forecasting for short-term views, then use trend-based models for longer horizons. If you have enough reliable historical data, AI sales forecasting can improve deal probabilities and reduce bias.

The best choice is not the most advanced method. It is the method that fits your reality.

Step 4 – Generate Initial Forecast

Prepare the initial sales forecast using the forecasting method selected in the previous step. Apply this method consistently to the current sales pipeline and available sales data to estimate future revenue for the chosen period.

The purpose of this step is to produce a single baseline forecast that reflects current reality, not optimism or targets.

Step 5 – Review and Adjust

Review the forecast with sales leadership, RevOps, and key managers. Look for common issues such as inflated late-stage probabilities, unrealistic close dates, and deals that are stuck. Adjust using documented reasoning, not gut feel.

This step is where qualitative input matters, but it should be anchored in data and past performance.

Step 6 – Measure Forecast Accuracy

Track forecast vs actual results and quantify the gap. Use a consistent metric such as forecast error percentage, MAPE, or simple variance. Segment accuracy by pipeline, team, and deal type to understand where forecasts break.

Measuring sales forecasting accuracy turns forecasting into a controllable system rather than a guessing game.

Step 7 – Improve and Recalibrate

Use forecast accuracy results from previous periods to adjust future forecasts. If your forecasts consistently overestimate or underestimate revenue, apply a calibration coefficient based on historical forecast error to correct future predictions.

This approach helps compensate for structural bias in the sales forecasting process and gradually improves sales forecasting accuracy over time without changing the underlying forecasting method.

Common Sales Forecasting Mistakes to Avoid

Even experienced sales leaders and mature sales organizations struggle with sales forecasting accuracy. In most cases, the problem is not the lack of tools or data, but a set of recurring mistakes that quietly distort future revenue projections and decision-making.

Below are the most common sales forecasting mistakes that consistently lead to unreliable forecasts.

Relying Only on Rep Commit

Many companies rely heavily on rep-submitted commit numbers as the primary sales forecast. While rep input is valuable, it is also influenced by optimism, quota pressure, and deal ownership bias.

When commit forecasts are not validated against historical sales data or pipeline behavior, they tend to inflate expected revenue and hide late-stage risk. Commit should be one signal, not the forecast itself.

Ignoring Historical Accuracy

A common mistake is treating every forecast as a clean slate. Teams generate new forecasts each period without reviewing how accurate previous forecasts were.

Without tracking forecast accuracy and understanding where and why forecasts missed, the same errors repeat. Reviewing historical sales data and forecast errors is essential for improving sales forecasting accuracy over time.

Mixing Different Deal Types in One Forecast

Combining new business, renewals, and expansion deals into a single forecast often distorts results. These deal types have different sales cycles, win rates, and risk profiles.

When they are mixed in one sales pipeline or forecast view, probabilities become meaningless and pipeline forecasting becomes unreliable. Segmentation is critical for accurately forecasting sales.

Overconfidence in a Single Forecasting Method

Relying on one forecasting method for all situations is another frequent issue. No single model works equally well across different deal sizes, markets, or sales motions.

High-performing teams combine pipeline forecasting, historical forecasting, qualitative input, and where possible, AI-driven models to create more accurate forecasts.

Poor CRM Data Hygiene

Inaccurate close dates, outdated stages, and missing deal information undermine any sales forecasting process. Even advanced sales forecasting software cannot compensate for poor data quality.

Maintaining CRM discipline and consistent data entry is one of the simplest ways to improve sales forecasting accuracy.

Sales Forecasting Predictions for 2026

1. AI becomes the default forecasting engine

AI will move from “nice to have” to essential. Most B2B teams will rely on AI-driven forecasting to detect patterns, adjust projections in real time, and reduce human bias. The best results will come from combining AI insights with human judgment, not replacing it.

2. Continuous forecasting replaces annual planning

Static annual forecasts are becoming obsolete. In 2026, leading teams will use rolling and scenario-based forecasting to adjust plans monthly or even weekly. Flexibility and speed will matter more than long-term static plans.

3. Data quality becomes a competitive advantage

Accurate forecasts depend on clean, unified data. Companies will invest more in data hygiene, CRM discipline, and single-source-of-truth systems. Poor data quality will remain one of the biggest blockers to reliable forecasting.

4. Buying behavior reshapes forecasting models

B2B buying cycles are longer, more complex, and involve more stakeholders. Forecasting will rely less on pipeline volume and more on buyer intent signals, deal engagement, and real buying behavior rather than stage-based assumptions.

5. RevOps becomes the forecasting backbone

Revenue Operations will play a central role in aligning sales, marketing, and customer success around one forecast. Strong RevOps teams will own data governance, forecasting processes, and cross-team accountability.

6. Scenario planning becomes standard practice

Instead of one forecast, leaders will operate with multiple scenarios (best case, expected, downside). This approach helps teams react faster to market changes and reduces risk when conditions shift.

Bottom line:

In 2026, sales forecasting will be less about predicting a single number and more about building a flexible, data-driven system that adapts in real time. Companies that combine AI, strong RevOps foundations, and disciplined forecasting processes will be far better positioned to hit their targets—consistently.

Share: