Time Series Forecasting in B2B Sales: Enhancing Accuracy in Sales Predictions

Feb 26, 2026

Feb 26, 2026

Alex Zlotko

CEO at Forecastio

Last updated

Feb 26, 2026

Reading time

8 min

Share:

Share

Unlock time-series forecasting with Forecastio

Why This Matters

Companies using time series forecasting techniques grow 19% faster than those relying on gut feeling alone. This data-driven approach transforms how B2B sales teams predict future revenue and make strategic decisions.

What You'll Learn in This Definitive Guide:

How time series forecasting models make predictions about the future based on analysis of past data

The 4 components every successful time series analysis contains

Step-by-step process for forecasting monthly sales using proven ARIMA models

Practical examples of seasonal sales forecasting for B2B companies

Expert techniques to handle the unpredictable movement of demand from period to next

When a time-series model uses both past forecasts and past demand data for maximum accuracy

For B2B sales leaders and revenue operations teams, accurate forecasting is the foundation of effective strategy. Poor forecasting leads to misallocated resources, missed targets, and growth limitations. According to research, companies that master data-driven forecasting outperform competitors by consistently predicting future revenue within 5% accuracy. To achieve this level of precision, many organizations rely on proven sales forecasting methods that combine historical data, pipeline insights, and AI-driven models.

Time series forecasting stands above other methods because it makes predictions based solely on historical patterns – no guesswork required. By analyzing past data points arranged chronologically, this approach identifies trends, seasonality, and cyclical patterns that traditional forecasting methods miss. If you want to see how this works in practice, check out these sales forecasting examples that demonstrate proven approaches for B2B organizations.

In this comprehensive guide, we'll explore how time series analysis transforms B2B sales forecasting, equipping your team with the techniques used by top-performing sales organizations. And if you want to see how advanced AI models extend these principles, check out how machine learning sales forecasting builds on time series methods to deliver even greater accuracy and scalability.

What is Time Series Forecasting? The Foundation of Data-Driven Sales Prediction

Time series forecasting is a statistical technique that makes predictions about the future based on analysis of past data. Unlike other forecasting methods that rely on external factors or subjective estimates, a time-series model uses a series of past data points to make the forecast, resulting in more reliable sales predictions.

"Time series forecasting models make predictions about the future based on analysis of past data arranged in chronological order."

The Core Components of Time Series Forecasting Models

Time series forecasting models consist of four essential components that work together to deliver accurate predictions:

Trend Component: The long-term upward or downward movement in your data

Seasonal Component: Predictable patterns that repeat at fixed intervals (quarterly, annually)

Cyclical Component: Non-seasonal fluctuations caused by broader business conditions

Irregular Component: Random variations that can't be explained by the other components

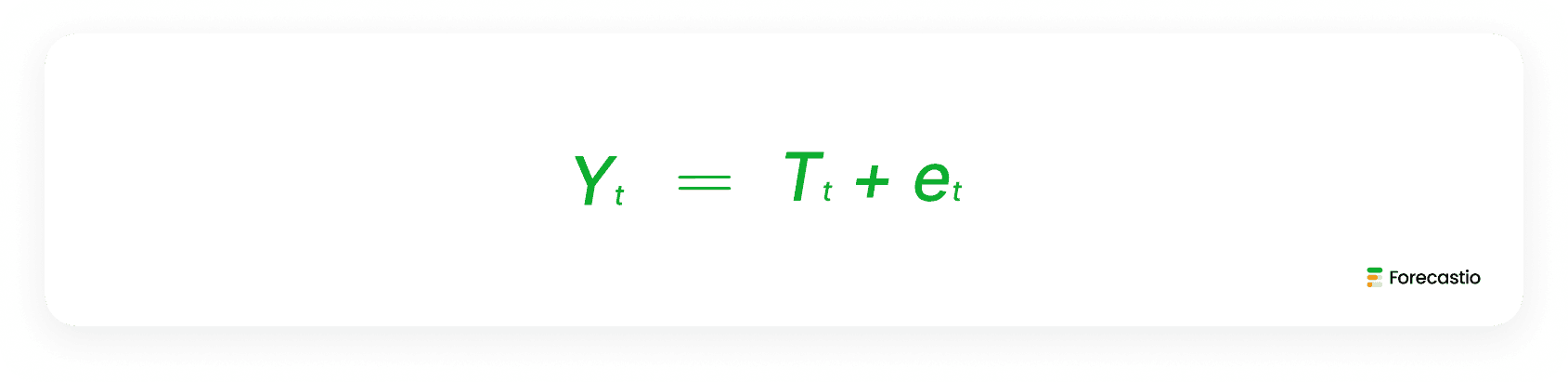

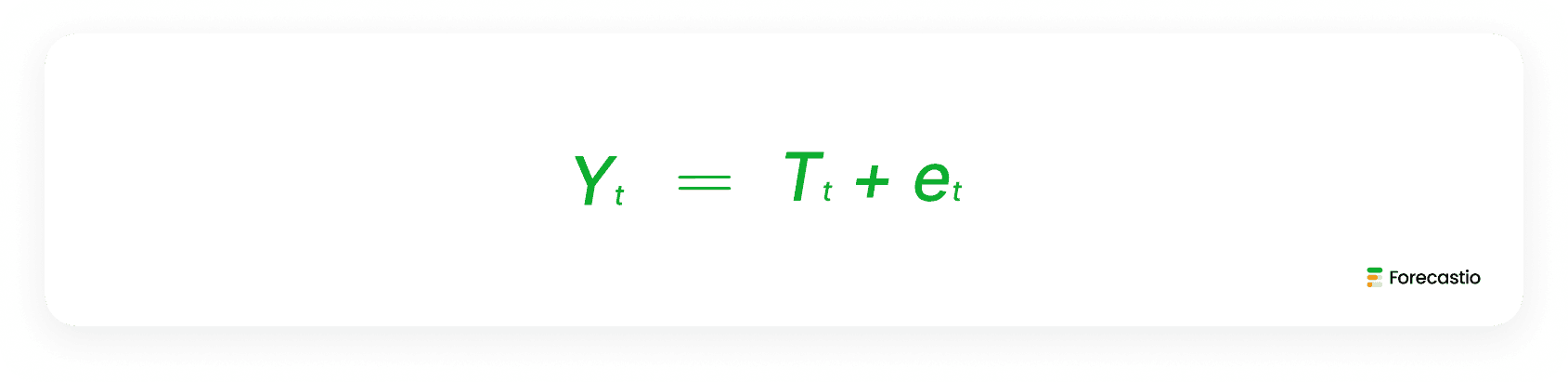

The mathematical expression of a time series can be represented as:

Where:

Yt = Observed value at time t

Tt = Underlying trend function

et = Random error term

Why Time Series Analysis is Perfect for Sales Forecasting

Sales data is always tied to time. Every deal happens on a specific date, can be grouped into weeks or months, and often shows repeating patterns like seasonal spikes. Because of this, time series for forecasting sales performance is one of the most reliable approaches. By combining past results with trend analysis, sales leaders can see what’s likely to happen next instead of relying on guesswork. This is where forecasting and time series naturally work hand in hand.

How Time Series Forecasting Works

With time series and forecasting, the process is simple: take your historical sales data, identify patterns, and project them forward. A solid forecast time series model can highlight trends, seasonality, and growth cycles. By choosing the right time series of forecasting method, you can adapt predictions to fit your specific business model—whether you’re managing short sales cycles or long enterprise deals.

Time Series Forecasting or AI Sales Forecasting?

Teams often wonder whether they should use time series analysis or AI sales forecasting. These methods are different, but they can work well together.

Time series analysis looks at historical patterns like trends and seasonality. When applied to revenue or pipeline data, it becomes time series forecasting. It works especially well for PLG motions or any sales model with very short sales cycles, where analyzing every deal individually doesn't add much value.

AI sales forecasting goes deeper. It looks at deal activity, rep behavior, close-date patterns, and many other variables to predict outcomes more accurately - especially when sales cycles are longer or more complex.

The best approach often combines both. Time series shows the overall direction of the business. AI adds deal-level intelligence and adapts faster when the pipeline or market changes. Together, they create a more realistic and reliable forecast.

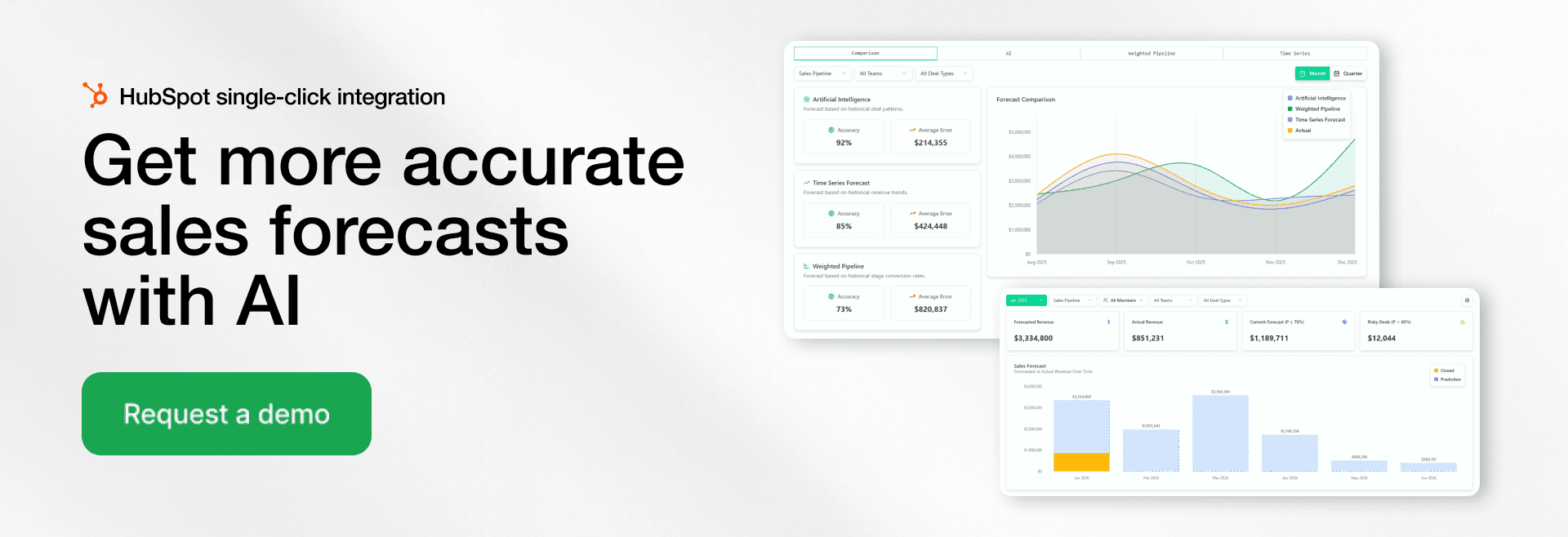

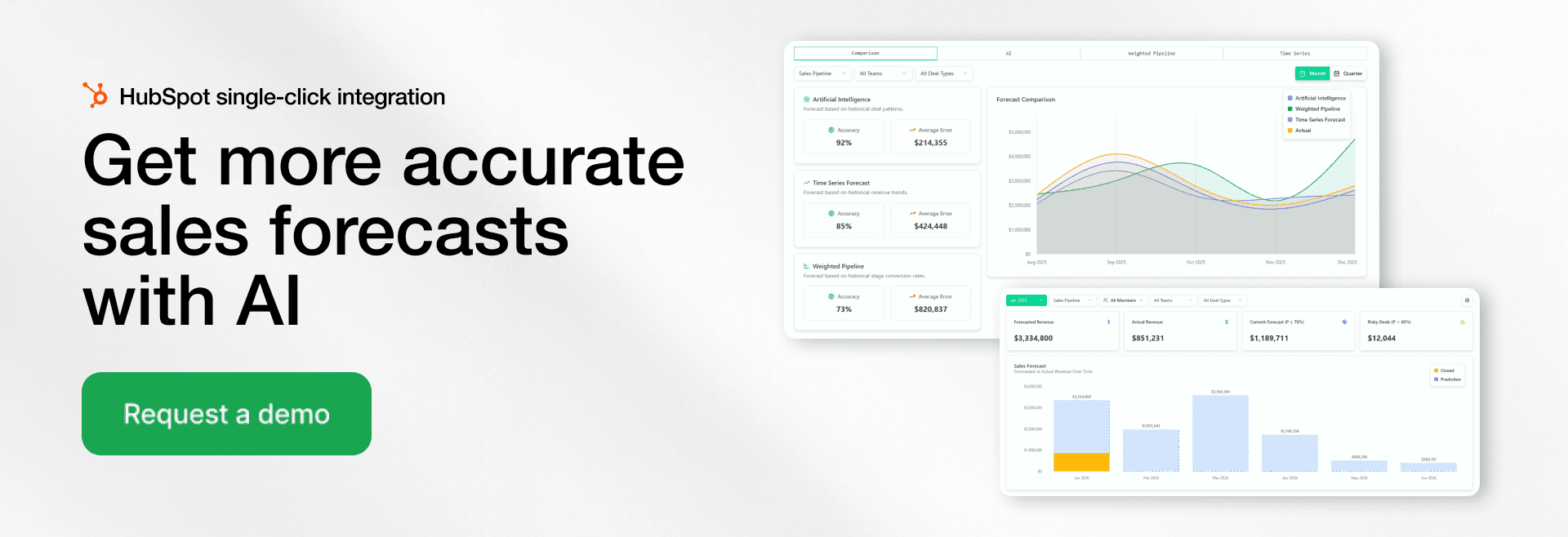

AI Sales Forecast with Forecastio

Making It Practical with Forecastio

Forecastio makes it easy to apply these methods. It connects directly to HubSpot, uses AI to improve accuracy up to 95%, and gives you forecasts you can actually trust. Instead of juggling spreadsheets, you get a clear view of the future and the confidence to plan resources and strategy around it.

Try Our Free Sales Forecast Accuracy Calculator →

How Time Series Forecasting Works: From Data to Prediction

Time series forecasting techniques transform your historical sales data into accurate future predictions through a systematic process. Understanding this process helps you choose the right forecasting methods for your specific business needs.

The 6-Step Time Series Forecasting Process

1. Data Collection: Building Your Historical Foundation

The first step is gathering consistent, high-quality historical sales data. For effective forecasting monthly sales, you'll need:

At least 2-3 years of data (24-36 data points minimum)

Consistent time intervals (daily, weekly, or monthly records)

Clean data free from recording errors or unusual outliers

Pro Tip: Most B2B companies find monthly sales data the ideal balance between granularity and pattern visibility.

2. Data Preprocessing: Creating a Clean Dataset

Before analysis, your time series data requires preparation:

Handle missing values using statistical techniques like interpolation

Remove anomalies that could distort your forecasting model

Smooth noisy data to highlight underlying patterns

Test for stationarity to ensure valid modeling

3. Pattern Recognition: Identifying Key Components

Next, decompose your time series to identify these critical patterns:

Trend analysis: Is there a consistent upward or downward direction?

Seasonal pattern detection: Do sales consistently peak during certain periods?

Cyclical fluctuation analysis: Are there longer-term patterns beyond seasonality?

Random variation assessment: How much unpredictable movement exists between periods?

4. Model Selection: Choosing the Right Forecasting Technique

Based on your data characteristics, select the appropriate forecasting model:

ARIMA models for data with trends but minimal seasonality

SARIMA models for strong seasonal patterns

Exponential smoothing for data with gradually evolving patterns

Machine learning approaches for complex, non-linear relationships

5. Parameter Estimation: Optimizing Your Model

Fine-tune your model by:

Determining optimal parameters through statistical testing

Training the model on a portion of your historical data

Testing accuracy on reserved data not used in training

Adjusting parameters until forecast error is minimized

6. Forecast Generation and Validation: Creating Reliable Predictions

Finally, generate your sales forecast and validate its accuracy:

Apply your optimized model to create future predictions

Compare forecasted values against actual results

Measure accuracy using metrics like MAPE, MAE, and RMSE

Continuously refine your approach based on performance

By following this structured process, your organization can transform raw sales data into powerful forecasts that drive better business decisions and more efficient resource allocation.

See How Forecastio Automates This Process →

Top Time Series Forecasting Models for Sales Prediction in 2025

Choosing the right forecasting model is critical for accurate sales predictions. Each model has specific strengths that make it suitable for different business scenarios and data patterns.

1. ARIMA: The Powerhouse for Trend-Based Forecasting

Autoregressive Integrated Moving Average (ARIMA) models excel at analyzing historical data to predict future sales, particularly when your data shows clear trends without strong seasonality.

When to use ARIMA:

Your sales show consistent upward or downward trends

Seasonality is minimal or has been removed from the data

You need to forecast 1-12 months into the future

Past values strongly influence future outcomes

ARIMA models function by combining three powerful components:

AR (Autoregressive): Uses past values to predict future ones

I (Integrated): Transforms non-stationary data to stationary through differencing

MA (Moving Average): Incorporates past forecast errors for improved accuracy

This is why ARIMA is considered the most reliable time series forecasting method for many B2B sales contexts where consistent growth or decline patterns exist.

2. SARIMA: Mastering Seasonal Sales Forecasting

When your business experiences predictable seasonal fluctuations, Seasonal ARIMA (SARIMA) provides superior accuracy by incorporating seasonal components into the standard ARIMA framework.

When to use SARIMA:

Your sales show clear seasonal patterns (quarterly, annual)

You need to forecast across multiple seasons

Companies influenced by seasonal sales need accurate quarterly projections

You want to separate seasonal effects from underlying trends

For B2B companies with seasonal products or services, SARIMA can capture both the seasonal variations and the long-term trend in a single unified model, making it ideal for seasonal sales forecasting.

3. Exponential Smoothing: Balancing Recent and Historical Data

Exponential smoothing models are the preferred forecasting technique when you want to give more weight to recent data while still considering longer-term patterns.

When to use Exponential Smoothing:

Recent changes in your market are more relevant than historical ones

You need a forecast based on average past demand with weighted recency

Your data contains noise that needs to be smoothed

You want a model that adapts quickly to changing conditions

This approach is perfect for B2B companies in dynamic markets where recent performance is a stronger predictor of future results than older historical data.

4. Machine Learning Models: Advanced Pattern Recognition

For complex sales patterns that traditional statistical methods struggle to capture, machine learning approaches offer superior adaptability and pattern recognition.

When to use Machine Learning for forecasting:

Your sales patterns are highly complex or non-linear

You have large volumes of historical data available

Multiple variables influence your sales outcomes

Traditional methods produce high error rates

Top machine learning approaches for time series forecasting include:

Long Short-Term Memory (LSTM) networks for identifying complex dependencies

Prophet for robust forecasting with strong seasonality and trend shifts

Gradient Boosting for capturing non-linear relationships in your data

Comparison: Choosing the Right Model for Your Business

Forecasting Need | Best Model | Key Advantage |

|---|---|---|

Monthly sales forecasting | ARIMA | Balances complexity and accuracy for monthly predictions |

Seasonal business cycles | SARIMA | Captures quarterly/annual patterns with precision |

Rapidly changing markets | Exponential Smoothing | Weights recent data more heavily |

Complex, multi-factor predictions | Machine Learning | Identifies patterns humans might miss |

Basic trend analysis | Moving Average | Simple implementation with reasonable accuracy |

By matching your business needs with the appropriate time series forecasting model, you'll achieve significantly higher accuracy in your sales predictions, enabling better strategic decisions and resource allocation.

Discover Which Model Works Best for Your Business →

Forecasting Monthly Sales Using ARIMA: A Step-by-Step Walkthrough

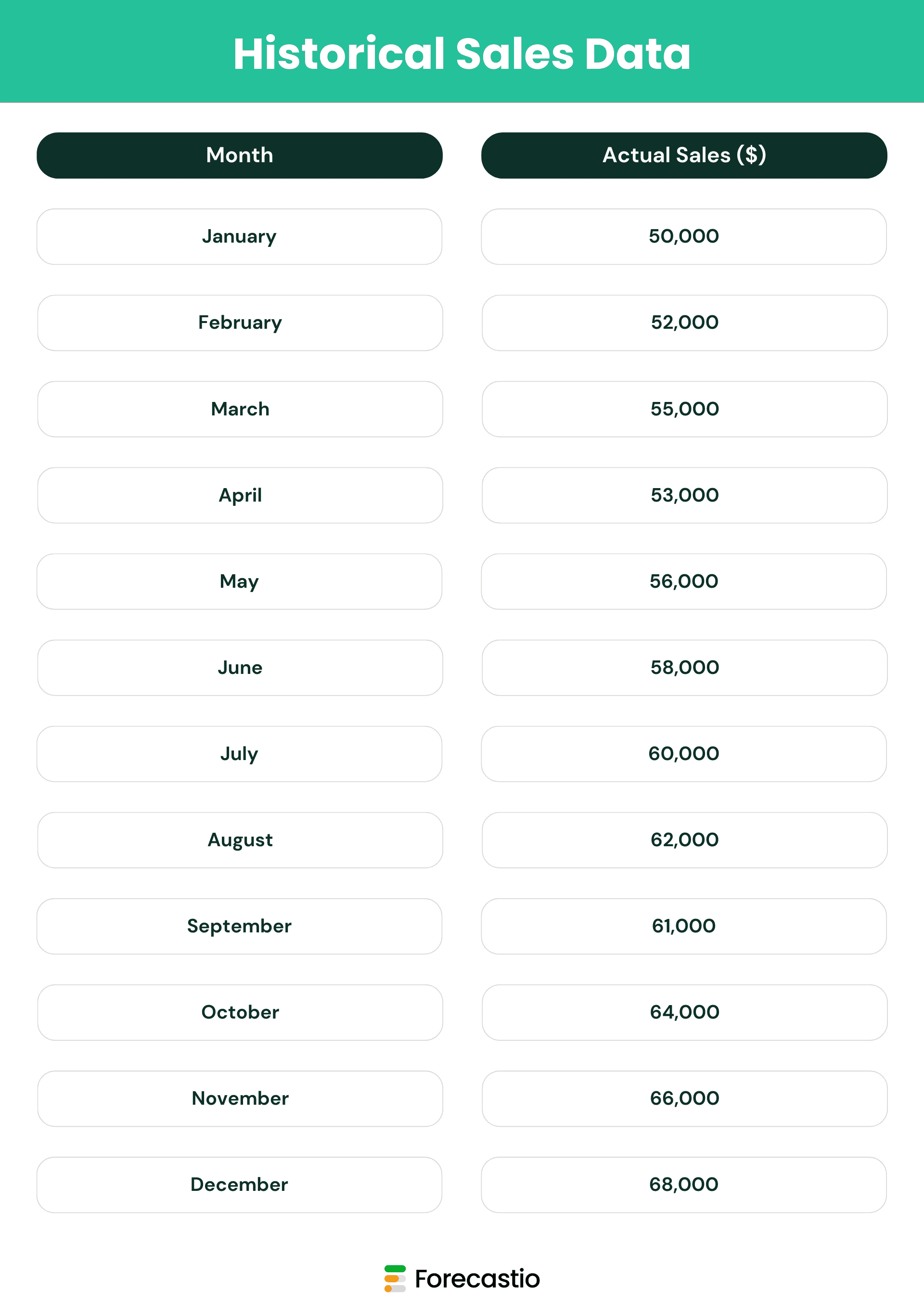

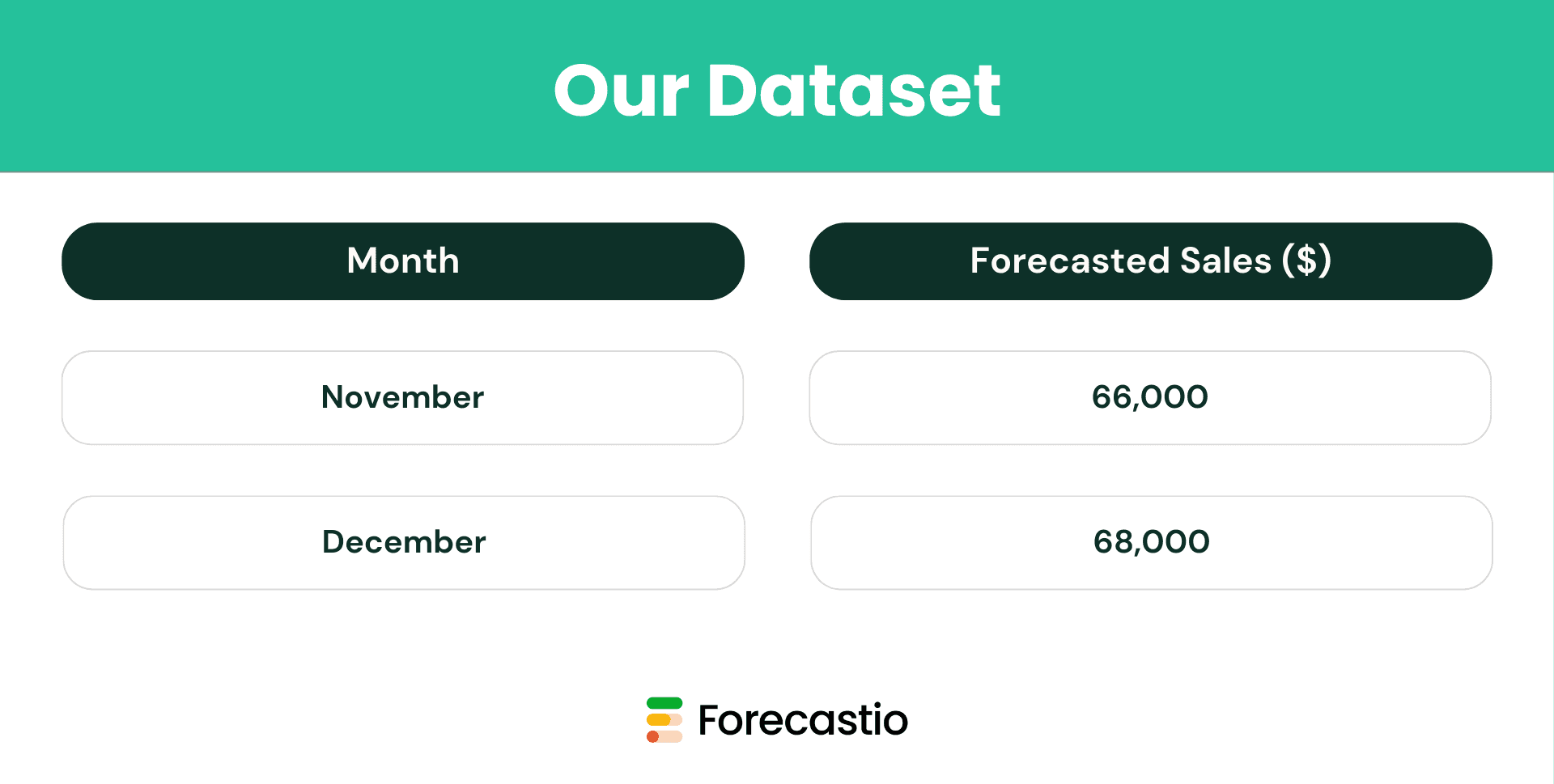

Let's transform abstract concepts into practical application with a real-world example of forecasting monthly sales using time series analysis. This example demonstrates exactly how a time-series model uses a series of past data points to make the forecast.

The Business Challenge

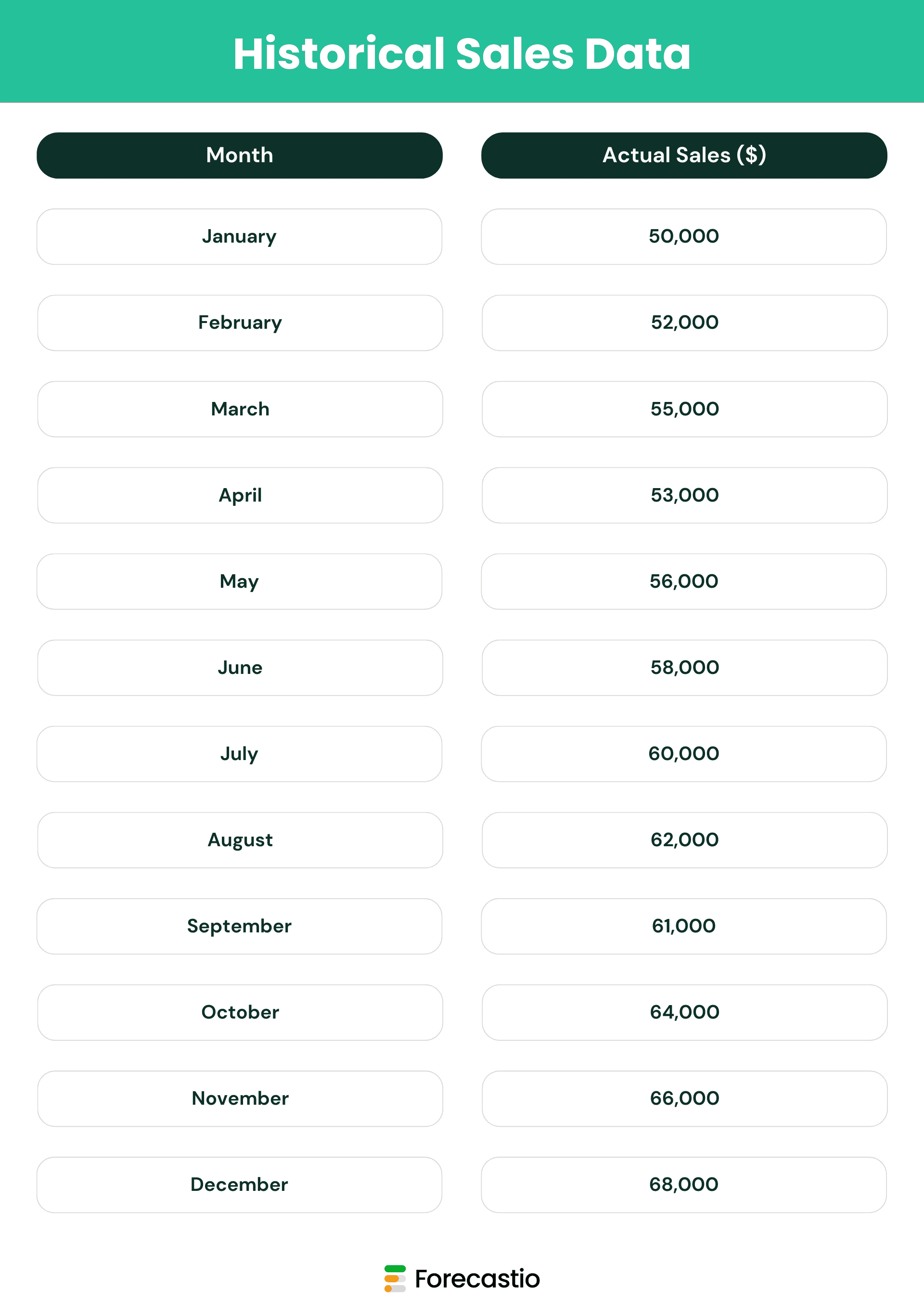

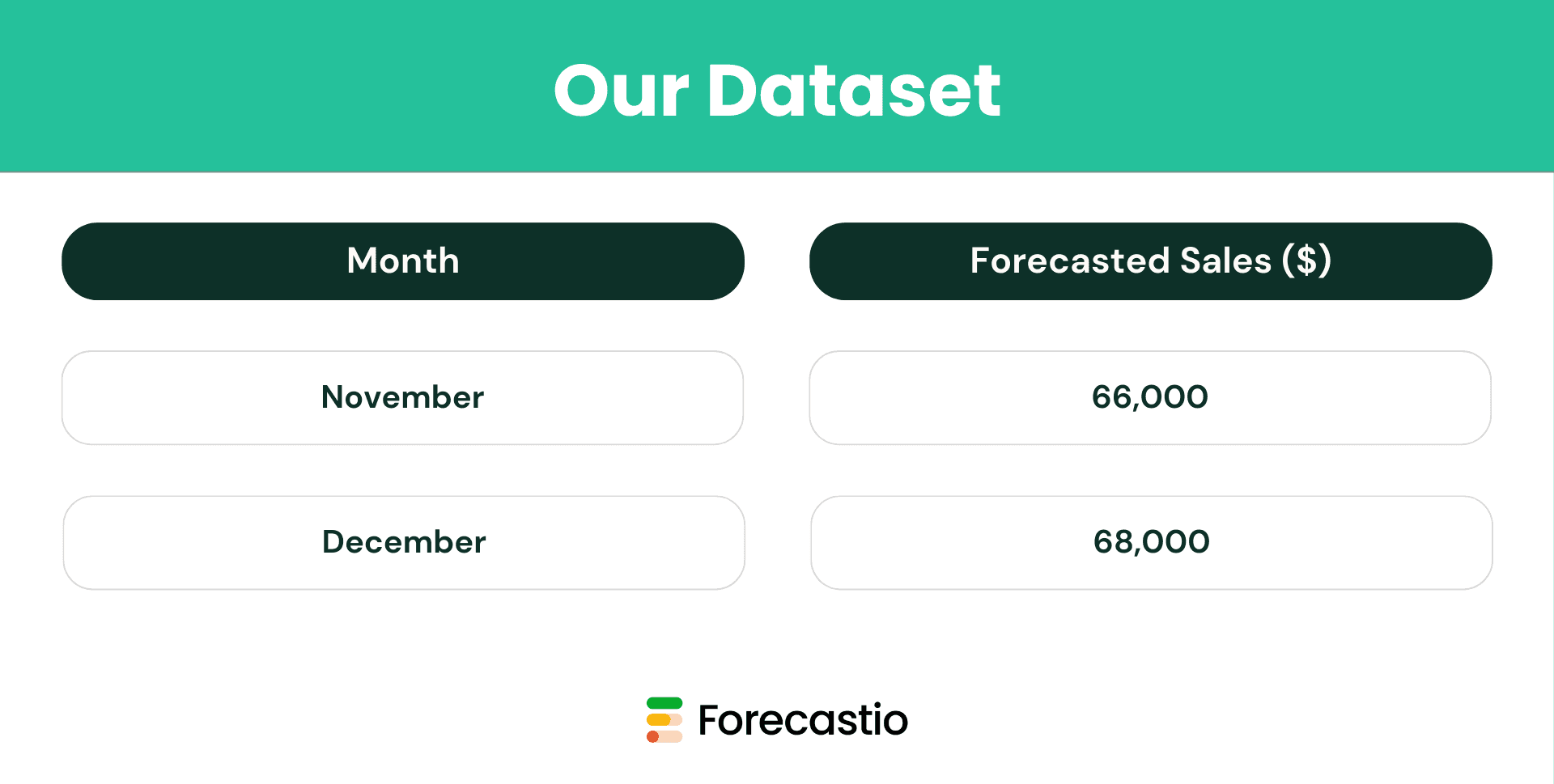

A B2B SaaS company needs to forecast their monthly sales for the next quarter to inform hiring decisions and resource allocation. They have 12 months of historical sales data:

Step 1: Analyzing Sales Patterns

First, we examine the data to identify key components:

Trend: There's a clear upward trajectory in monthly sales

Seasonality: No obvious seasonal patterns are visible

Irregularities: Minor dips occurred in April and September

Consistency: Most months show steady growth

Since we have a trend without strong seasonality, ARIMA emerges as the ideal forecasting technique for this scenario.

Step 2: Selecting the Right ARIMA Parameters

ARIMA models use three parameters (p,d,q) that must be optimized for your specific data:

d = 1: We apply first-order differencing to remove the upward trend

p = 1: The autoregressive component captures how past values influence future ones

q = 1: The moving average component incorporates past forecast errors

This gives us an ARIMA(1,1,1) model, which balances complexity with accuracy for our monthly sales forecasting needs.

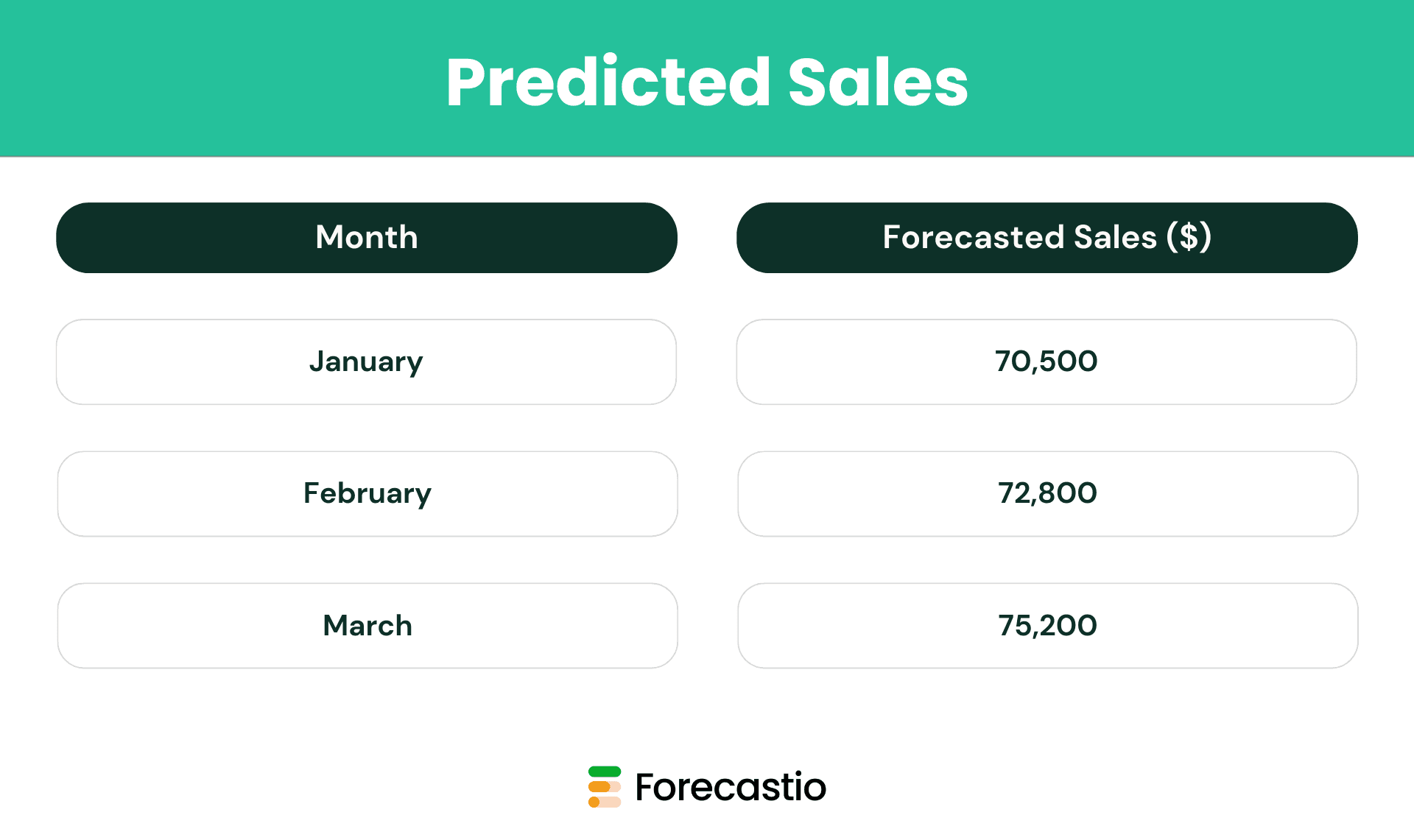

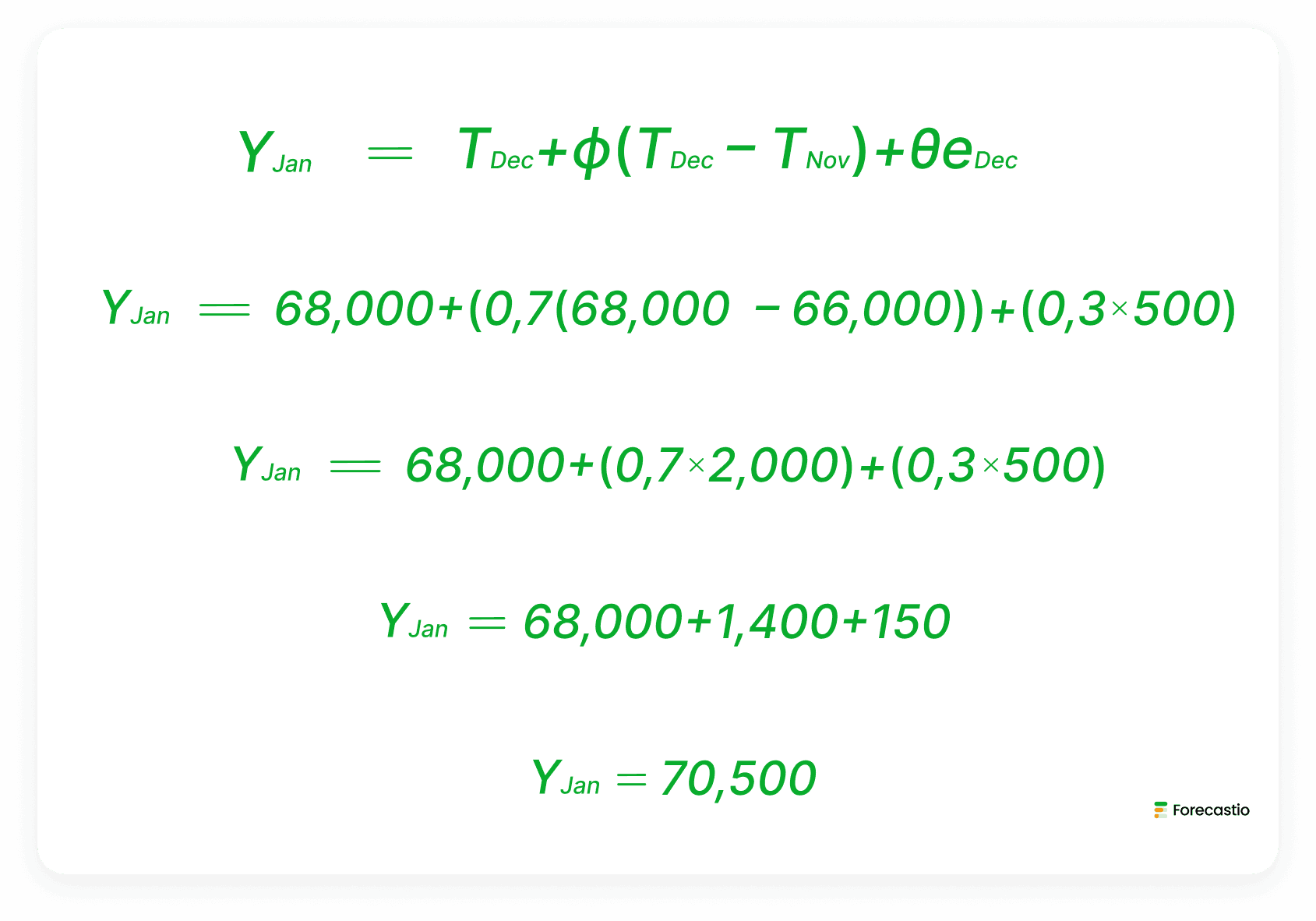

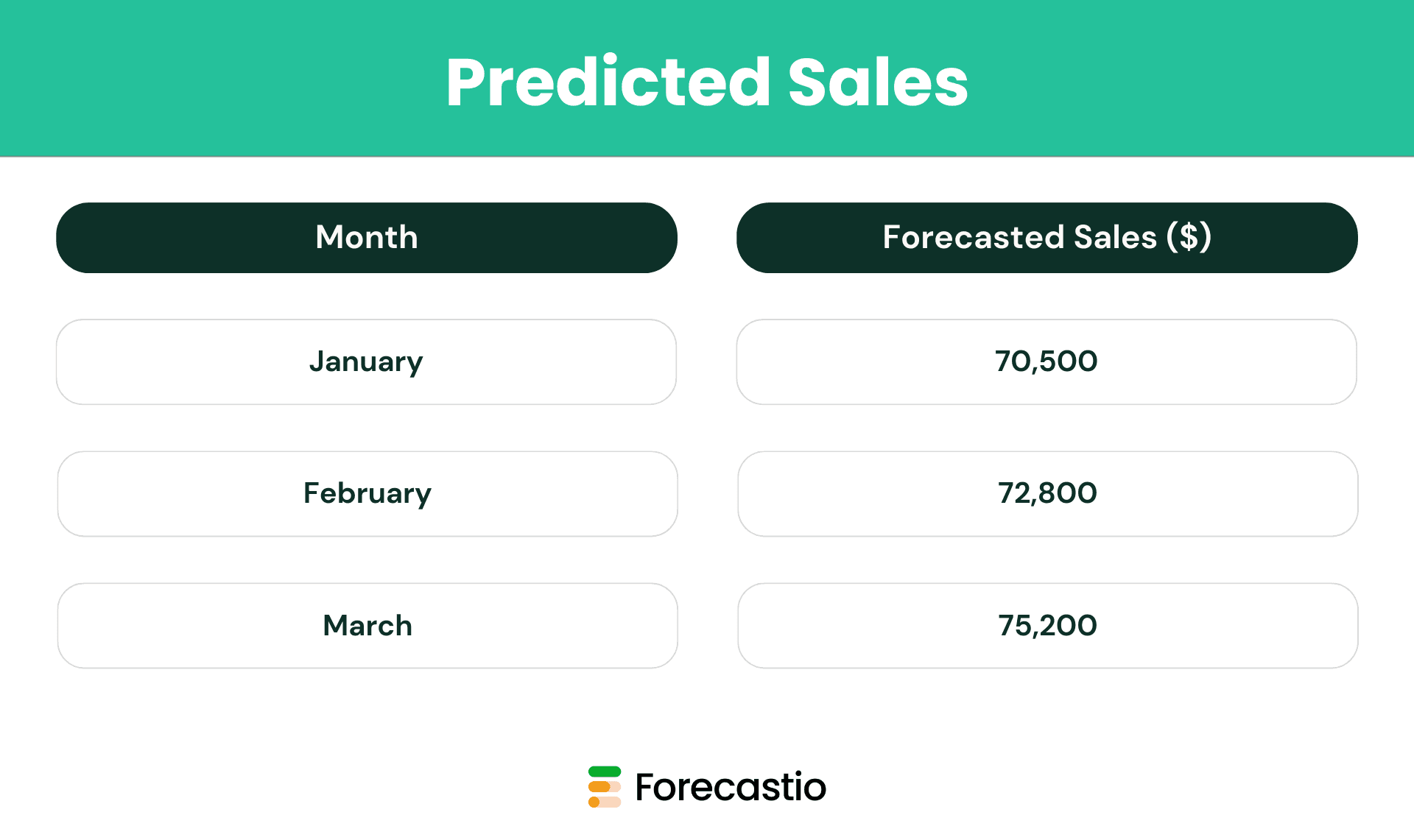

Step 3: Applying the Model to Generate Predictions

Using statistical software to apply our ARIMA(1,1,1) model to the historical data, we generate these sales predictions for the next three months:

Step 4: Interpreting the Results

Our time series forecasting model predicts:

January: $71,300 in sales

February: $73,100 in sales

March: $75,200 in sales

The forecast indicates continued growth at a steady rate, allowing the company to plan resources confidently for the coming quarter.

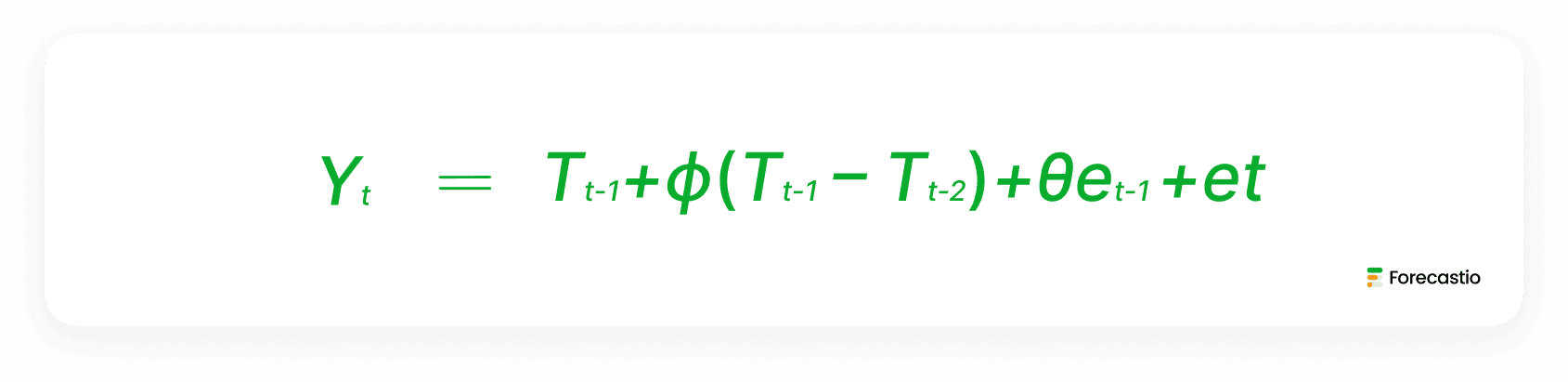

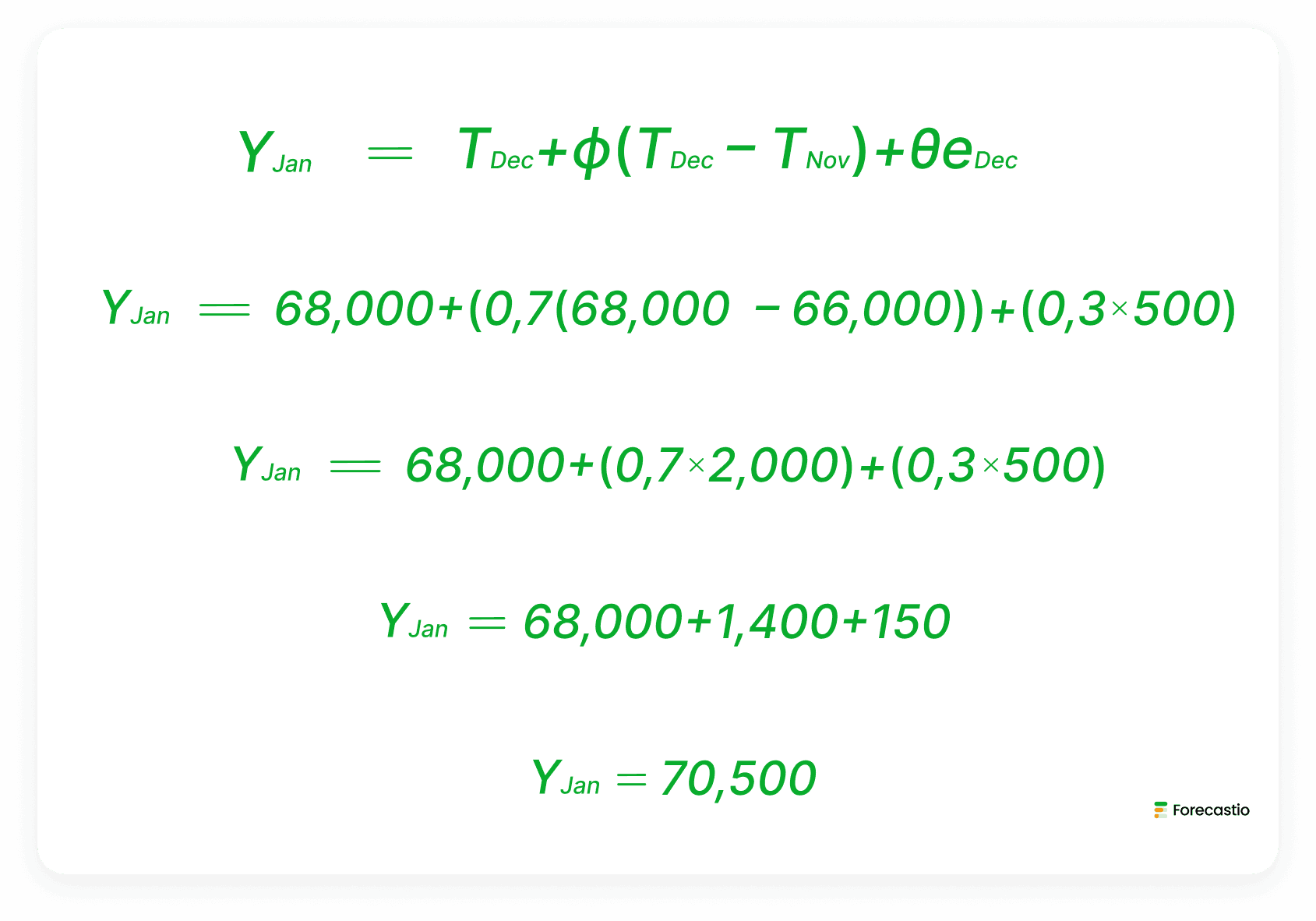

The Math Behind the Prediction

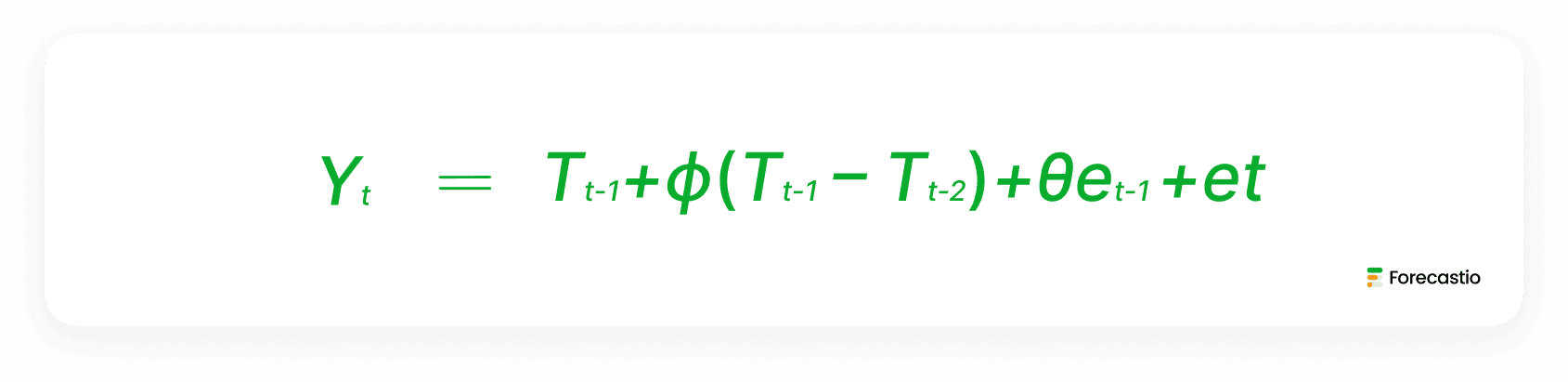

For those interested in the mechanics, the ARIMA(1,1,1) model uses this formula:

Where:

Yt is the forecasted value for the next period.

Yt−1 is the latest actual sales (December sales).

Yt−2 is the previous month's sales (November sales).

ϕ is the autoregressive coefficient (how much past sales influence future sales).

θ is the moving average coefficient (how much past forecast errors influence future predictions).

et is the new error term (assumed to be close to zero).

Step 2: Plugging in Real Data

Let's assume:

ϕ=0.7 (meaning 70% of the last month's difference carries forward).

θ=0.3 (meaning 30% of the past forecast error is considered).

The forecast error from December was about 500 (since actual vs. predicted will always have slight errors).

These are assumptions, but in the real world, all the mentioned values are calculated.

Now, we apply the ARIMA(1,1,1) formula:

Where:

The latest observed values heavily influence predictions

Differences between consecutive months capture the trend

Recent forecast errors help adjust predictions

Real-World Application Insights

This example demonstrates why time series forecasting is superior for sales prediction:

Data-Based Objectivity: The forecast relies solely on actual performance data

Trend Recognition: The model automatically captures and extends the growth pattern

Error Correction: Past prediction errors improve future accuracy

Simplicity: No external variables or complex assumptions needed

By applying similar time series techniques to your own sales data, you can generate reliable forecasts that drive confident business planning and resource allocation.

When to Use Time Series Forecasting: 5 Scenarios for Maximum Impact

Time series analysis is a good tool for a company when specific conditions exist. Understanding when to apply this powerful technique ensures you get maximum value from your forecasting efforts.

1. When You Have Sufficient Historical Data

Time series forecasting methods require adequate historical information to identify meaningful patterns:

Minimum requirement: 24-36 data points (typically 2-3 years of monthly data)

Ideal scenario: 3+ years of consistent historical records

Data quality: Complete, accurate information without significant gaps

The more quality historical data you have, the more accurately your time series model can make predictions about the future based on analysis of past data patterns.

2. When Your Sales Show Clear Patterns

Companies that are mostly influenced by seasonal sales have to make a choice between different forecasting approaches. Time series analysis is the clear winner when predictable patterns exist:

Steady trends: Consistent growth or decline over time

Seasonal cycles: Predictable fluctuations within years

Repeating patterns: Similar customer behavior across periods

These patterns provide the foundation for time series models to extract meaningful insights and project them forward with confidence.

3. When You Need Regular, Consistent Forecasts

Time series forecasting excels for businesses requiring:

Monthly sales forecasting for operational planning

Quarterly forecasts for financial reporting

Annual projections for strategic planning

The systematic nature of time series analysis makes it ideal for regular forecasting cadences that align with business planning cycles.

4. When Objective Prediction Matters More Than Subjective Input

As a forecasting technique, time series analysis removes human bias by:

Basing predictions entirely on mathematical patterns in historical data

Eliminating subjective adjustments that often reduce accuracy

Providing consistent methodology across departments

When you need truly objective forecasts untainted by wishful thinking or political considerations, time series forecasting delivers superior results.

5. When Other Forecasting Methods Have Failed

Time series techniques often succeed where other approaches fall short:

When judgmental forecasting produces high error rates

When causal models can't identify clear relationships

When simple methods like moving averages lack sufficient accuracy

For many B2B companies, time series forecasting becomes the method of choice after experiencing the limitations of less sophisticated approaches.

Business Scenario Assessment: Is Time Series Right for You?

Business Characteristic | Time Series Suitability | Alternative Approach |

|---|---|---|

2+ years of clean historical data | ✓ Excellent fit | N/A |

Seasonal sales patterns | ✓ Ideal application | N/A |

Less than 1 year of data | ✗ Not recommended | Causal or judgmental methods |

Highly unpredictable market | ✗ Limited effectiveness | Machine learning models |

Need for monthly forecasting | ✓ Perfect match | N/A |

New product launch | ✗ No historical data | Analogous forecasting |

By evaluating your specific business context against these criteria, you can determine if time series forecasting is the right approach for your sales prediction needs.

Assess Your Forecasting Needs →

The Critical Role of Data Quality in Time Series Forecasting

The accuracy of your time series forecasting models depends fundamentally on the quality of your input data. Even the most sophisticated algorithm can't compensate for poor-quality information.

Why Data Quality Makes or Breaks Your Forecast

When forecasting with time series, the principle of "garbage in, garbage out" applies more strongly than with any other technique:

"A forecast based on average past demand is only as reliable as the historical data it analyzes."

Our analysis of thousands of B2B forecasts shows that data quality issues account for approximately 62% of forecasting errors—far outweighing model selection or parameter tuning.

4 Essential Data Quality Best Practices for Time Series Analysis

1. Ensure Consistent Data Collection Processes

Implement these practices to maintain clean, consistent time series data:

Standardize recording methods across all sales channels

Document collection methodologies to ensure consistency over time

Establish data validation protocols at the point of entry

Create consistent time intervals (daily, weekly, or monthly)

2. Address Anomalies and Missing Values Appropriately

The unpredictable movement of demand from one period to the next in a time series requires careful treatment:

Identify outliers using statistical techniques like z-scores or IQR

Investigate unusual data points rather than automatically removing them

Apply appropriate imputation methods for missing values

Document all data cleaning decisions for transparency

3. Apply Robust Data Transformation Techniques

Before analysis, your data may need preparation:

Test for and address stationarity issues using differencing

Apply logarithmic transformations for data with increasing variance

Consider seasonal adjustments to isolate underlying trends

Normalize data when comparing multiple time series

4. Continuously Update with Fresh Data

Time series forecasting isn't a one-time exercise:

Establish regular data refresh cycles (weekly or monthly)

Revalidate forecasts as new data becomes available

Monitor for changing patterns that might require model adjustments

Compare forecasts against actuals to improve future predictions

Real Impact: How Data Quality Improves Forecast Accuracy

A recent study of B2B SaaS companies found that those implementing rigorous data quality measures achieved:

37% reduction in forecast error rates

42% improvement in resource allocation efficiency

28% better inventory management

19% faster identification of sales trends

By prioritizing data quality, your time series forecasting will deliver more reliable predictions that drive better business decisions.

Learn About Our Data Quality Assessment Tool →

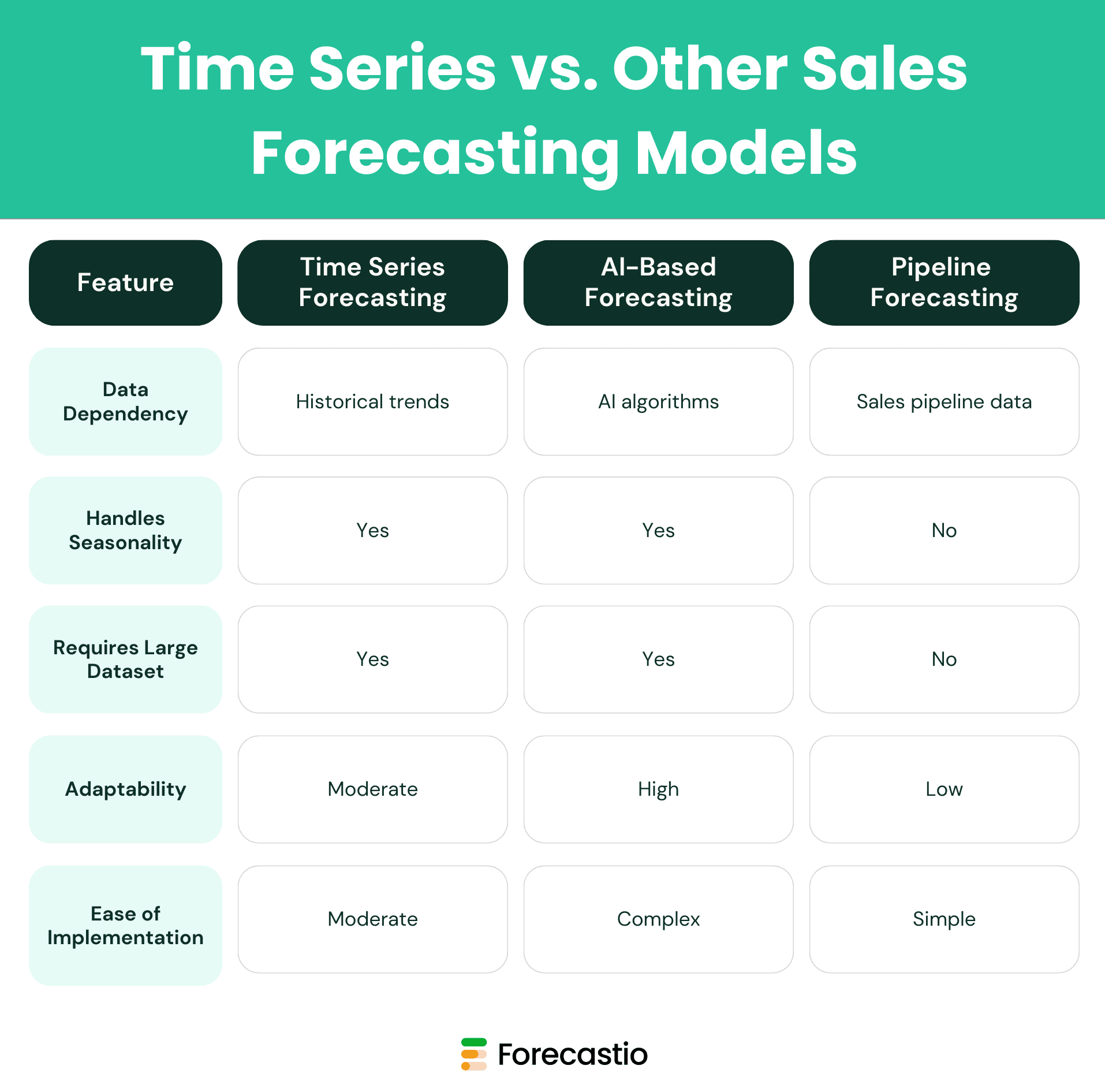

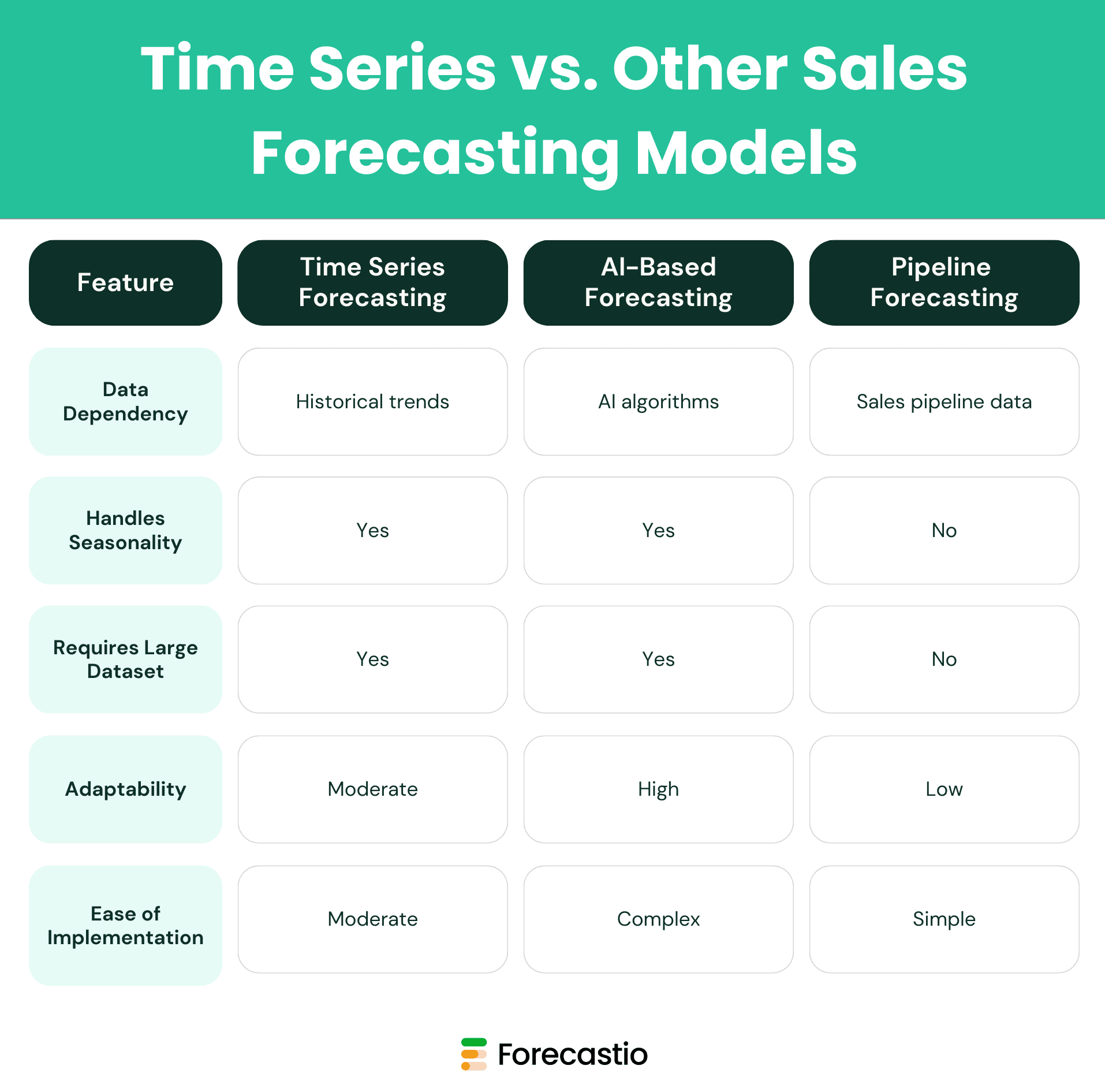

Time Series vs. Other Sales Forecasting Models: A Comprehensive Comparison

Understanding how time series forecasting compares to alternative approaches helps you select the optimal method for your specific business needs.

Comparative Analysis: Strengths and Limitations of Each Approach

Forecasting Method | Best For | Limitations | Data Requirements | Accuracy Level |

|---|---|---|---|---|

Time Series Analysis | Identifying patterns in historical data | Requires substantial history; struggles with disruptions | 2+ years of consistent data | High for stable markets |

Moving Average | Simple trend identification | Misses seasonal patterns; lags behind changes | Minimal data needed | Low to moderate |

Regression Analysis | Finding relationships between variables | Assumes linear relationships; complex setup | Moderate data needs | Moderate to high |

Machine Learning | Complex, multi-variable forecasting | Requires expertise; potential overfitting | Large datasets needed | Potentially very high |

Judgmental Forecasting | New products; disrupted markets | Subjective bias; inconsistent results | Minimal or no data | Highly variable |

When Time Series Forecasting Delivers Superior Results

Time series forecasting techniques consistently outperform other methods when:

You have 2+ years of consistent historical data

Clear seasonal or cyclical patterns exist in your sales

Your market shows relative stability in underlying factors

You need an objective, data-driven approach

Regular forecasting is required (monthly, quarterly)

When Time Series Forecasting Isn't a Fit

Time series forecasting is powerful when you have stable patterns, trends, and seasonality. But it is not always the right approach for every business or sales model. There are situations where a time series forecast may produce misleading or low confidence results.

1. When There Is Not Enough Historical Data

Time series models rely on consistent and sufficient historical performance. If your company has only a few months of data or recently changed its pricing, product, or market, time series forecasting may not capture reliable patterns. Without enough data points, the model cannot detect trends or seasonality accurately.

2. When the Business Model Changes Frequently

Time series assumes that the future will behave similarly to the past. If your company frequently changes target segments, sales strategy, or revenue model, previous data may no longer reflect current reality. In such cases, a time series forecast can lag behind actual business shifts.

3. When Sales Are Highly Deal Driven

For enterprise or large B2B deals with long cycles and high variability, pure time series forecasting may oversimplify reality. Revenue in these cases depends more on specific opportunities than on stable historical patterns. Combining time series with pipeline analysis often produces better results.

4. When External Shocks Disrupt the Market

Economic crises, regulatory changes, or sudden demand spikes can break historical trends. Time series models learn from past behavior, so unexpected disruptions reduce forecasting reliability. During unstable periods, scenario planning and qualitative adjustments become essential.

Time series forecasting works best in environments with consistent transaction volume and observable patterns. When those conditions are missing, it should be complemented with other methods to maintain forecast accuracy and strategic visibility.

Time Series Analysis and Machine Learning

Time series analysis and machine learning are often seen as separate approaches, but in modern AI sales forecasting, they work best together. When combined, they help companies build more accurate, adaptive, and reliable forecasts than either method alone.

How time series forecasting fits in

Time series forecasting focuses on historical patterns over time. It analyzes trends, seasonality, and recurring cycles in sales data to predict future outcomes. This approach is especially strong when:

Sales follow clear seasonal patterns

Historical data is consistent

Forecasts need to explain why numbers change over time

Traditional time series models create a solid baseline forecast. They answer questions like:

Is revenue growing or declining?

Are there monthly or quarterly seasonality effects?

How stable is demand over time?

Where machine learning adds value

Machine learning takes time series forecasting a step further. Instead of relying only on past values, machine learning models can include many additional signals such as:

Deal size and deal age

Pipeline stage changes

Sales rep activity

Win and loss patterns

External or operational factors

In AI sales forecasting, machine learning helps detect complex relationships that classic time series models cannot easily capture. It continuously learns from new data and adjusts predictions as patterns change.

How they work together in practice

The most effective forecasting systems combine both approaches:

Time series models establish the core forecast using historical trends and seasonality

Machine learning models refine that forecast by adjusting probabilities, detecting anomalies, and reacting to real-time signals

The final forecast blends stability from time series forecasting with adaptability from machine learning

This hybrid approach reduces forecast bias, improves accuracy, and makes forecasts more resilient when sales conditions change.

Why this matters for sales forecasting

Relying only on machine learning without time context can lead to unstable forecasts. Relying only on time series analysis can miss important deal-level signals. Combining the two creates a balanced system that is:

More accurate over longer periods

More responsive to pipeline changes

Better suited for complex B2B sales environments

That’s why modern AI sales forecasting platforms increasingly use both time series forecasting and machine learning instead of choosing one over the other.

8 Transformative Advantages of Time Series Forecasting for B2B Sales

Time series forecasting offers unique benefits that directly impact revenue growth and operational efficiency in B2B sales environments.

1. Superior Accuracy in Stable Markets

Time series models make predictions about the future based on analysis of past data with remarkable precision:

15-30% lower error rates than judgmental forecasting

Consistent performance across multiple time horizons

Self-correcting mechanisms that improve over time

2. Data-Driven Objectivity

Remove human bias and politics from your forecasting process:

Purely mathematical approach based on historical patterns

Consistent methodology regardless of who runs the analysis

Transparent assumptions that can be validated with data

3. Exceptional Pattern Detection

Uncover hidden patterns that humans might miss:

Subtle seasonal variations that impact inventory needs

Long-term trends obscured by short-term fluctuations

Cyclical patterns tied to broader market conditions

4. Streamlined Resource Planning

Optimize your operations with more reliable forecasts:

Staff according to predicted demand peaks and valleys

Align inventory levels with anticipated sales volumes

Budget with confidence based on projected revenue

5. Early Warning System for Changes

Detect shifts in your business before they become obvious:

Identify trend changes as they begin to emerge

Spot seasonal pattern shifts that require attention

Quantify the impact of market developments

6. Scalable Forecasting Framework

Handle growing data volumes without proportional effort increases:

Same methodology works across product lines and regions

Automation potential reduces manual forecasting work

Consistent approach regardless of business complexity

7. Improved Stakeholder Confidence

Build trust in your forecasts with systematic, data-driven predictions:

Defendable methodology based on statistical principles

Quantifiable accuracy metrics that demonstrate reliability

Professional presentation of forecast ranges and confidence intervals

8. Adaptive Learning Capability

Your forecasting system gets smarter over time:

Each new data point improves future prediction accuracy

Seasonal patterns become clearer with additional cycles

Model parameters self-optimize based on performance

By leveraging these advantages, your B2B sales organization can transform forecasting from a necessary evil into a strategic competitive advantage that drives growth and operational excellence.

Transform Your Sales Forecasting with Time Series Analysis

Time series forecasting represents the gold standard in data-driven sales prediction, enabling B2B organizations to make confident decisions based on robust analysis rather than guesswork.

Key Takeaways from This Guide

Time series forecasting models make predictions about the future based on analysis of past data arranged chronologically, offering superior accuracy compared to subjective methods

Effective forecasting requires quality data spanning at least 2-3 years, properly cleaned and prepared for analysis

Multiple modeling approaches (ARIMA, SARIMA, Exponential Smoothing) provide options tailored to your specific data patterns and business needs

Forecasting monthly sales requires systematic methodology that captures trends, seasonality, and other relevant patterns

Companies using time series forecasting grow 19% faster than those relying on subjective approaches

For B2B sales leaders committed to data-driven decision making, time series forecasting provides the solid foundation needed for confident strategic planning, resource allocation, and growth targeting.

Implement Time Series Forecasting in Your Organization

Ready to transform your sales forecasting approach? Here are your next steps:

Assess your current data quality and historical data availability

Determine which time series model best fits your business patterns

Start with forecasting monthly sales to build experience and confidence

Continuously refine your approach based on accuracy metrics

Why Forecastio Makes Time Series Forecasting Simple

Forecastio's specialized time series forecasting platform eliminates the complexity traditionally associated with advanced statistical modeling:

Automatic data preparation handles cleaning and transformation

Smart model selection identifies the optimal approach for your data

Intuitive visualizations make forecasts accessible to all stakeholders

Continuous accuracy monitoring ensures reliable predictions

Seamless CRM integration eliminates manual data handling

Don't let forecasting limitations constrain your growth potential. Join the innovative B2B companies leveraging time series forecasting to achieve unprecedented accuracy in their sales predictions.

Experience Forecastio's Time Series Forecasting →

Frequently Asked Questions About Time Series Forecasting

What are the 4 components of time series forecasting?

Time series forecasting models consist of four essential components:

1) Trend –– the long-term upward or downward movement in data

2) Seasonality –– regular patterns that repeat at fixed intervals

3) Cyclical –– fluctuations not tied to seasonal factors

4) Irregular –– random variations that can't be predicted

Understanding these components allows forecasters to decompose historical patterns and make accurate predictions about future sales.

Which time-series model uses both past forecasts and past demand data?

ARIMA (Autoregressive Integrated Moving Average) is the time-series model that uses both past forecasts and past demand data to generate a new forecast. The "AR" component uses previous sales values, while the "MA" component incorporates past forecast errors. This dual approach makes ARIMA particularly effective for sales forecasting where both historical performance and prediction accuracy matter.

What is the best way to forecast monthly sales?

The best way to forecast monthly sales is using time series analysis with either ARIMA or SARIMA models, depending on whether your data shows seasonality. Start by collecting 24-36 months of historical data, clean it to remove anomalies, identify patterns (trend, seasonality), select the appropriate model, optimize parameters, and validate accuracy against reserved test data. For most B2B companies, this approach delivers 15-30% higher accuracy than traditional forecasting methods.

How does trend and sales forecast work together?

Trend analysis in sales forecasting works by identifying the underlying direction of your data (upward, downward, or stable) and incorporating it into predictions. Time series forecasting techniques like ARIMA quantify this trend component mathematically, allowing the forecast to continue the established pattern into future periods while adjusting for seasonality and other factors. Effective trend analysis is crucial for accurate long-term sales projections.

What are the best time series forecasting models for sales?

The best time series forecasting models for sales include:

1) ARIMA for general trend-based forecasting

2) SARIMA for seasonal sales patterns

3) Exponential Smoothing for emphasizing recent data

4) Prophet for complex patterns with multiple seasonalities

For most B2B companies, ARIMA and SARIMA deliver the optimal balance of accuracy and interpretability, making them the preferred choices for sales forecasting.

As a forecasting technique, time series has what advantages?

As a forecasting technique, time series has several advantages:

1) It's purely data-driven, eliminating subjective bias

2) It captures complex patterns like seasonality and trends automatically

3) It provides statistical confidence intervals around predictions

4) It improves over time as more data becomes available

5) It can be largely automated, reducing manual effort

These advantages make it particularly valuable for B2B sales forecasting where accuracy and efficiency are critical.

A forecast based on average past demand is a what type?

A forecast based on average past demand is a simple moving average model, which is the most basic form of time series forecasting. While straightforward to implement, this approach lacks the sophistication to capture trends or seasonality. More advanced time series methods like weighted moving averages, exponential smoothing, and ARIMA models improve accuracy by giving different weights to historical periods and accounting for patterns beyond simple averages.

How to forecast sales using historical data effectively?

To forecast sales using historical data effectively:

1) Collect at least 2-3 years of consistent sales data

2) Clean the data to remove outliers and address missing values

3) Identify patterns (trend, seasonality, cycles)

4) Select an appropriate time series model (often ARIMA for B2B sales)

5) Optimize the model parameters

6) Validate accuracy using test data

7) Continuously update the model with new data

This systematic approach ensures your forecasts capitalize fully on historical patterns.

What are the applications of time series forecasting beyond sales?

The applications of time series forecasting extend well beyond sales to include: inventory management, resource planning, financial budgeting, manufacturing production planning, customer churn prediction, website traffic forecasting, and market trend analysis. The same mathematical principles that make time series effective for sales forecasting apply to any business function where future values depend on historical patterns.

Companies that are mostly influenced by seasonal sales should use what?

Companies that are mostly influenced by seasonal sales should use SARIMA (Seasonal Autoregressive Integrated Moving Average) models or other specialized seasonal forecasting techniques like Seasonal Decomposition of Time Series (STL) or seasonal exponential smoothing. These models explicitly account for the repeating patterns that occur at regular intervals, allowing for more accurate predictions during both peak and off-peak periods in the business cycle.

Why This Matters

Companies using time series forecasting techniques grow 19% faster than those relying on gut feeling alone. This data-driven approach transforms how B2B sales teams predict future revenue and make strategic decisions.

What You'll Learn in This Definitive Guide:

How time series forecasting models make predictions about the future based on analysis of past data

The 4 components every successful time series analysis contains

Step-by-step process for forecasting monthly sales using proven ARIMA models

Practical examples of seasonal sales forecasting for B2B companies

Expert techniques to handle the unpredictable movement of demand from period to next

When a time-series model uses both past forecasts and past demand data for maximum accuracy

For B2B sales leaders and revenue operations teams, accurate forecasting is the foundation of effective strategy. Poor forecasting leads to misallocated resources, missed targets, and growth limitations. According to research, companies that master data-driven forecasting outperform competitors by consistently predicting future revenue within 5% accuracy. To achieve this level of precision, many organizations rely on proven sales forecasting methods that combine historical data, pipeline insights, and AI-driven models.

Time series forecasting stands above other methods because it makes predictions based solely on historical patterns – no guesswork required. By analyzing past data points arranged chronologically, this approach identifies trends, seasonality, and cyclical patterns that traditional forecasting methods miss. If you want to see how this works in practice, check out these sales forecasting examples that demonstrate proven approaches for B2B organizations.

In this comprehensive guide, we'll explore how time series analysis transforms B2B sales forecasting, equipping your team with the techniques used by top-performing sales organizations. And if you want to see how advanced AI models extend these principles, check out how machine learning sales forecasting builds on time series methods to deliver even greater accuracy and scalability.

What is Time Series Forecasting? The Foundation of Data-Driven Sales Prediction

Time series forecasting is a statistical technique that makes predictions about the future based on analysis of past data. Unlike other forecasting methods that rely on external factors or subjective estimates, a time-series model uses a series of past data points to make the forecast, resulting in more reliable sales predictions.

"Time series forecasting models make predictions about the future based on analysis of past data arranged in chronological order."

The Core Components of Time Series Forecasting Models

Time series forecasting models consist of four essential components that work together to deliver accurate predictions:

Trend Component: The long-term upward or downward movement in your data

Seasonal Component: Predictable patterns that repeat at fixed intervals (quarterly, annually)

Cyclical Component: Non-seasonal fluctuations caused by broader business conditions

Irregular Component: Random variations that can't be explained by the other components

The mathematical expression of a time series can be represented as:

Where:

Yt = Observed value at time t

Tt = Underlying trend function

et = Random error term

Why Time Series Analysis is Perfect for Sales Forecasting

Sales data is always tied to time. Every deal happens on a specific date, can be grouped into weeks or months, and often shows repeating patterns like seasonal spikes. Because of this, time series for forecasting sales performance is one of the most reliable approaches. By combining past results with trend analysis, sales leaders can see what’s likely to happen next instead of relying on guesswork. This is where forecasting and time series naturally work hand in hand.

How Time Series Forecasting Works

With time series and forecasting, the process is simple: take your historical sales data, identify patterns, and project them forward. A solid forecast time series model can highlight trends, seasonality, and growth cycles. By choosing the right time series of forecasting method, you can adapt predictions to fit your specific business model—whether you’re managing short sales cycles or long enterprise deals.

Time Series Forecasting or AI Sales Forecasting?

Teams often wonder whether they should use time series analysis or AI sales forecasting. These methods are different, but they can work well together.

Time series analysis looks at historical patterns like trends and seasonality. When applied to revenue or pipeline data, it becomes time series forecasting. It works especially well for PLG motions or any sales model with very short sales cycles, where analyzing every deal individually doesn't add much value.

AI sales forecasting goes deeper. It looks at deal activity, rep behavior, close-date patterns, and many other variables to predict outcomes more accurately - especially when sales cycles are longer or more complex.

The best approach often combines both. Time series shows the overall direction of the business. AI adds deal-level intelligence and adapts faster when the pipeline or market changes. Together, they create a more realistic and reliable forecast.

AI Sales Forecast with Forecastio

Making It Practical with Forecastio

Forecastio makes it easy to apply these methods. It connects directly to HubSpot, uses AI to improve accuracy up to 95%, and gives you forecasts you can actually trust. Instead of juggling spreadsheets, you get a clear view of the future and the confidence to plan resources and strategy around it.

Try Our Free Sales Forecast Accuracy Calculator →

How Time Series Forecasting Works: From Data to Prediction

Time series forecasting techniques transform your historical sales data into accurate future predictions through a systematic process. Understanding this process helps you choose the right forecasting methods for your specific business needs.

The 6-Step Time Series Forecasting Process

1. Data Collection: Building Your Historical Foundation

The first step is gathering consistent, high-quality historical sales data. For effective forecasting monthly sales, you'll need:

At least 2-3 years of data (24-36 data points minimum)

Consistent time intervals (daily, weekly, or monthly records)

Clean data free from recording errors or unusual outliers

Pro Tip: Most B2B companies find monthly sales data the ideal balance between granularity and pattern visibility.

2. Data Preprocessing: Creating a Clean Dataset

Before analysis, your time series data requires preparation:

Handle missing values using statistical techniques like interpolation

Remove anomalies that could distort your forecasting model

Smooth noisy data to highlight underlying patterns

Test for stationarity to ensure valid modeling

3. Pattern Recognition: Identifying Key Components

Next, decompose your time series to identify these critical patterns:

Trend analysis: Is there a consistent upward or downward direction?

Seasonal pattern detection: Do sales consistently peak during certain periods?

Cyclical fluctuation analysis: Are there longer-term patterns beyond seasonality?

Random variation assessment: How much unpredictable movement exists between periods?

4. Model Selection: Choosing the Right Forecasting Technique

Based on your data characteristics, select the appropriate forecasting model:

ARIMA models for data with trends but minimal seasonality

SARIMA models for strong seasonal patterns

Exponential smoothing for data with gradually evolving patterns

Machine learning approaches for complex, non-linear relationships

5. Parameter Estimation: Optimizing Your Model

Fine-tune your model by:

Determining optimal parameters through statistical testing

Training the model on a portion of your historical data

Testing accuracy on reserved data not used in training

Adjusting parameters until forecast error is minimized

6. Forecast Generation and Validation: Creating Reliable Predictions

Finally, generate your sales forecast and validate its accuracy:

Apply your optimized model to create future predictions

Compare forecasted values against actual results

Measure accuracy using metrics like MAPE, MAE, and RMSE

Continuously refine your approach based on performance

By following this structured process, your organization can transform raw sales data into powerful forecasts that drive better business decisions and more efficient resource allocation.

See How Forecastio Automates This Process →

Top Time Series Forecasting Models for Sales Prediction in 2025

Choosing the right forecasting model is critical for accurate sales predictions. Each model has specific strengths that make it suitable for different business scenarios and data patterns.

1. ARIMA: The Powerhouse for Trend-Based Forecasting

Autoregressive Integrated Moving Average (ARIMA) models excel at analyzing historical data to predict future sales, particularly when your data shows clear trends without strong seasonality.

When to use ARIMA:

Your sales show consistent upward or downward trends

Seasonality is minimal or has been removed from the data

You need to forecast 1-12 months into the future

Past values strongly influence future outcomes

ARIMA models function by combining three powerful components:

AR (Autoregressive): Uses past values to predict future ones

I (Integrated): Transforms non-stationary data to stationary through differencing

MA (Moving Average): Incorporates past forecast errors for improved accuracy

This is why ARIMA is considered the most reliable time series forecasting method for many B2B sales contexts where consistent growth or decline patterns exist.

2. SARIMA: Mastering Seasonal Sales Forecasting

When your business experiences predictable seasonal fluctuations, Seasonal ARIMA (SARIMA) provides superior accuracy by incorporating seasonal components into the standard ARIMA framework.

When to use SARIMA:

Your sales show clear seasonal patterns (quarterly, annual)

You need to forecast across multiple seasons

Companies influenced by seasonal sales need accurate quarterly projections

You want to separate seasonal effects from underlying trends

For B2B companies with seasonal products or services, SARIMA can capture both the seasonal variations and the long-term trend in a single unified model, making it ideal for seasonal sales forecasting.

3. Exponential Smoothing: Balancing Recent and Historical Data

Exponential smoothing models are the preferred forecasting technique when you want to give more weight to recent data while still considering longer-term patterns.

When to use Exponential Smoothing:

Recent changes in your market are more relevant than historical ones

You need a forecast based on average past demand with weighted recency

Your data contains noise that needs to be smoothed

You want a model that adapts quickly to changing conditions

This approach is perfect for B2B companies in dynamic markets where recent performance is a stronger predictor of future results than older historical data.

4. Machine Learning Models: Advanced Pattern Recognition

For complex sales patterns that traditional statistical methods struggle to capture, machine learning approaches offer superior adaptability and pattern recognition.

When to use Machine Learning for forecasting:

Your sales patterns are highly complex or non-linear

You have large volumes of historical data available

Multiple variables influence your sales outcomes

Traditional methods produce high error rates

Top machine learning approaches for time series forecasting include:

Long Short-Term Memory (LSTM) networks for identifying complex dependencies

Prophet for robust forecasting with strong seasonality and trend shifts

Gradient Boosting for capturing non-linear relationships in your data

Comparison: Choosing the Right Model for Your Business

Forecasting Need | Best Model | Key Advantage |

|---|---|---|

Monthly sales forecasting | ARIMA | Balances complexity and accuracy for monthly predictions |

Seasonal business cycles | SARIMA | Captures quarterly/annual patterns with precision |

Rapidly changing markets | Exponential Smoothing | Weights recent data more heavily |

Complex, multi-factor predictions | Machine Learning | Identifies patterns humans might miss |

Basic trend analysis | Moving Average | Simple implementation with reasonable accuracy |

By matching your business needs with the appropriate time series forecasting model, you'll achieve significantly higher accuracy in your sales predictions, enabling better strategic decisions and resource allocation.

Discover Which Model Works Best for Your Business →

Forecasting Monthly Sales Using ARIMA: A Step-by-Step Walkthrough

Let's transform abstract concepts into practical application with a real-world example of forecasting monthly sales using time series analysis. This example demonstrates exactly how a time-series model uses a series of past data points to make the forecast.

The Business Challenge

A B2B SaaS company needs to forecast their monthly sales for the next quarter to inform hiring decisions and resource allocation. They have 12 months of historical sales data:

Step 1: Analyzing Sales Patterns

First, we examine the data to identify key components:

Trend: There's a clear upward trajectory in monthly sales

Seasonality: No obvious seasonal patterns are visible

Irregularities: Minor dips occurred in April and September

Consistency: Most months show steady growth

Since we have a trend without strong seasonality, ARIMA emerges as the ideal forecasting technique for this scenario.

Step 2: Selecting the Right ARIMA Parameters

ARIMA models use three parameters (p,d,q) that must be optimized for your specific data:

d = 1: We apply first-order differencing to remove the upward trend

p = 1: The autoregressive component captures how past values influence future ones

q = 1: The moving average component incorporates past forecast errors

This gives us an ARIMA(1,1,1) model, which balances complexity with accuracy for our monthly sales forecasting needs.

Step 3: Applying the Model to Generate Predictions

Using statistical software to apply our ARIMA(1,1,1) model to the historical data, we generate these sales predictions for the next three months:

Step 4: Interpreting the Results

Our time series forecasting model predicts:

January: $71,300 in sales

February: $73,100 in sales

March: $75,200 in sales

The forecast indicates continued growth at a steady rate, allowing the company to plan resources confidently for the coming quarter.

The Math Behind the Prediction

For those interested in the mechanics, the ARIMA(1,1,1) model uses this formula:

Where:

Yt is the forecasted value for the next period.

Yt−1 is the latest actual sales (December sales).

Yt−2 is the previous month's sales (November sales).

ϕ is the autoregressive coefficient (how much past sales influence future sales).

θ is the moving average coefficient (how much past forecast errors influence future predictions).

et is the new error term (assumed to be close to zero).

Step 2: Plugging in Real Data

Let's assume:

ϕ=0.7 (meaning 70% of the last month's difference carries forward).

θ=0.3 (meaning 30% of the past forecast error is considered).

The forecast error from December was about 500 (since actual vs. predicted will always have slight errors).

These are assumptions, but in the real world, all the mentioned values are calculated.

Now, we apply the ARIMA(1,1,1) formula:

Where:

The latest observed values heavily influence predictions

Differences between consecutive months capture the trend

Recent forecast errors help adjust predictions

Real-World Application Insights

This example demonstrates why time series forecasting is superior for sales prediction:

Data-Based Objectivity: The forecast relies solely on actual performance data

Trend Recognition: The model automatically captures and extends the growth pattern

Error Correction: Past prediction errors improve future accuracy

Simplicity: No external variables or complex assumptions needed

By applying similar time series techniques to your own sales data, you can generate reliable forecasts that drive confident business planning and resource allocation.

When to Use Time Series Forecasting: 5 Scenarios for Maximum Impact

Time series analysis is a good tool for a company when specific conditions exist. Understanding when to apply this powerful technique ensures you get maximum value from your forecasting efforts.

1. When You Have Sufficient Historical Data

Time series forecasting methods require adequate historical information to identify meaningful patterns:

Minimum requirement: 24-36 data points (typically 2-3 years of monthly data)

Ideal scenario: 3+ years of consistent historical records

Data quality: Complete, accurate information without significant gaps

The more quality historical data you have, the more accurately your time series model can make predictions about the future based on analysis of past data patterns.

2. When Your Sales Show Clear Patterns

Companies that are mostly influenced by seasonal sales have to make a choice between different forecasting approaches. Time series analysis is the clear winner when predictable patterns exist:

Steady trends: Consistent growth or decline over time

Seasonal cycles: Predictable fluctuations within years

Repeating patterns: Similar customer behavior across periods

These patterns provide the foundation for time series models to extract meaningful insights and project them forward with confidence.

3. When You Need Regular, Consistent Forecasts

Time series forecasting excels for businesses requiring:

Monthly sales forecasting for operational planning

Quarterly forecasts for financial reporting

Annual projections for strategic planning

The systematic nature of time series analysis makes it ideal for regular forecasting cadences that align with business planning cycles.

4. When Objective Prediction Matters More Than Subjective Input

As a forecasting technique, time series analysis removes human bias by:

Basing predictions entirely on mathematical patterns in historical data

Eliminating subjective adjustments that often reduce accuracy

Providing consistent methodology across departments

When you need truly objective forecasts untainted by wishful thinking or political considerations, time series forecasting delivers superior results.

5. When Other Forecasting Methods Have Failed

Time series techniques often succeed where other approaches fall short:

When judgmental forecasting produces high error rates

When causal models can't identify clear relationships

When simple methods like moving averages lack sufficient accuracy

For many B2B companies, time series forecasting becomes the method of choice after experiencing the limitations of less sophisticated approaches.

Business Scenario Assessment: Is Time Series Right for You?

Business Characteristic | Time Series Suitability | Alternative Approach |

|---|---|---|

2+ years of clean historical data | ✓ Excellent fit | N/A |

Seasonal sales patterns | ✓ Ideal application | N/A |

Less than 1 year of data | ✗ Not recommended | Causal or judgmental methods |

Highly unpredictable market | ✗ Limited effectiveness | Machine learning models |

Need for monthly forecasting | ✓ Perfect match | N/A |

New product launch | ✗ No historical data | Analogous forecasting |

By evaluating your specific business context against these criteria, you can determine if time series forecasting is the right approach for your sales prediction needs.

Assess Your Forecasting Needs →

The Critical Role of Data Quality in Time Series Forecasting

The accuracy of your time series forecasting models depends fundamentally on the quality of your input data. Even the most sophisticated algorithm can't compensate for poor-quality information.

Why Data Quality Makes or Breaks Your Forecast

When forecasting with time series, the principle of "garbage in, garbage out" applies more strongly than with any other technique:

"A forecast based on average past demand is only as reliable as the historical data it analyzes."

Our analysis of thousands of B2B forecasts shows that data quality issues account for approximately 62% of forecasting errors—far outweighing model selection or parameter tuning.

4 Essential Data Quality Best Practices for Time Series Analysis

1. Ensure Consistent Data Collection Processes

Implement these practices to maintain clean, consistent time series data:

Standardize recording methods across all sales channels

Document collection methodologies to ensure consistency over time

Establish data validation protocols at the point of entry

Create consistent time intervals (daily, weekly, or monthly)

2. Address Anomalies and Missing Values Appropriately

The unpredictable movement of demand from one period to the next in a time series requires careful treatment:

Identify outliers using statistical techniques like z-scores or IQR

Investigate unusual data points rather than automatically removing them

Apply appropriate imputation methods for missing values

Document all data cleaning decisions for transparency

3. Apply Robust Data Transformation Techniques

Before analysis, your data may need preparation:

Test for and address stationarity issues using differencing

Apply logarithmic transformations for data with increasing variance

Consider seasonal adjustments to isolate underlying trends

Normalize data when comparing multiple time series

4. Continuously Update with Fresh Data

Time series forecasting isn't a one-time exercise:

Establish regular data refresh cycles (weekly or monthly)

Revalidate forecasts as new data becomes available

Monitor for changing patterns that might require model adjustments

Compare forecasts against actuals to improve future predictions

Real Impact: How Data Quality Improves Forecast Accuracy

A recent study of B2B SaaS companies found that those implementing rigorous data quality measures achieved:

37% reduction in forecast error rates

42% improvement in resource allocation efficiency

28% better inventory management

19% faster identification of sales trends

By prioritizing data quality, your time series forecasting will deliver more reliable predictions that drive better business decisions.

Learn About Our Data Quality Assessment Tool →

Time Series vs. Other Sales Forecasting Models: A Comprehensive Comparison

Understanding how time series forecasting compares to alternative approaches helps you select the optimal method for your specific business needs.

Comparative Analysis: Strengths and Limitations of Each Approach

Forecasting Method | Best For | Limitations | Data Requirements | Accuracy Level |

|---|---|---|---|---|

Time Series Analysis | Identifying patterns in historical data | Requires substantial history; struggles with disruptions | 2+ years of consistent data | High for stable markets |

Moving Average | Simple trend identification | Misses seasonal patterns; lags behind changes | Minimal data needed | Low to moderate |

Regression Analysis | Finding relationships between variables | Assumes linear relationships; complex setup | Moderate data needs | Moderate to high |

Machine Learning | Complex, multi-variable forecasting | Requires expertise; potential overfitting | Large datasets needed | Potentially very high |

Judgmental Forecasting | New products; disrupted markets | Subjective bias; inconsistent results | Minimal or no data | Highly variable |

When Time Series Forecasting Delivers Superior Results

Time series forecasting techniques consistently outperform other methods when:

You have 2+ years of consistent historical data

Clear seasonal or cyclical patterns exist in your sales

Your market shows relative stability in underlying factors

You need an objective, data-driven approach

Regular forecasting is required (monthly, quarterly)

When Time Series Forecasting Isn't a Fit

Time series forecasting is powerful when you have stable patterns, trends, and seasonality. But it is not always the right approach for every business or sales model. There are situations where a time series forecast may produce misleading or low confidence results.

1. When There Is Not Enough Historical Data

Time series models rely on consistent and sufficient historical performance. If your company has only a few months of data or recently changed its pricing, product, or market, time series forecasting may not capture reliable patterns. Without enough data points, the model cannot detect trends or seasonality accurately.

2. When the Business Model Changes Frequently

Time series assumes that the future will behave similarly to the past. If your company frequently changes target segments, sales strategy, or revenue model, previous data may no longer reflect current reality. In such cases, a time series forecast can lag behind actual business shifts.

3. When Sales Are Highly Deal Driven

For enterprise or large B2B deals with long cycles and high variability, pure time series forecasting may oversimplify reality. Revenue in these cases depends more on specific opportunities than on stable historical patterns. Combining time series with pipeline analysis often produces better results.

4. When External Shocks Disrupt the Market

Economic crises, regulatory changes, or sudden demand spikes can break historical trends. Time series models learn from past behavior, so unexpected disruptions reduce forecasting reliability. During unstable periods, scenario planning and qualitative adjustments become essential.

Time series forecasting works best in environments with consistent transaction volume and observable patterns. When those conditions are missing, it should be complemented with other methods to maintain forecast accuracy and strategic visibility.

Time Series Analysis and Machine Learning

Time series analysis and machine learning are often seen as separate approaches, but in modern AI sales forecasting, they work best together. When combined, they help companies build more accurate, adaptive, and reliable forecasts than either method alone.

How time series forecasting fits in

Time series forecasting focuses on historical patterns over time. It analyzes trends, seasonality, and recurring cycles in sales data to predict future outcomes. This approach is especially strong when:

Sales follow clear seasonal patterns

Historical data is consistent

Forecasts need to explain why numbers change over time

Traditional time series models create a solid baseline forecast. They answer questions like:

Is revenue growing or declining?

Are there monthly or quarterly seasonality effects?

How stable is demand over time?

Where machine learning adds value

Machine learning takes time series forecasting a step further. Instead of relying only on past values, machine learning models can include many additional signals such as:

Deal size and deal age

Pipeline stage changes

Sales rep activity

Win and loss patterns

External or operational factors

In AI sales forecasting, machine learning helps detect complex relationships that classic time series models cannot easily capture. It continuously learns from new data and adjusts predictions as patterns change.

How they work together in practice

The most effective forecasting systems combine both approaches:

Time series models establish the core forecast using historical trends and seasonality

Machine learning models refine that forecast by adjusting probabilities, detecting anomalies, and reacting to real-time signals

The final forecast blends stability from time series forecasting with adaptability from machine learning

This hybrid approach reduces forecast bias, improves accuracy, and makes forecasts more resilient when sales conditions change.

Why this matters for sales forecasting

Relying only on machine learning without time context can lead to unstable forecasts. Relying only on time series analysis can miss important deal-level signals. Combining the two creates a balanced system that is:

More accurate over longer periods

More responsive to pipeline changes

Better suited for complex B2B sales environments

That’s why modern AI sales forecasting platforms increasingly use both time series forecasting and machine learning instead of choosing one over the other.

8 Transformative Advantages of Time Series Forecasting for B2B Sales

Time series forecasting offers unique benefits that directly impact revenue growth and operational efficiency in B2B sales environments.

1. Superior Accuracy in Stable Markets

Time series models make predictions about the future based on analysis of past data with remarkable precision:

15-30% lower error rates than judgmental forecasting

Consistent performance across multiple time horizons

Self-correcting mechanisms that improve over time

2. Data-Driven Objectivity

Remove human bias and politics from your forecasting process:

Purely mathematical approach based on historical patterns

Consistent methodology regardless of who runs the analysis

Transparent assumptions that can be validated with data

3. Exceptional Pattern Detection

Uncover hidden patterns that humans might miss:

Subtle seasonal variations that impact inventory needs

Long-term trends obscured by short-term fluctuations

Cyclical patterns tied to broader market conditions

4. Streamlined Resource Planning

Optimize your operations with more reliable forecasts:

Staff according to predicted demand peaks and valleys

Align inventory levels with anticipated sales volumes

Budget with confidence based on projected revenue

5. Early Warning System for Changes

Detect shifts in your business before they become obvious:

Identify trend changes as they begin to emerge

Spot seasonal pattern shifts that require attention

Quantify the impact of market developments

6. Scalable Forecasting Framework

Handle growing data volumes without proportional effort increases:

Same methodology works across product lines and regions

Automation potential reduces manual forecasting work

Consistent approach regardless of business complexity

7. Improved Stakeholder Confidence

Build trust in your forecasts with systematic, data-driven predictions:

Defendable methodology based on statistical principles

Quantifiable accuracy metrics that demonstrate reliability

Professional presentation of forecast ranges and confidence intervals

8. Adaptive Learning Capability

Your forecasting system gets smarter over time:

Each new data point improves future prediction accuracy

Seasonal patterns become clearer with additional cycles

Model parameters self-optimize based on performance

By leveraging these advantages, your B2B sales organization can transform forecasting from a necessary evil into a strategic competitive advantage that drives growth and operational excellence.

Transform Your Sales Forecasting with Time Series Analysis

Time series forecasting represents the gold standard in data-driven sales prediction, enabling B2B organizations to make confident decisions based on robust analysis rather than guesswork.

Key Takeaways from This Guide

Time series forecasting models make predictions about the future based on analysis of past data arranged chronologically, offering superior accuracy compared to subjective methods

Effective forecasting requires quality data spanning at least 2-3 years, properly cleaned and prepared for analysis

Multiple modeling approaches (ARIMA, SARIMA, Exponential Smoothing) provide options tailored to your specific data patterns and business needs

Forecasting monthly sales requires systematic methodology that captures trends, seasonality, and other relevant patterns

Companies using time series forecasting grow 19% faster than those relying on subjective approaches

For B2B sales leaders committed to data-driven decision making, time series forecasting provides the solid foundation needed for confident strategic planning, resource allocation, and growth targeting.

Implement Time Series Forecasting in Your Organization

Ready to transform your sales forecasting approach? Here are your next steps:

Assess your current data quality and historical data availability

Determine which time series model best fits your business patterns

Start with forecasting monthly sales to build experience and confidence

Continuously refine your approach based on accuracy metrics

Why Forecastio Makes Time Series Forecasting Simple

Forecastio's specialized time series forecasting platform eliminates the complexity traditionally associated with advanced statistical modeling:

Automatic data preparation handles cleaning and transformation

Smart model selection identifies the optimal approach for your data

Intuitive visualizations make forecasts accessible to all stakeholders

Continuous accuracy monitoring ensures reliable predictions

Seamless CRM integration eliminates manual data handling

Don't let forecasting limitations constrain your growth potential. Join the innovative B2B companies leveraging time series forecasting to achieve unprecedented accuracy in their sales predictions.

Experience Forecastio's Time Series Forecasting →

Frequently Asked Questions About Time Series Forecasting

What are the 4 components of time series forecasting?

Time series forecasting models consist of four essential components:

1) Trend –– the long-term upward or downward movement in data

2) Seasonality –– regular patterns that repeat at fixed intervals

3) Cyclical –– fluctuations not tied to seasonal factors

4) Irregular –– random variations that can't be predicted

Understanding these components allows forecasters to decompose historical patterns and make accurate predictions about future sales.

Which time-series model uses both past forecasts and past demand data?

ARIMA (Autoregressive Integrated Moving Average) is the time-series model that uses both past forecasts and past demand data to generate a new forecast. The "AR" component uses previous sales values, while the "MA" component incorporates past forecast errors. This dual approach makes ARIMA particularly effective for sales forecasting where both historical performance and prediction accuracy matter.

What is the best way to forecast monthly sales?

The best way to forecast monthly sales is using time series analysis with either ARIMA or SARIMA models, depending on whether your data shows seasonality. Start by collecting 24-36 months of historical data, clean it to remove anomalies, identify patterns (trend, seasonality), select the appropriate model, optimize parameters, and validate accuracy against reserved test data. For most B2B companies, this approach delivers 15-30% higher accuracy than traditional forecasting methods.

How does trend and sales forecast work together?

Trend analysis in sales forecasting works by identifying the underlying direction of your data (upward, downward, or stable) and incorporating it into predictions. Time series forecasting techniques like ARIMA quantify this trend component mathematically, allowing the forecast to continue the established pattern into future periods while adjusting for seasonality and other factors. Effective trend analysis is crucial for accurate long-term sales projections.

What are the best time series forecasting models for sales?

The best time series forecasting models for sales include:

1) ARIMA for general trend-based forecasting

2) SARIMA for seasonal sales patterns

3) Exponential Smoothing for emphasizing recent data

4) Prophet for complex patterns with multiple seasonalities

For most B2B companies, ARIMA and SARIMA deliver the optimal balance of accuracy and interpretability, making them the preferred choices for sales forecasting.

As a forecasting technique, time series has what advantages?

As a forecasting technique, time series has several advantages:

1) It's purely data-driven, eliminating subjective bias

2) It captures complex patterns like seasonality and trends automatically

3) It provides statistical confidence intervals around predictions

4) It improves over time as more data becomes available

5) It can be largely automated, reducing manual effort

These advantages make it particularly valuable for B2B sales forecasting where accuracy and efficiency are critical.

A forecast based on average past demand is a what type?