Sales Forecasting Examples That Actually Work

Jan 13, 2026

Jan 13, 2026

Alex Zlotko

CEO at Forecastio

Last updated

Jan 13, 2026

Reading time

11 min

Share:

Share

Why Sales Forecasting Is Critical for B2B Success

Sales forecasting is the backbone of strategic business planning. An accurate sales forecast empowers sales leaders to predict future revenue, allocate resources efficiently, and make confident, data-driven decisions. The ability to forecast sales reliably isn't just about generating reports—it's a strategic asset that directly impacts your company's growth and profitability.

According to Gartner research, companies that can forecast within 10% of actual results are more than twice as likely to experience consistent growth year-over-year. This clearly demonstrates why sales forecasting is so important—it gives your organization the clarity needed to navigate changing market conditions, anticipate demand, and optimize your sales strategy.

Most sales forecasts are based on past sales performances as well as current pipeline data, but what separates great forecasting from mediocre efforts is the methodology and consistency applied to the process. Whether using historical trend analysis, pipeline stage probabilities, or advanced AI-driven models, a structured approach to forecasting sales helps you stay aligned with business objectives while adjusting to external factors that influence projected sales. For instance, reviewing a sales forecast example can highlight how assumptions and data inputs shape results. Similarly, a sales forecast example for new business provides valuable insight into how startups and growing companies can plan realistically even without extensive historical data. For companies looking to align forecasting with pricing strategy, check out this Guide to Repricing Software.

How do you predict sales growth?

Predicting sales growth requires a balance between analyzing historical performance and applying forward-looking models. Businesses use past sales data, current pipeline health, and market trends to estimate how much revenue they will generate in the coming months or quarters. By creating detailed forecasts, sales leaders can allocate resources effectively, set realistic targets, and prepare strategies that respond to changing market conditions. Below are two common approaches that illustrate this process.

Monthly sales forecast example

A monthly sales forecast example breaks down projected sales into 30-day cycles, giving managers a clear picture of short-term performance. This approach is useful for identifying seasonality, understanding sales team productivity, and spotting trends that can affect future months. For instance, if a company notices declining conversion rates in one month, it can immediately take corrective actions to improve the next period’s results. Monthly forecasts provide agility and allow businesses to react quickly rather than waiting until quarterly reviews.

Revenue forecast example

A revenue forecast example goes one step further by showing how predicted sales figures translate into overall business income. It connects sales activity directly with financial outcomes, helping leaders make informed decisions about budgeting, hiring, and investments. Revenue forecasts are especially important for aligning sales goals with broader organizational objectives. By combining pipeline analysis, average deal size, and win rates, businesses can build revenue models that highlight not only expected income but also potential risks and growth opportunities.

Why Do Companies Fail to Forecast Sales Accurately?

Despite understanding the importance of sales forecasting, many organizations struggle to deliver accurate and actionable forecasts. The problem isn't the concept of forecasting itself—it's how the sales forecasting process is executed. Here are the most common reasons sales forecasts fail:

Overreliance on intuition: Sales reps often rely on gut feelings rather than data-driven sales forecasting methods. While intuitive forecasting feels comfortable, it rarely produces an accurate sales forecast without solid historical data and performance metrics.

Poor data quality: Outdated or incomplete sales data inevitably skews forecasts. Without clean, current information from your sales pipeline, you can't reliably predict future sales or estimate revenue.

Inconsistent CRM hygiene: When your team doesn't maintain consistent deal stages or follow a clearly defined sales process, it becomes nearly impossible to forecast with precision. Sales forecasting tools only work when the underlying data is trustworthy.

One-size-fits-all approach: Using the same forecasting method across different sales motions—like applying a model built for enterprise sales to a high-velocity team—leads to misaligned projections and inaccurate estimates.

Lack of deal-level risk assessment: Without accounting for stalled opportunities, deals stuck in the sales cycle, or single-threaded conversations, sales forecasts become overly optimistic and unreliable.

To create a sales forecast that actually drives decisions, you need to choose the right sales forecasting method, ensure clean data, and maintain a disciplined process that reflects your market conditions and sales strategy.

6 Powerful Sales Forecasting Examples With Real Numbers

1. Opportunity Stage Forecasting

This fundamental sales forecasting method uses your pipeline stages to generate reliable projections. Each stage in the sales cycle — such as Discovery, Demo, Proposal, and Contract— is assigned a probability based on historical conversion rates. These probabilities are then applied to active deals to forecast revenue.

Example of a sales forecast using stage probabilities:

Step 1: Calculate stage probabilities based on historical data

Stage | Deals Entered | Deals Won | Conversion Rate |

|---|---|---|---|

Discovery | 100 | 20 | 20% |

Demo | 80 | 32 | 40% |

Proposal | 50 | 30 | 60% |

Contract | 30 | 24 | 80% |

Formula: Probability = Deals Won ÷ Deals Entered

Step 2: Apply probabilities to current pipeline

Deal | Stage | Deal Value | Stage Probability | Weighted Forecast |

|---|---|---|---|---|

Deal A | Proposal | $20,000 | 60% | $12,000 |

Deal B | Demo | $10,000 | 40% | $4,000 |

Deal C | Discovery | $15,000 | 20% | $3,000 |

Total Forecast = $19,000

This sales forecasting example works best when you have:

Clearly defined pipeline stages

Reliable historical sales data

A relatively stable sales cycle

Pros:

Simple and intuitive methodology

Doesn't require advanced forecasting software

Works well when historical performance is consistent

Cons:

May overlook deal quality or sales rep behavior

Doesn't account for stalled deals

Can be skewed if historical data is unreliable

With opportunity stage forecasting, recalibration is an important step. It means reviewing how far your previous forecasts were from actual results and adjusting the model to account for that error. Without recalibration, even the best sales forecasting examples start drifting over time because the model continues making the same mistakes. A simple example is comparing last quarter's predicted revenue with actual revenue and then applying that correction factor to the next forecast.

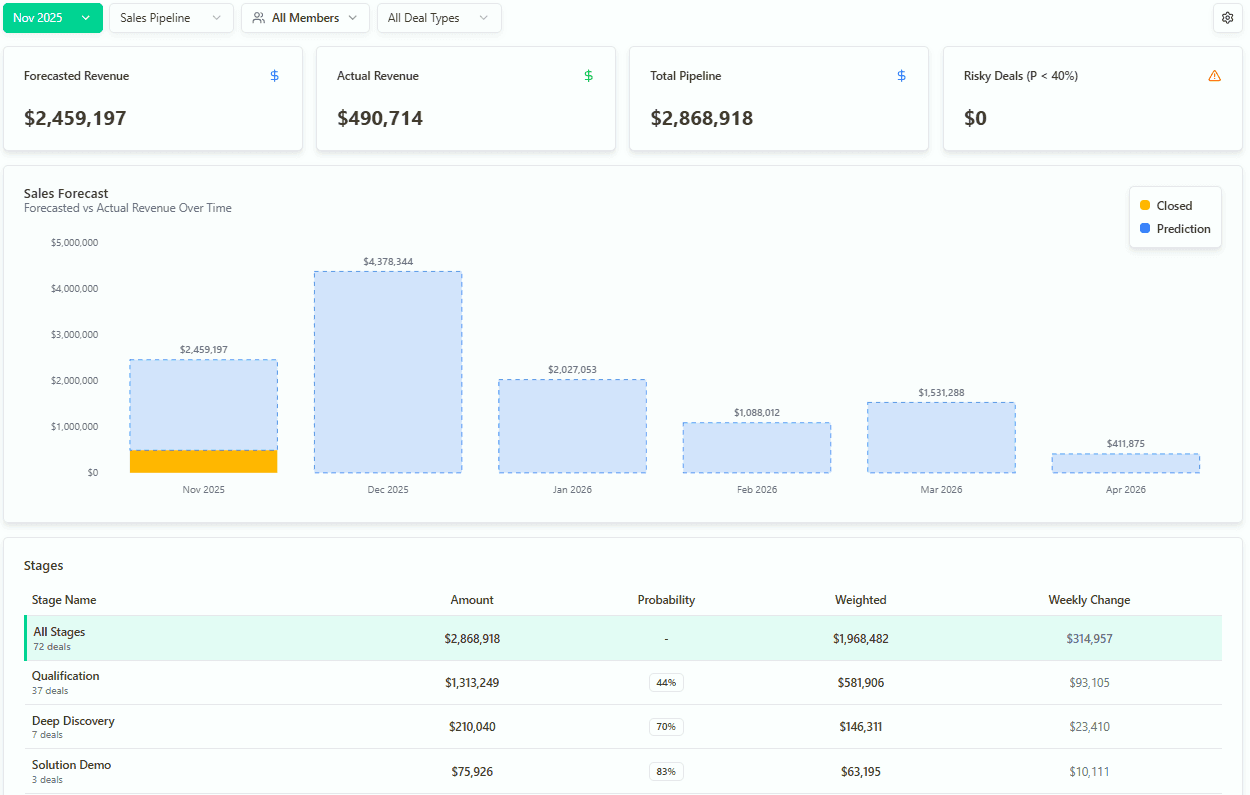

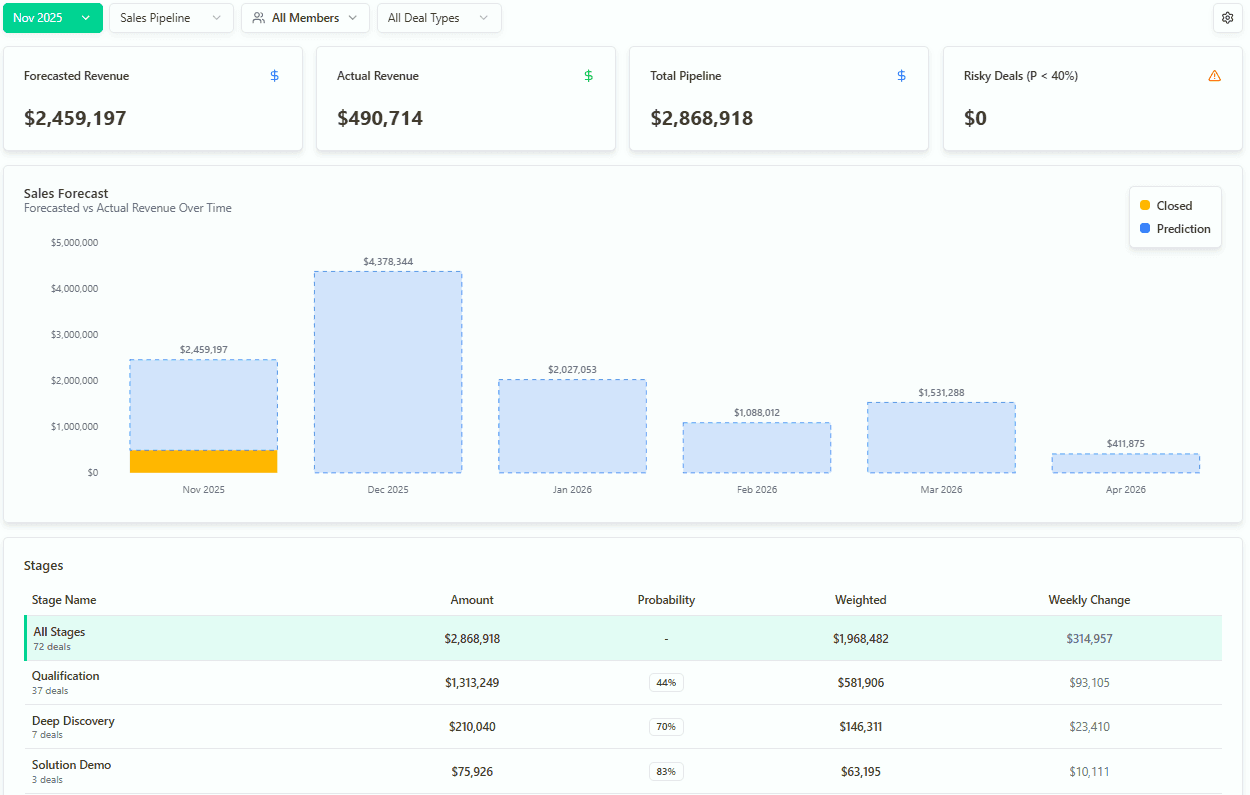

Opportunity Stage Forecasting with Forecastio

2. Advanced Stage Forecasting with Time-in-Stage Analysis

This more sophisticated forecasting example builds upon traditional stage forecasting by incorporating time spent in each stage. Deals that are stuck or spend significantly longer than average in a stage have their probabilities discounted—making your sales forecast more realistic.

Forecasting example with time-in-stage adjustments:

Step 1: Determine average time in each stage

Stage | Avg Time in Stage |

|---|---|

Discovery | 5 days |

Demo | 7 days |

Proposal | 10 days |

Step 2: Apply discount rule

If time in stage > 150% of average: Reduce probability by 50%

Step 3: Calculate adjusted forecast

Deal | Stage | Deal Value | Standard Probability | Time in Stage | Adjusted Probability | Weighted Forecast |

|---|---|---|---|---|---|---|

Deal A | Proposal | $25,000 | 60% | 20 days (2× avg) | 30% | $7,500 |

Deal B | Demo | $10,000 | 40% | 7 days (on track) | 40% | $4,000 |

Total Forecast = $11,500

This advanced sales projection example gives sales leaders a clearer view of at-risk deals and prevents inflated forecasts caused by pipeline stagnation.

When to use this method:

When you want to reduce the risk of overforecasting

For sales cycles where deals frequently stall

To predict sales with greater precision by factoring in velocity

3. Historical Trend Analysis Forecasting

Historical forecasting uses past sales data from previous periods to predict future performance. This approach assumes that sales follows consistent patterns over time, making it especially useful for companies with clear seasonality or repeatable business cycles.

Projected sales example based on historical data:

Period | Bookings | Growth Rate |

|---|---|---|

Q2 2023 | $100,000 | - |

Q2 2024 | $120,000 | +20% |

Q2 2025 (projected) | $144,000 | +20% (forecast) |

This sales forecasting example is based purely on past trends and assumes that your sales strategy, team structure, and market conditions remain relatively stable.

Best used when:

Your business has steady, predictable sales cycles

Seasonality and trends are reliable indicators

You need a quick, top-level forecast as a baseline

While simple, historical forecasting plays an important role in validating more complex forecasting models and providing a reality check against pipeline-based projections.

4. Machine Learning Probability Forecasting

This advanced sales forecasting method uses AI to calculate win probabilities for each deal based on dozens of variables. Unlike traditional models that rely on static stage probabilities, machine learning analyzes complex patterns in historical data to predict future sales with remarkable accuracy.

Example of forecasting with machine learning

ML models analyze factors including:

Current pipeline stage

Time in stage and total deal age

Deal value and complexity

Industry and company size

Customer engagement metrics

Sales rep activities and skill level

Previous interactions history

Lead source quality

Competitive situation

Sample ML-generated forecast:

Deal | Value | ML-Calculated Probability | Weighted Forecast |

|---|---|---|---|

Deal A | $50,000 | 35% | $17,500 |

Deal B | $30,000 | 70% | $21,000 |

Deal C | $40,000 | 15% | $6,000 |

Total Forecast = $44,500

This example of sales forecasting offers a far more nuanced and responsive view of future revenue than traditional methods. Machine learning sales forecasting models can identify patterns and relationships that human analysis might miss.

When to use ML-based forecasting:

Your CRM contains rich, clean historical data

You have sufficient deal volume for model training

You want to improve forecasting accuracy and reduce bias

You're ready to invest in sales forecasting software

This is one of the most powerful and scalable forecasting examples, giving sales leaders a reliable way to predict future sales with unprecedented precision.

Machine learning takes forecasting a step further. A strong model should estimate two separate probabilities: the overall probability of winning the deal and the most likely month it will close. This makes ML-based sales forecasting much more useful, because you understand both “if” and “when.” Traditional methods typically provide only a single probability, which limits how accurate a this sales forecast example can be.

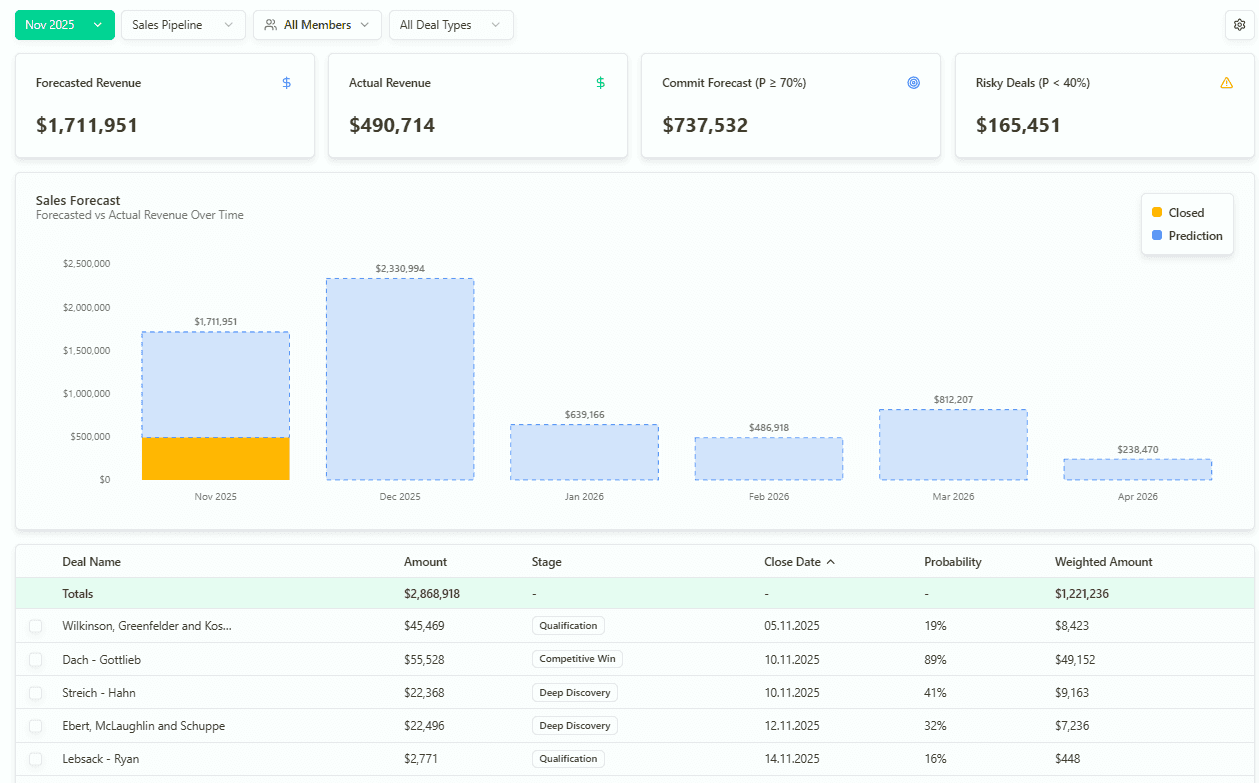

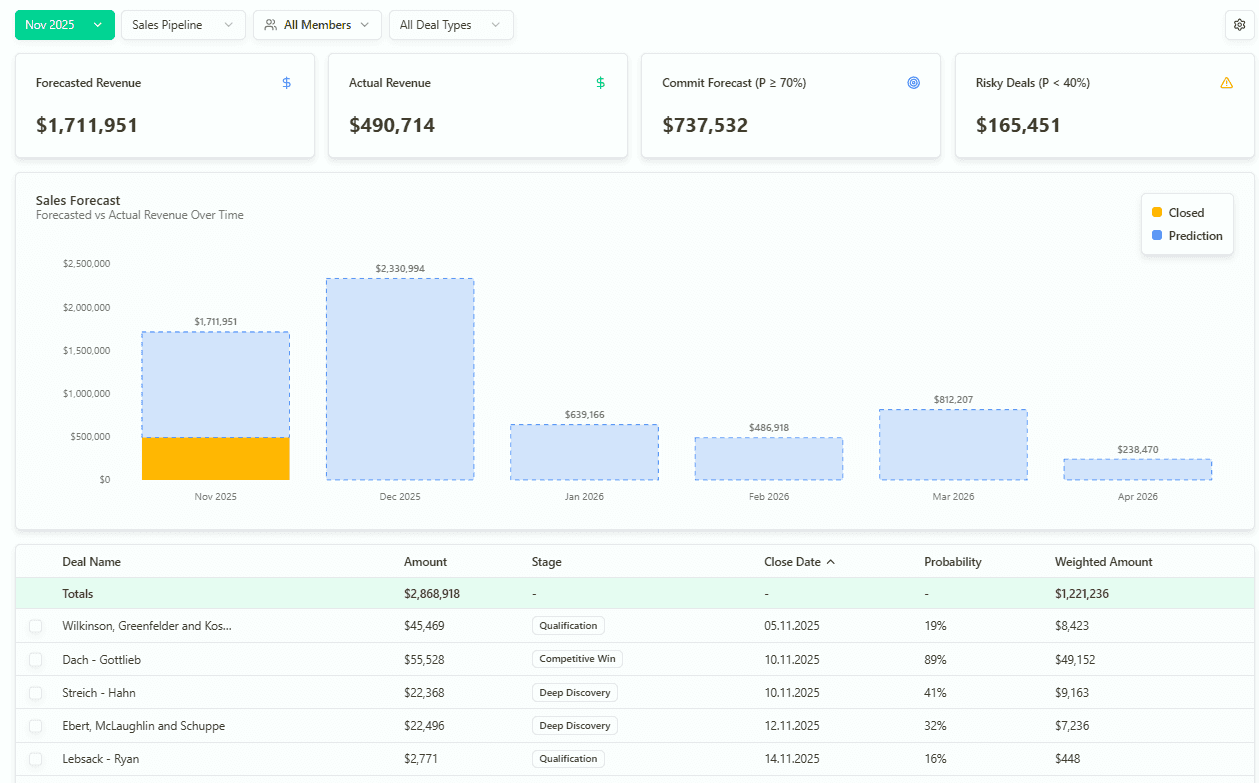

AI Sales Forecasting with Forecastio

5. Sales Cycle Length Forecasting

This sales forecasting method uses the length of your sales cycle to estimate deal probabilities. Instead of focusing solely on pipeline stages, it evaluates where each deal stands relative to your average cycle length. The further along a deal is, the higher its predicted probability of closing.

Example of cycle-based forecasting:

Step 1: Determine your average sales cycle length

Average cycle = 60 days

Step 2: Calculate probabilities based on progress

Formula: Probability = Days in Cycle ÷ Average Cycle Length

Step 3: Apply to active deals

Deal | Deal Value | Days in Cycle | Avg Sales Cycle | Probability | Weighted Forecast |

|---|---|---|---|---|---|

Deal A | $40,000 | 30 days | 60 days | 50% | $20,000 |

Deal B | $20,000 | 15 days | 60 days | 25% | $5,000 |

Total Forecast = $25,000

This method helps sales teams quickly forecast without requiring deep insights into customer engagement or deal quality. It's particularly effective for companies with high-volume, transactional sales models.

Best suited for:

High deal volume with consistent cycle durations

Teams following a uniform sales process

Quick, high-level sales projections for resource planning

6. Weighted Pipeline Forecast with Calibration

This approach is used when a team already applies a weighted pipeline forecast but wants to correct systematic forecasting bias based on historical performance. It’s especially useful for teams that consistently over-forecast or under-forecast revenue.

Step 1: Standard weighted pipeline forecast

Assume the current pipeline looks like this:

Deal | Deal Value | Stage Probability | Weighted Value |

Deal A | $100,000 | 40% | $40,000 |

Deal B | $80,000 | 60% | $48,000 |

Deal C | $120,000 | 80% | $96,000 |

Weighted pipeline forecast:

$40,000 + $48,000 + $96,000 = $184,000

Step 2: Analyze historical forecast accuracy

Looking at the last 6 months, the team sees the following pattern:

Average weighted pipeline forecast: $200,000

Average actual closed-won revenue: $160,000

This means the team historically over-forecasts by 25%.

Calibration factor:

$160,000 ÷ $200,000 = 0.8

Step 3: Apply calibration to the current forecast

Apply the calibration factor to the weighted pipeline forecast:

$184,000 × 0.8 = $147,200

Final calibrated forecast

Uncalibrated weighted forecast: $184,000

Calibrated forecast: $147,200

This calibrated forecast reflects real historical performance, not just pipeline probabilities.

How to Choose the Right Sales Forecasting Method

There's no universal approach to building an accurate sales forecast—the best method depends on your specific business model, team structure, and data maturity. To forecast sales effectively, consider these key factors:

1. Your Sales Motion

Is your team closing high-velocity deals or navigating complex enterprise sales?

High-velocity sales: Consider stage-based or cycle-length forecasting

Enterprise sales: Use machine learning or advanced stage forecasting that accounts for multiple risk factors

2. Data Availability and Quality

How much historical data do you have, and how reliable is it?

Clean, extensive data: Leverage sophisticated sales forecasting tools that analyze multiple variables

Limited or inconsistent data: Start simple with historical or basic stage forecasting

3. Team Size and CRM Discipline

Are you a small team or a mature organization with RevOps support?

Small team, simple process: Begin with classic stage-based forecasting

Larger team, good CRM hygiene: Move toward AI-based forecasting or hybrid models

Mixed organization: Combine multiple methods for a blended view of future revenue

Improving Your Sales Forecasting Accuracy

Enhancing your sales forecasting accuracy doesn't require completely overhauling your process. Instead, focus on these practical steps:

Audit your CRM data: Standardize fields, define pipeline stages clearly, and maintain clean data

Analyze past forecast accuracy: Compare predictions to actual results by rep, team, and method

Segment your pipeline: Separate enterprise from high-velocity deals—each requires its own approach

Use multiple models: Blend historical, stage-based, and AI-driven forecasts for greater reliability

Review weekly: Make forecasting a routine part of your sales process, not just a monthly task

Factor in deal-level risk: Flag and discount stalled, single-threaded, or aging deals

Invest in forecasting tools: Platforms like Forecastio automate complex calculations and help sales leaders make faster, data-driven decisions

External Factors That Influence a Sales Forecast

A comprehensive sales forecast must account for various external factors that can significantly impact results. When building your forecast model, be sure to consider:

Economic conditions: Overall economic health, inflation rates, and industry-specific economic indicators

Seasonality: Recurring patterns of demand fluctuation throughout the year

Market trends: Emerging technologies, shifting customer preferences, and industry disruptions

Competitive landscape: New competitors, pricing changes, or product launches from existing rivals

Regulatory changes: New laws or regulations that could affect your products or target markets

Supply chain factors: Availability of materials, shipping delays, or cost fluctuations

Political environment: Elections, policy changes, or international relations that might impact business

List external factors that influence a sales forecast to ensure your projections account for all variables beyond your control. Adjusting for these factors will help you develop more accurate, resilient forecasts.

Summary: Making Sales Forecasting Work for Your Business

Sales forecasting is both art and science. From simple stage-based projections to advanced AI-powered models, each sales forecasting method offers unique advantages. The key is selecting the right approach based on your sales motion, data quality, and business objectives.

Most importantly, treat sales forecasting as a dynamic, ongoing process—not just a quarterly spreadsheet exercise. Regular updates, better inputs, and continuous learning will drive more accurate forecasts over time. This disciplined approach to forecasting ensures you aren't just predicting future sales—you're actively shaping how you lead, plan, and scale your business with confidence.

Ready to transform your sales forecasting process? Book a demo to see how Forecastio's advanced forecasting platform can help you achieve unprecedented accuracy and make data-driven decisions that drive growth.

FAQs About Sales Forecasting

What is the formula for predicting sales?

The most common formula for predicting sales is: Forecasted Sales = (Deal Value × Probability of Closing). However, advanced forecasting methods incorporate multiple variables including historical trends, pipeline metrics, and external factors for greater accuracy.

Which type of sales forecasting is based on the analysis of hard facts or numerical data?

Quantitative sales forecasting methods like historical analysis, regression, and pipeline-based modeling rely on numerical data rather than subjective judgment. These methods use statistical techniques to analyze past performance and current pipeline data to predict future sales.

Why do some businesses fail to forecast sales?

Businesses fail to forecast sales accurately due to poor data quality, inconsistent processes, over-reliance on intuition rather than metrics, inadequate tools, and failure to account for external market factors. Successful forecasting requires clean data, consistent methodology, and regular review.

What are the 5 machine learning techniques for sales forecasting?

The five primary machine learning techniques for sales forecasting are:

Regression analysis (linear/multivariate)

Time series models (ARIMA/SARIMA)

Random forest algorithms

Neural networks (deep learning)

Gradient boosting models

What does a sales forecast look like?

A sales forecast typically appears as a structured report containing projected revenue figures broken down by time period (monthly, quarterly, annual), product line, territory, or sales team. It often includes probability-weighted deal values, historical comparisons, and graphical representations of trends.

Why Sales Forecasting Is Critical for B2B Success

Sales forecasting is the backbone of strategic business planning. An accurate sales forecast empowers sales leaders to predict future revenue, allocate resources efficiently, and make confident, data-driven decisions. The ability to forecast sales reliably isn't just about generating reports—it's a strategic asset that directly impacts your company's growth and profitability.

According to Gartner research, companies that can forecast within 10% of actual results are more than twice as likely to experience consistent growth year-over-year. This clearly demonstrates why sales forecasting is so important—it gives your organization the clarity needed to navigate changing market conditions, anticipate demand, and optimize your sales strategy.

Most sales forecasts are based on past sales performances as well as current pipeline data, but what separates great forecasting from mediocre efforts is the methodology and consistency applied to the process. Whether using historical trend analysis, pipeline stage probabilities, or advanced AI-driven models, a structured approach to forecasting sales helps you stay aligned with business objectives while adjusting to external factors that influence projected sales. For instance, reviewing a sales forecast example can highlight how assumptions and data inputs shape results. Similarly, a sales forecast example for new business provides valuable insight into how startups and growing companies can plan realistically even without extensive historical data. For companies looking to align forecasting with pricing strategy, check out this Guide to Repricing Software.

How do you predict sales growth?

Predicting sales growth requires a balance between analyzing historical performance and applying forward-looking models. Businesses use past sales data, current pipeline health, and market trends to estimate how much revenue they will generate in the coming months or quarters. By creating detailed forecasts, sales leaders can allocate resources effectively, set realistic targets, and prepare strategies that respond to changing market conditions. Below are two common approaches that illustrate this process.

Monthly sales forecast example

A monthly sales forecast example breaks down projected sales into 30-day cycles, giving managers a clear picture of short-term performance. This approach is useful for identifying seasonality, understanding sales team productivity, and spotting trends that can affect future months. For instance, if a company notices declining conversion rates in one month, it can immediately take corrective actions to improve the next period’s results. Monthly forecasts provide agility and allow businesses to react quickly rather than waiting until quarterly reviews.

Revenue forecast example

A revenue forecast example goes one step further by showing how predicted sales figures translate into overall business income. It connects sales activity directly with financial outcomes, helping leaders make informed decisions about budgeting, hiring, and investments. Revenue forecasts are especially important for aligning sales goals with broader organizational objectives. By combining pipeline analysis, average deal size, and win rates, businesses can build revenue models that highlight not only expected income but also potential risks and growth opportunities.

Why Do Companies Fail to Forecast Sales Accurately?

Despite understanding the importance of sales forecasting, many organizations struggle to deliver accurate and actionable forecasts. The problem isn't the concept of forecasting itself—it's how the sales forecasting process is executed. Here are the most common reasons sales forecasts fail:

Overreliance on intuition: Sales reps often rely on gut feelings rather than data-driven sales forecasting methods. While intuitive forecasting feels comfortable, it rarely produces an accurate sales forecast without solid historical data and performance metrics.

Poor data quality: Outdated or incomplete sales data inevitably skews forecasts. Without clean, current information from your sales pipeline, you can't reliably predict future sales or estimate revenue.

Inconsistent CRM hygiene: When your team doesn't maintain consistent deal stages or follow a clearly defined sales process, it becomes nearly impossible to forecast with precision. Sales forecasting tools only work when the underlying data is trustworthy.

One-size-fits-all approach: Using the same forecasting method across different sales motions—like applying a model built for enterprise sales to a high-velocity team—leads to misaligned projections and inaccurate estimates.

Lack of deal-level risk assessment: Without accounting for stalled opportunities, deals stuck in the sales cycle, or single-threaded conversations, sales forecasts become overly optimistic and unreliable.

To create a sales forecast that actually drives decisions, you need to choose the right sales forecasting method, ensure clean data, and maintain a disciplined process that reflects your market conditions and sales strategy.

6 Powerful Sales Forecasting Examples With Real Numbers

1. Opportunity Stage Forecasting

This fundamental sales forecasting method uses your pipeline stages to generate reliable projections. Each stage in the sales cycle — such as Discovery, Demo, Proposal, and Contract— is assigned a probability based on historical conversion rates. These probabilities are then applied to active deals to forecast revenue.

Example of a sales forecast using stage probabilities:

Step 1: Calculate stage probabilities based on historical data

Stage | Deals Entered | Deals Won | Conversion Rate |

|---|---|---|---|

Discovery | 100 | 20 | 20% |

Demo | 80 | 32 | 40% |

Proposal | 50 | 30 | 60% |

Contract | 30 | 24 | 80% |

Formula: Probability = Deals Won ÷ Deals Entered

Step 2: Apply probabilities to current pipeline

Deal | Stage | Deal Value | Stage Probability | Weighted Forecast |

|---|---|---|---|---|

Deal A | Proposal | $20,000 | 60% | $12,000 |

Deal B | Demo | $10,000 | 40% | $4,000 |

Deal C | Discovery | $15,000 | 20% | $3,000 |

Total Forecast = $19,000

This sales forecasting example works best when you have:

Clearly defined pipeline stages

Reliable historical sales data

A relatively stable sales cycle

Pros:

Simple and intuitive methodology

Doesn't require advanced forecasting software

Works well when historical performance is consistent

Cons:

May overlook deal quality or sales rep behavior

Doesn't account for stalled deals

Can be skewed if historical data is unreliable

With opportunity stage forecasting, recalibration is an important step. It means reviewing how far your previous forecasts were from actual results and adjusting the model to account for that error. Without recalibration, even the best sales forecasting examples start drifting over time because the model continues making the same mistakes. A simple example is comparing last quarter's predicted revenue with actual revenue and then applying that correction factor to the next forecast.

Opportunity Stage Forecasting with Forecastio

2. Advanced Stage Forecasting with Time-in-Stage Analysis

This more sophisticated forecasting example builds upon traditional stage forecasting by incorporating time spent in each stage. Deals that are stuck or spend significantly longer than average in a stage have their probabilities discounted—making your sales forecast more realistic.

Forecasting example with time-in-stage adjustments:

Step 1: Determine average time in each stage

Stage | Avg Time in Stage |

|---|---|

Discovery | 5 days |

Demo | 7 days |

Proposal | 10 days |

Step 2: Apply discount rule

If time in stage > 150% of average: Reduce probability by 50%

Step 3: Calculate adjusted forecast

Deal | Stage | Deal Value | Standard Probability | Time in Stage | Adjusted Probability | Weighted Forecast |

|---|---|---|---|---|---|---|

Deal A | Proposal | $25,000 | 60% | 20 days (2× avg) | 30% | $7,500 |

Deal B | Demo | $10,000 | 40% | 7 days (on track) | 40% | $4,000 |

Total Forecast = $11,500

This advanced sales projection example gives sales leaders a clearer view of at-risk deals and prevents inflated forecasts caused by pipeline stagnation.

When to use this method:

When you want to reduce the risk of overforecasting

For sales cycles where deals frequently stall

To predict sales with greater precision by factoring in velocity

3. Historical Trend Analysis Forecasting

Historical forecasting uses past sales data from previous periods to predict future performance. This approach assumes that sales follows consistent patterns over time, making it especially useful for companies with clear seasonality or repeatable business cycles.

Projected sales example based on historical data:

Period | Bookings | Growth Rate |

|---|---|---|

Q2 2023 | $100,000 | - |

Q2 2024 | $120,000 | +20% |

Q2 2025 (projected) | $144,000 | +20% (forecast) |

This sales forecasting example is based purely on past trends and assumes that your sales strategy, team structure, and market conditions remain relatively stable.

Best used when:

Your business has steady, predictable sales cycles

Seasonality and trends are reliable indicators

You need a quick, top-level forecast as a baseline

While simple, historical forecasting plays an important role in validating more complex forecasting models and providing a reality check against pipeline-based projections.

4. Machine Learning Probability Forecasting

This advanced sales forecasting method uses AI to calculate win probabilities for each deal based on dozens of variables. Unlike traditional models that rely on static stage probabilities, machine learning analyzes complex patterns in historical data to predict future sales with remarkable accuracy.

Example of forecasting with machine learning

ML models analyze factors including:

Current pipeline stage

Time in stage and total deal age

Deal value and complexity

Industry and company size

Customer engagement metrics

Sales rep activities and skill level

Previous interactions history

Lead source quality

Competitive situation

Sample ML-generated forecast:

Deal | Value | ML-Calculated Probability | Weighted Forecast |

|---|---|---|---|

Deal A | $50,000 | 35% | $17,500 |

Deal B | $30,000 | 70% | $21,000 |

Deal C | $40,000 | 15% | $6,000 |

Total Forecast = $44,500

This example of sales forecasting offers a far more nuanced and responsive view of future revenue than traditional methods. Machine learning sales forecasting models can identify patterns and relationships that human analysis might miss.

When to use ML-based forecasting:

Your CRM contains rich, clean historical data

You have sufficient deal volume for model training

You want to improve forecasting accuracy and reduce bias

You're ready to invest in sales forecasting software

This is one of the most powerful and scalable forecasting examples, giving sales leaders a reliable way to predict future sales with unprecedented precision.

Machine learning takes forecasting a step further. A strong model should estimate two separate probabilities: the overall probability of winning the deal and the most likely month it will close. This makes ML-based sales forecasting much more useful, because you understand both “if” and “when.” Traditional methods typically provide only a single probability, which limits how accurate a this sales forecast example can be.

AI Sales Forecasting with Forecastio

5. Sales Cycle Length Forecasting

This sales forecasting method uses the length of your sales cycle to estimate deal probabilities. Instead of focusing solely on pipeline stages, it evaluates where each deal stands relative to your average cycle length. The further along a deal is, the higher its predicted probability of closing.

Example of cycle-based forecasting:

Step 1: Determine your average sales cycle length

Average cycle = 60 days

Step 2: Calculate probabilities based on progress

Formula: Probability = Days in Cycle ÷ Average Cycle Length

Step 3: Apply to active deals

Deal | Deal Value | Days in Cycle | Avg Sales Cycle | Probability | Weighted Forecast |

|---|---|---|---|---|---|

Deal A | $40,000 | 30 days | 60 days | 50% | $20,000 |

Deal B | $20,000 | 15 days | 60 days | 25% | $5,000 |

Total Forecast = $25,000

This method helps sales teams quickly forecast without requiring deep insights into customer engagement or deal quality. It's particularly effective for companies with high-volume, transactional sales models.

Best suited for:

High deal volume with consistent cycle durations

Teams following a uniform sales process

Quick, high-level sales projections for resource planning

6. Weighted Pipeline Forecast with Calibration

This approach is used when a team already applies a weighted pipeline forecast but wants to correct systematic forecasting bias based on historical performance. It’s especially useful for teams that consistently over-forecast or under-forecast revenue.

Step 1: Standard weighted pipeline forecast

Assume the current pipeline looks like this:

Deal | Deal Value | Stage Probability | Weighted Value |

Deal A | $100,000 | 40% | $40,000 |

Deal B | $80,000 | 60% | $48,000 |

Deal C | $120,000 | 80% | $96,000 |

Weighted pipeline forecast:

$40,000 + $48,000 + $96,000 = $184,000

Step 2: Analyze historical forecast accuracy

Looking at the last 6 months, the team sees the following pattern:

Average weighted pipeline forecast: $200,000

Average actual closed-won revenue: $160,000

This means the team historically over-forecasts by 25%.

Calibration factor:

$160,000 ÷ $200,000 = 0.8

Step 3: Apply calibration to the current forecast

Apply the calibration factor to the weighted pipeline forecast:

$184,000 × 0.8 = $147,200

Final calibrated forecast

Uncalibrated weighted forecast: $184,000

Calibrated forecast: $147,200

This calibrated forecast reflects real historical performance, not just pipeline probabilities.

How to Choose the Right Sales Forecasting Method

There's no universal approach to building an accurate sales forecast—the best method depends on your specific business model, team structure, and data maturity. To forecast sales effectively, consider these key factors:

1. Your Sales Motion

Is your team closing high-velocity deals or navigating complex enterprise sales?

High-velocity sales: Consider stage-based or cycle-length forecasting

Enterprise sales: Use machine learning or advanced stage forecasting that accounts for multiple risk factors

2. Data Availability and Quality

How much historical data do you have, and how reliable is it?

Clean, extensive data: Leverage sophisticated sales forecasting tools that analyze multiple variables

Limited or inconsistent data: Start simple with historical or basic stage forecasting

3. Team Size and CRM Discipline

Are you a small team or a mature organization with RevOps support?

Small team, simple process: Begin with classic stage-based forecasting

Larger team, good CRM hygiene: Move toward AI-based forecasting or hybrid models

Mixed organization: Combine multiple methods for a blended view of future revenue

Improving Your Sales Forecasting Accuracy

Enhancing your sales forecasting accuracy doesn't require completely overhauling your process. Instead, focus on these practical steps:

Audit your CRM data: Standardize fields, define pipeline stages clearly, and maintain clean data

Analyze past forecast accuracy: Compare predictions to actual results by rep, team, and method

Segment your pipeline: Separate enterprise from high-velocity deals—each requires its own approach

Use multiple models: Blend historical, stage-based, and AI-driven forecasts for greater reliability

Review weekly: Make forecasting a routine part of your sales process, not just a monthly task

Factor in deal-level risk: Flag and discount stalled, single-threaded, or aging deals

Invest in forecasting tools: Platforms like Forecastio automate complex calculations and help sales leaders make faster, data-driven decisions

External Factors That Influence a Sales Forecast

A comprehensive sales forecast must account for various external factors that can significantly impact results. When building your forecast model, be sure to consider:

Economic conditions: Overall economic health, inflation rates, and industry-specific economic indicators

Seasonality: Recurring patterns of demand fluctuation throughout the year

Market trends: Emerging technologies, shifting customer preferences, and industry disruptions

Competitive landscape: New competitors, pricing changes, or product launches from existing rivals

Regulatory changes: New laws or regulations that could affect your products or target markets

Supply chain factors: Availability of materials, shipping delays, or cost fluctuations

Political environment: Elections, policy changes, or international relations that might impact business

List external factors that influence a sales forecast to ensure your projections account for all variables beyond your control. Adjusting for these factors will help you develop more accurate, resilient forecasts.

Summary: Making Sales Forecasting Work for Your Business

Sales forecasting is both art and science. From simple stage-based projections to advanced AI-powered models, each sales forecasting method offers unique advantages. The key is selecting the right approach based on your sales motion, data quality, and business objectives.

Most importantly, treat sales forecasting as a dynamic, ongoing process—not just a quarterly spreadsheet exercise. Regular updates, better inputs, and continuous learning will drive more accurate forecasts over time. This disciplined approach to forecasting ensures you aren't just predicting future sales—you're actively shaping how you lead, plan, and scale your business with confidence.

Ready to transform your sales forecasting process? Book a demo to see how Forecastio's advanced forecasting platform can help you achieve unprecedented accuracy and make data-driven decisions that drive growth.

FAQs About Sales Forecasting

What is the formula for predicting sales?

The most common formula for predicting sales is: Forecasted Sales = (Deal Value × Probability of Closing). However, advanced forecasting methods incorporate multiple variables including historical trends, pipeline metrics, and external factors for greater accuracy.

Which type of sales forecasting is based on the analysis of hard facts or numerical data?

Quantitative sales forecasting methods like historical analysis, regression, and pipeline-based modeling rely on numerical data rather than subjective judgment. These methods use statistical techniques to analyze past performance and current pipeline data to predict future sales.

Why do some businesses fail to forecast sales?

Businesses fail to forecast sales accurately due to poor data quality, inconsistent processes, over-reliance on intuition rather than metrics, inadequate tools, and failure to account for external market factors. Successful forecasting requires clean data, consistent methodology, and regular review.

What are the 5 machine learning techniques for sales forecasting?

The five primary machine learning techniques for sales forecasting are:

Regression analysis (linear/multivariate)

Time series models (ARIMA/SARIMA)

Random forest algorithms

Neural networks (deep learning)

Gradient boosting models

What does a sales forecast look like?

A sales forecast typically appears as a structured report containing projected revenue figures broken down by time period (monthly, quarterly, annual), product line, territory, or sales team. It often includes probability-weighted deal values, historical comparisons, and graphical representations of trends.

Share:

Alex is the CEO at Forecastio, bringing over 15 years of experience as a seasoned B2B sales expert and leader in the tech industry. His expertise lies in streamlining sales operations, developing robust go-to-market strategies, enhancing sales planning and forecasting, and refining sales processes.

Alex is the CEO at Forecastio, bringing over 15 years of experience as a seasoned B2B sales expert and leader in the tech industry. His expertise lies in streamlining sales operations, developing robust go-to-market strategies, enhancing sales planning and forecasting, and refining sales processes.

Related articles

Sales Forecasting

Dec 29, 2025

17 min

Sales Forecasting

Dec 29, 2025

17 min

Revenue Operations

Dec 11, 2025

13 min

Revenue Operations

Dec 11, 2025

13 min

Revenue Operations

Jan 12, 2026

14 min

Revenue Operations

Jan 12, 2026

14 min

Sales Forecasting

Dec 29, 2025

17 min

Revenue Operations

Dec 11, 2025

13 min

Sales Forecasting

Dec 29, 2025

17 min

Revenue Operations

Dec 11, 2025

13 min

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

© 2025 Forecastio, All rights reserved.

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

© 2025 Forecastio, All rights reserved.

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

© 2025 Forecastio, All rights reserved.

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

Sales Planning

Sales Forecasting

Sales Performance Insights

© 2025 Forecastio, All rights reserved.